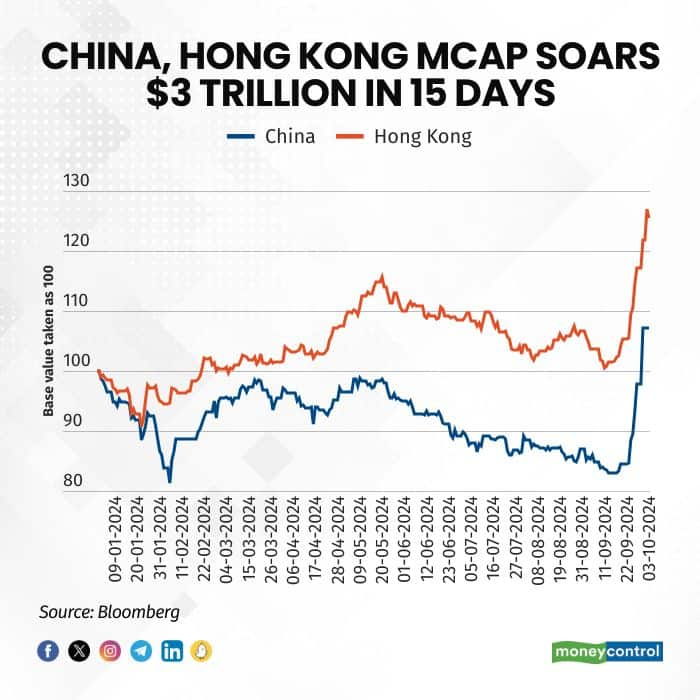

China and Hong Kong saw their market capitalization surge by over $2 trillion and $1.2 trillion, respectively in just 15 trading sessions following a strong rally. This growth has been primarily driven by Beijing's implementation of bold stimulus measures, including significant interest rate cuts and fiscal support, aimed at revitalising the struggling economy.

As on October 2, China's total market capitalization was pegged at $10.1 trillion, up from $7.95 trillion on September 13, marking an increase of around $2 trillion -- equivalent to the market capitalisation of Switzerland, South Korea, and Australia.

Similarly, Hong Kong's total market capitalisation surged to $6 trillion, up from $4.79 trillion, marking an increase of over $1.25 trillion. This growth is equivalent to the market capitalisation of countries like Sweden, Netherlands, UAE, Denmark, Spain, and Indonesia among others.

On the Shanghai Composite Index, around 37 companies saw their stock prices soar by over 1000 percent, while more than 200 companies gained between 40-87 percent. Similarly, on the Hang Seng Index, 19 companies recorded gains of 50-100 percent, and 50 companies rose by 10-40 percent.

China has rolled out measures to boost economic growth and restore confidence in its financial markets, especially following stagnation in the property sector.

The People's Bank of China (PBOC) has cut the main policy interest rate from 1.7% to 1.5% and reduced the Required Reserve Ratio (RRR) for banks by 50 basis points, injecting around 1 trillion RMB (around $142 billion) into the economy.

Following this, mortgage rates are expected to drop by an average of 50 basis points, benefiting about 50 million households and saving them around 150 billion RMB ($21.1 billion) in interest.

To revitalise the stock market, a RMB 500 billion (around $71 billion) swap facility has been launched for brokers, alongside refinancing options for listed companies to support share buybacks. The government is increasing fiscal spending, marking a shift from its previous cautious approach.

This sparked a rally in beaten-down stocks, lifting the CSI300 by 21 percent in September, its best since 2014. The Shanghai Composite rose 17 percent, its highest since 2015, while the Hang Seng had its best month since November 2022 with a 17 percent gain.

This stimulus package comes in response to months of weak macroeconomic data, jeopardizing China's growth target of around 5%. It reflects President Xi's recent call for stronger policy support amid ongoing economic challenges.

The post-reopening recovery in China has been lacklustre, with the housing market experiencing its worst downturn ever, negatively affecting economic growth and other sectors. Amid a complacent market anticipating a soft landing in 2024, concerns about costly deflation are rising.

While progress in the new energy and NEV sectors positions China as the largest auto exporter, policy support has focused more on industry than on boosting consumption. This has intensified fears of a debt-deflation trap and "Japanification" risks, leading to worries about reverting to a manufacturing-driven growth model instead of a consumption-based one.

Morgan Stanley suggests a favourable environment for a tactical recovery in equities, reminiscent of early April. The potential recovery depends on factors like domestic policy and earnings performance, as well as the outcome of the US presidential election.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!