Madhuchanda Dey

Moneycontrol Research

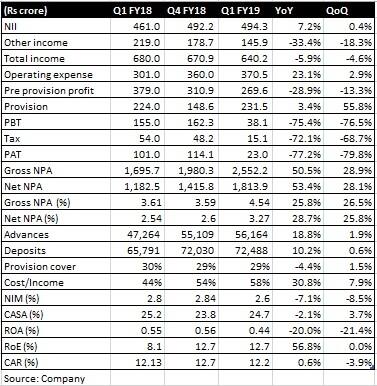

South Indian Bank’s (SIB) weak quarter was marred by high slippages from its corporate and small and medium enterprise (SME) book. Core business performance was lacklustre, with margin compression and weak non-interest income impacted by losses in the bond portfolio and higher costs due to gratuity-related expenses. Accretion of low cost current account-savings account (CASA) deposits was also uninspiring. Going forward, the bank would need a round of capital raising to grow as advances growth remains robust amid overall weakness.

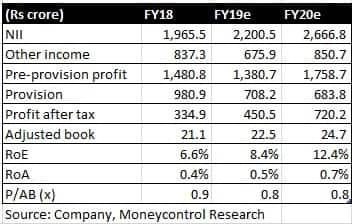

After the earnings disappointment-led correction, valuation at 0.8 times FY20 adjusted book looks undemanding. The question most investors are asking is whether the weakness is cyclical or is the SME pain likely to persist?

Source: Company

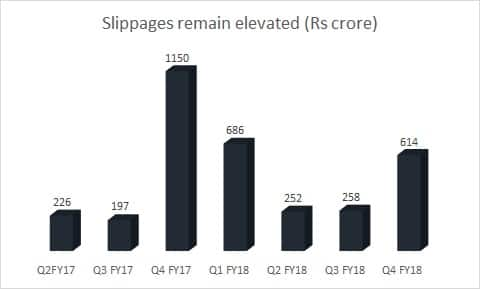

Contrary to the management’s Rs 600 crore slippages guidance for this fiscal in Q4 FY18, the same in Q1 FY19 stood at Rs 609 crore: Rs 308 crore from corporate and Rs 298 crore from SME. While slippage in Q4 FY18 was driven by the Reserve Bank’s circular, the Q1 figure was rather shocking.

On the corporate side, the management mentioned that slippages included a social infrastructure project (Rs 105 crore), two cashew accounts (Rs 117 crore) and one engineering, procurement and construction company (Rs 22 crore). It is pertinent to note that the standard restructured asset pool had already fallen to Rs 57 crore as of March-end and even then there was a significant slippage in Q1 FY19. We therefore draw less comfort from the negligible outstanding standard restructured assets at Rs 20 crore.

While stress on the corporate side was known, the cause for worry from SIB’s result is the high slippage in SME book. Of the non-corporate slippage, Rs 226 crore was from MSME, Rs 11 crore from agriculture and Rs 61 crore from retail. Slippage from the MSME (micro, small and medium enterprise) space came in from a variety of sectors. With a warning on the SME space coming from a banking stalwart, we will remain watchful.

The management has alluded to taking a number of steps, including centralised processing, to improve underwriting quality. The bank has guided to incremental slippage of Rs 600 crore in the remaining three quarters, a figure that will be monitored closely.

Weak core performance

Despite very strong growth in the asset book, core performance was uninspiring.

Net interest income (the difference between interest income and expense) growth was tepid on account of 20 basis points decline in interest margin to 2.6 percent. While non-interest income was mostly impacted by lower treasury gains, core fee growth of 8.3 percent was unexciting as well. The quarter gone by saw the impact of Rs 34 crore mark-to-market (MTM) loss as bond yields hardened. Operating expense saw Rs 20 crore impact on account of gratuity provision.

Asset growth

Robust asset growth was a silver lining in the midst of dark clouds in the quarter gone by. Overall advances grew 19 percent driven mostly by growth in retail and SME segments, while corporate and agriculture book grew modestly. Although we appreciate the management’s effort to make the lending book more granular, asset quality issues, especially in the MSME space, make us less excited at this juncture.

Liability: A lot to catch up

Despite a strong growth in assets, deposit growth, especially low-cost deposits, has lagged behind. The bank is running a very high incremental credit-to-deposit ratio of 133 percent, which might incrementally exert pressure on margin. While growth in relatively higher cost term deposits was almost at par with overall growth in deposits, current account de-grew leading to single-digit growth in CASA (current & savings accounts), whose share continues to stagnate around 24.7 percent. In the past nine months, while cost of deposits has not fallen, yield on advances has fallen resulting in margin compression. Going forward, this area would warrant substantial improvement if the bank were to improve its competitive positioning and incremental quality of its asset book.

Source: Company

While the management is incrementally trying to lend to better rated corporates, with the share of corporates rated A and above having gone up in the corporate lending book to 54.6 percent in June from 37.5 percent in the same month last year, it is difficult to comment on the same in the absence of a rating profile of its SME book.

Capital adequacy ratio has fallen to 12.2 percent. It remains to be seen how easily SIB is able to raise capital to fund its future growth.

The undemanding valuation could provide a decent trading upside should asset quality remain stable in forthcoming quarters. We would like to see some more structural improvement in core performance before recommending SIB to long term investors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.