Indian 4-wheeler major Tata Motors is expected to report robust Q4 results largely on the back of strong volume growth, an improvement in British unit JLR's performance and commodity price tailwinds. The company will declare its fiscal fourth quarter results on May 10.

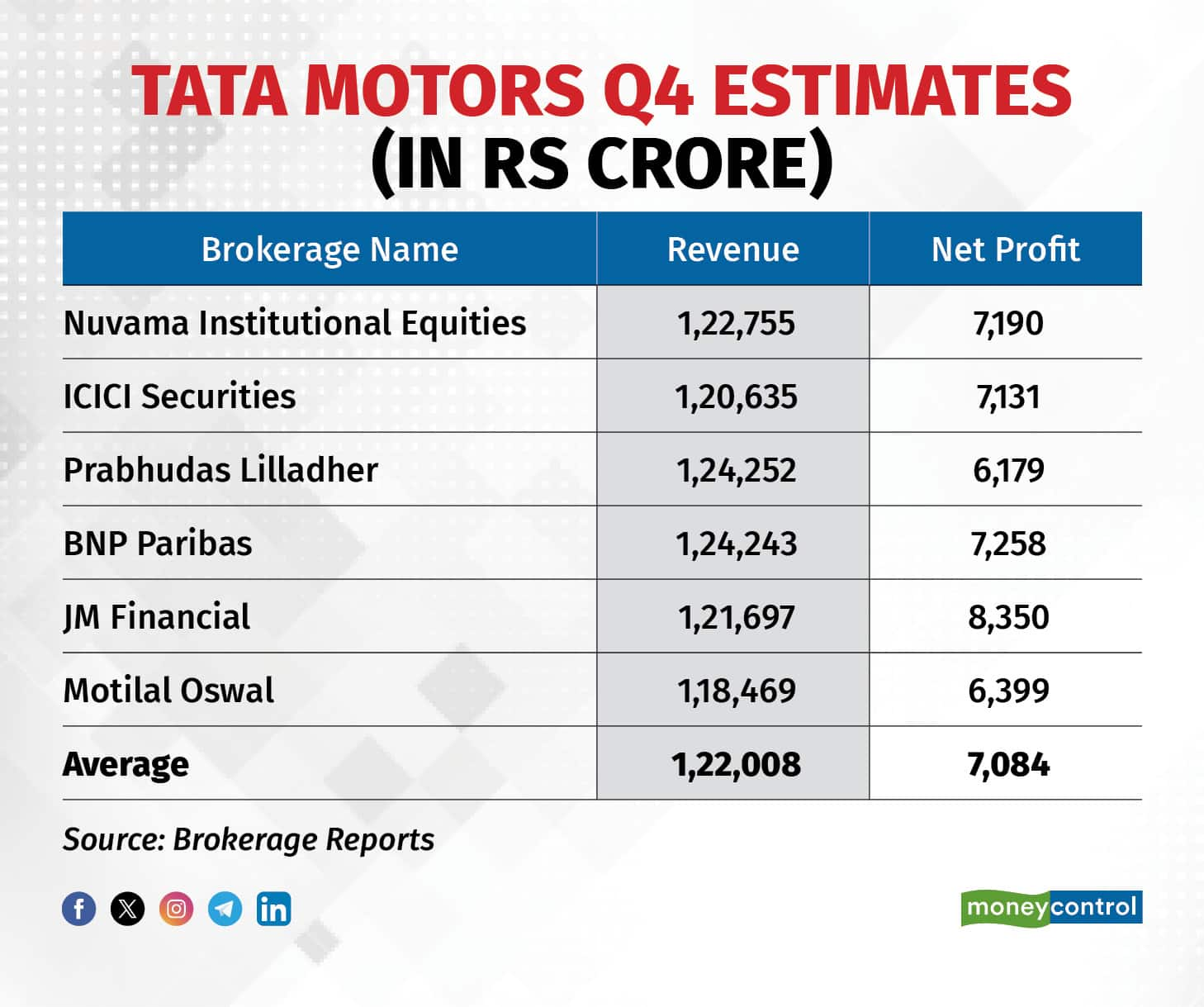

India's largest EV carmaker's consolidated net profit is expected to climb to Rs 7,084 crore in the fiscal fourth quarter, higher by 33 percent from the same quarter of the previous fiscal, a Moneycontrol poll of six broking firms showed. Revenue from operations for the automobile giant is likely to soar 15 percent on-year to Rs 1.22 lakh crore, per estimates.

ALSO READ: SBI in the process of hiring 12,000 employees for IT and other roles: Dinesh Khara

Nuvama Institutional Equities said that revenue growth is expected to be bolstered by robust expansion in JLR (Jaguar Land Rover) and positive growth in India's passenger vehicle (PV) and commercial vehicle (CV) divisions. EBITDA margin is anticipated to widen due to improved scale, enhanced net pricing strategies, and efforts in cost reduction.

However, the demand outlook remains a crucial factor to monitor.

The company is expected to report an EBITDA of Rs 17,527 crore for January-March, higher by over 36 percent on-year. Tata Motors reported an EBITDA of Rs 12,810 crore in the same quarter a year ago, buoyed by higher operating leverage.

READ MORE: Asian Paints eyes pricing stability amid steady raw material prices

JM Financial predicts a 6 percent year-over-year (YoY) revenue growth for the standalone commercial vehicle (CV) business and a 22 percent YoY growth for the standalone passenger vehicle (PV) business. Jaguar Land Rover (JLR) is expected to see a 16 percent YoY increase in revenue.

A BNP Paribas report said that with the automotive industry rebounding, JLR's shift towards modern luxury presents significant potential for Tata Motors. The report expressed confidence in Tata Motors' margin outlook, citing recent strong performance and JLR's upgraded guidance.

In April, the company reported a year-on-year increase in total wholesales, rising by 11.5 percent to 77,521 units compared to 69,599 units in April 2023. Total domestic dispatches also saw a 12 percent rise to 76,399 units, up from 68,514 units in April 2023.

Tata Motors shares closed nearly 2 percent higher to Rs 1,030 on May 9. In 2023, the company's share price more than doubled to become the second best performer on the NSE Nifty.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.