Rakesh Jhunjhunwala’s biggest bet Titan Company is set to report its earnings for the third quarter of the current fiscal year on February 4, 2025. Wedding demand, a low base, and higher gold prices are expected to impact the jewellery player's bottom line.

While sales growth is expected to be very strong, a one-time loss of Rs 200 crore to Rs 275 crore is expected on account of the customs duty reduction.

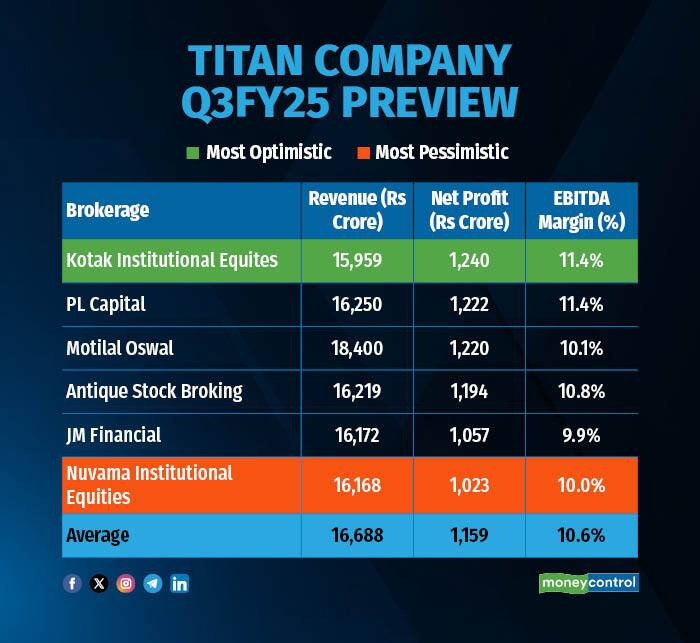

According to a Moneycontrol poll of six brokerages, the jewellery major is likely to report a 27.9 percent revenue growth at Rs 16,688 crore. Net profit is likely to come in at Rs 1,159 crore, jumping 11.5 percent from Rs 1,040 crore in the corresponding quarter last year.

There is a serious divergence in the earnings estimates of different analysts polled by Moneycontrol as some analysts expect the inventory cut to be classified as an exceptional item, similar to the previous quarter.

What factors are impacting the earnings?

Demand Uptick: With a lower base last quarter, and good wedding and festive seasons, demand is likely to see an uptick. As a result, strong same store sales growth (SSSG) will be seen. Further, Titan is expected to add 36 stores during the quarter, taking the total count to 1,045.

Segment Performance: Brokerages expect the watches to grow in the double digits. The jewellery segment is likely to clock a revenue growth of 17 percent on-year. The Eyewear business has

reported double digit sales growth at 18 percent led by heightened promotions and sales push. Growth in studded segment picked up this quarter with the segment reporting 22 percent growth driven by high value studded segment.

Margins: The EBIT margins for the jewellery segment are like to moderate on-year, due to decline in the studded share and marginal cut in diamond prices. Further, margins will be impacted on account of rationalization of gold rate mark-up, aggressive exchange offers, and higher competitive intensity, as local/unhedged players offering discounts as they are sitting on inventory gains, noted Kotak Institutional Equities.

What to look out for in the quarterly show?

Analysts will closely monitor purchase trends in H2 of the current year, with more wedding dates and festivals to boost demand. Additionally, they will also pay attention to gold prices since gold prices have been recording fresh highs.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!