Madhuchanda Dey

Moneycontrol Research

The last few years saw the balance of power tilting in favour of non-banking finance companies (NBFCs). Not only did the number of NBFCs grow rapidly, but they also managed to wrest a sizeable share of share of credit. Once considered a ‘shadow bank’, NBFCs were giving traditional banks a run for their money. The stock market was quick to recognise the trend and responded by boosting the valuations of NBFCs. All was well till the liquidity crisis in the wake of IL&FS default. Will life remain the same or will the balance of power tilt towards banks once again?

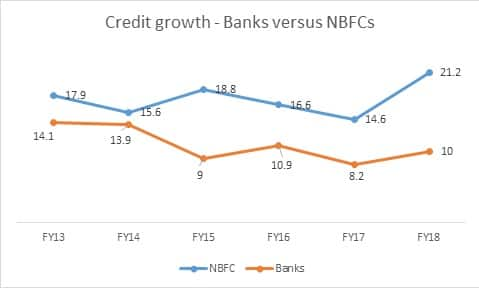

NBFC – an impressive past NBFCs clearly had a stellar run from FY13-18 with compounded annual growth rate in NBFC credit at 17.3 percent compared to 10.4 percent for banks. The gap between the credit growth of banks and NBFCs only widened over the years.

Source: RBI

The share of NBFCs, including housing finance companies, in total credit across India increased to 17 percent in 2018 from 13 percent in 2013.

The near comatose state of a large section of PSU banks weighed down by asset quality pressure and inadequate capitalisation was well captured by a section of NBFCs. In fact, banks too have been steadily increasing their exposure to NBFCs. While in the past two years (August 16 to August 18) the overall growth in non-food credit was around 9 percent, the growth in credit to NBFC sector was around 20 percent.

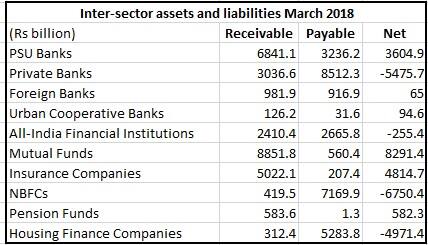

According to RBI’s recent Financial Stability Report, Mutual Funds were the dominant fund providers in the system, followed by the insurance companies, while NBFCs followed by scheduled commercial banks were the dominant receivers of funds.

Source: RBI

NBFCs received a large funding support from mutual funds

NBFCs were the largest net borrowers of funds from the financial system. A breakup of the gross payables indicates that the highest funds were received from scheduled commercial banks (44 per cent of total funds received by NBFCs), followed by mutual funds (at 33 per cent) and insurance companies (at 19 per cent). Long term debt followed by long term loans and Commercial Papers (CP) were the three biggest sources of funds for NBFCs.

In fact contrary to expectations, the overall hardening of rates did not affect NBFCs’ cost of funds till end of FY18. The cost continued to moderate even when systemic rates were rising, as NBFCs were able to tap the bond markets for funds. Rates in the commercial paper market continued to remain favourable. Further, NBFCs were able to secure bank funding at relatively favourable rates as banks’ marginal cost of lending rate was stable.

NBFCs face funding challenge

However, a lot will change in the aftermath of the IL&FS crisis. Mutual funds as a source of funding will clearly take a back seat. Following the default of IL&FS and group companies, mutual funds will limit lending to the quality names among NBFCs. There could be pressure from investors as well, to reduce exposure to NBFCs.

Secondly, there could be significant redemption in debt and liquid fund schemes as large institutional investors may not be comfortable with mark to market losses (as underlying papers get marked down) and prefer safer avenues in bank deposits.

Banks – gains from various fronts

So NBFCs are grappling with a double whammy of rising cost of funds as well as availability of funds. The scenario is quite the opposite for banks who might see some inflow (funds diverted from mutual funds) and a boost to their current account savings account (which till now was becoming a struggle) and can expect to see a moderation in the credit to deposit ratio with deposits going up. This could ease incremental pressure on margins.

In the absence of funding, NBFCs’ growth could suffer in the short to medium term. With competitive intensity waning from NBFCs, most of the well-capitalised banks that are likely to see a surge in deposits should be able to capture market share in the credit market as well.

While retail banks will be the first to grab this opportunity, many of the erstwhile corporate lenders that are at the fag end of the bad loan cycle could benefit from this changing competitive environment.

In addition to the market share gains in direct lending, banks may also have an opportunity to buy NBFC assets at a reasonable price as many of the NBFCs may have to sell some of their loans to shore up capital.

So it is a clear advantage for well-capitalised banks and an opportunity for investors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.