Tech Mahindra is expected to report a decline in Q4 revenue due to continued weakness in its telecom business, while net profit may grow due to a one-off cost in the preceding three-month period.

The company is expected to announce its results on April 25.

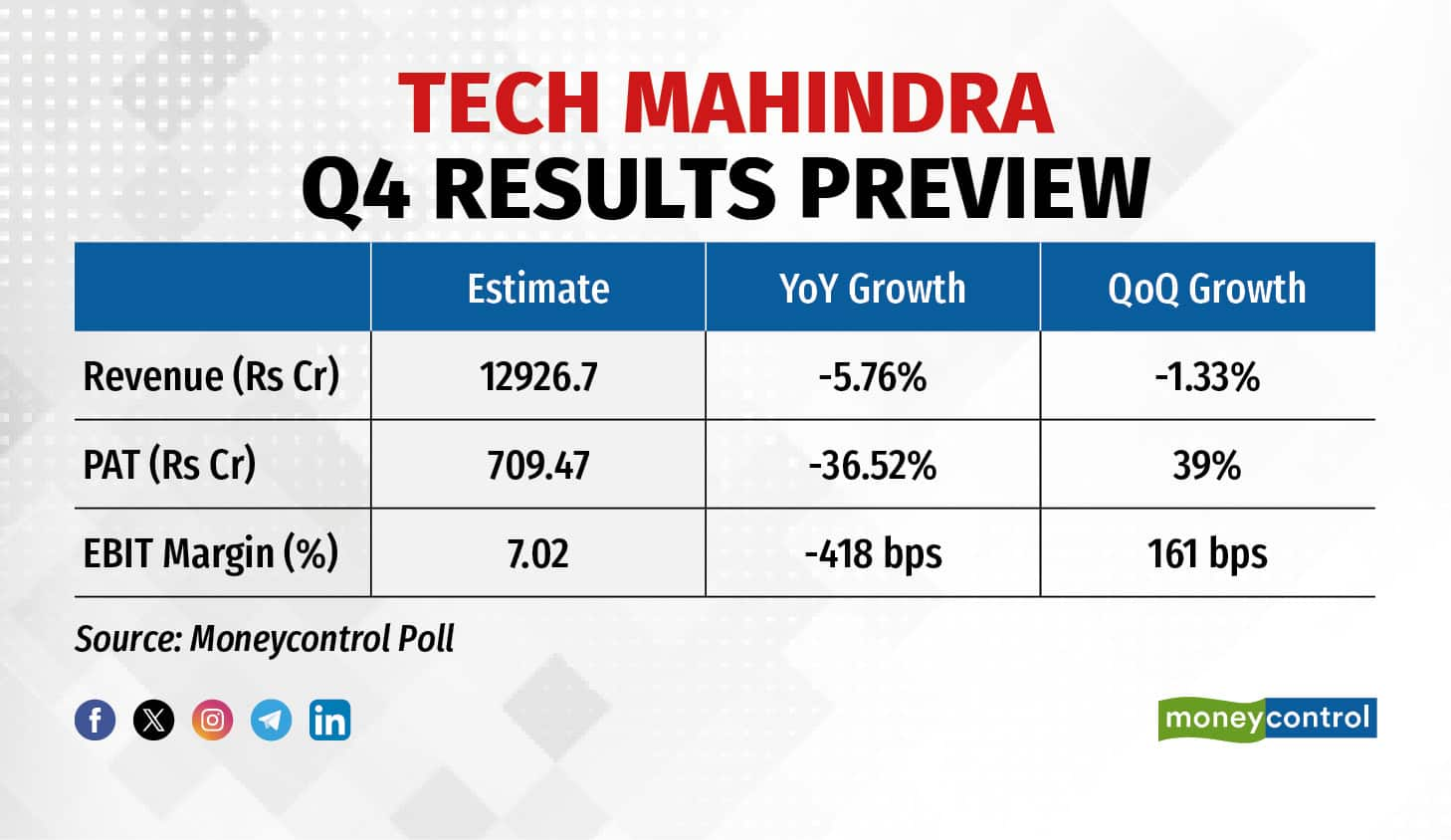

Tech Mahindra’s net profit may increase 39 percent QoQ to Rs 709.47 crore, while revenue is expected to decline 1.33 percent to 12,926.7 crore, according to the average estimate of seven brokerages.

Tech Mahindra Q4 Results Preview

Tech Mahindra Q4 Results Preview

The company's earnings would have been weighed down by weakness in the telecom business (communications, media and entertainment), its largest business vertical, which contributed 36.5 percent of revenue in the third quarter of FY24.

While margins are expected to decline from the previous year, they are expected to improve sequentially due to the absence of a one-off cost in Q3.

Nuvama said Tech Mahindra will report a 1.4 percent QoQ decline in constant currency (CC) terms due to weakness in the telecom segment and the absence of passthrough revenue.

JM Financial said the “reversal of seasonal uptick in Comviva/retail will likely pull down growth across Telecom/Enterprise.” Comviva is a mobility solutions provider that is part of Tech Mahindra.

Axis Capital has a contrarian view and expects QoQ improvement in CC revenue due to additional working days and reversal of furloughs. Dolat Capital said revenue will be impacted by sustained furloughs in the quarter.

Margins are expected to improve sequentially.

“Expect operating margin expansion of 200 bps QoQ to 7.4 percent as the last quarter was impacted by one-off costs. Adjusted EBIT is expected to remain flat,” said Antique Stock Broking.

Brokerages anticipate the company's deal wins to be muted in the quarter. Dolat expects a total contract value of $500 million, while Antique said deal wins are likely to improve but still remain below potential.

According to the brokerages, the key things to monitor in the company’s commentary are strategies of the new management, outlook on telecom clients, growth in verticals such as financial services and manufacturing.

Tech Mahindra had appointed Mohit Joshi as MD and CEO in March 2023. Joshi succeeded company veteran CP Gurnari.

According to Nuvama, the banking, financial services and insurance (BFSI) segment makes up about 15 percent of Tech Mahindra's revenue, while manufacturing contributes 18 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!