Titan Company Ltd is expected to report year-on-year growth of 11 percent in its standalone profit after tax (PAT) when it declares its results for the September quarter on November 4.

The jewellery and watchmaker’s revenue is likely to grow 20 percent year on year.

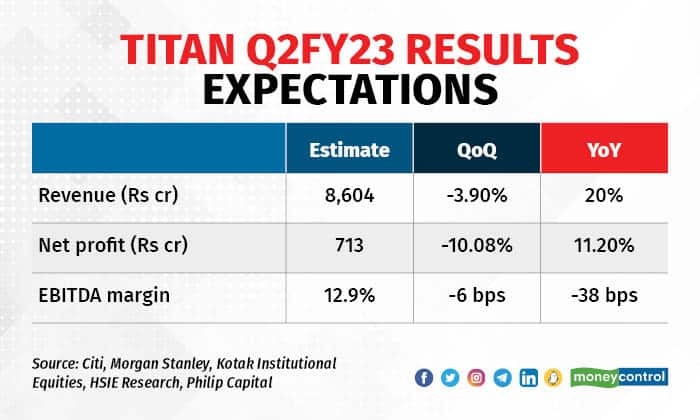

The Tata group company is expected to report post-tax profit of Rs 713 crore on revenue of Rs 8,604 crore, according to an average of estimates by five brokerages polled by Moneycontrol. EBITDA margin has been pegged at 12.9 percent.

In its Q2 business update, Titan said it witnessed a healthy double-digit growth across most businesses. “Retail network continued the pace of expansion adding 105 stores (net) for the quarter. The outlook for festive season continues to be optimistic,” it said.

The jewellery division grew 18 percent YoY on a high base of Q2FY22 with elements of pent-up demand and spill-over purchases, the company added.

Analysts at Kotak Institutional Equities expect EBIT margin of 12.6 percent for the jewellery business.

Watches and wearables’ division is seen clocking its highest quarterly revenue, growing 20 percent YoY.

Titan and Fastrack smartwatches with Bluetooth calling feature were also launched in the September quarter. Kotak expects 11.75 percent EBIT margin for watches.

In the update, the company also said that sales from Titan Eye+ stores clocked a healthy double-digit growth YoY. But this was offset by lower sales across trade and distribution channel, leading to an overall growth of 7 percent YoY.

Kotak Equities analysts expect a 16.5 percent EBIT margin for the eyewear division.

In the June quarter, Titan reported a 13-time jump in standalone profit due to a low base in Q1FY22, impacted by the second COVID wave.

In the September quarter, the base remains favourable with analysts expecting strong festival and wedding season to drive growth.

Investors will keenly watch management’s commentary on gains in the South India market, inventory levels and capital base movement, HDFC Securities said.

On November 3, the stock was among the top Nifty gainers and closed at Rs 2,766.60, up 1.40 percent.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.