SBI Life Insurance Company is set to announce its July-September quarter (Q2FY25) results on October 23. Analysts anticipate the life insurer will post double-digit year-on-year profit growth for the quarter, driven by strong growth in both renewal premiums and new business premiums.

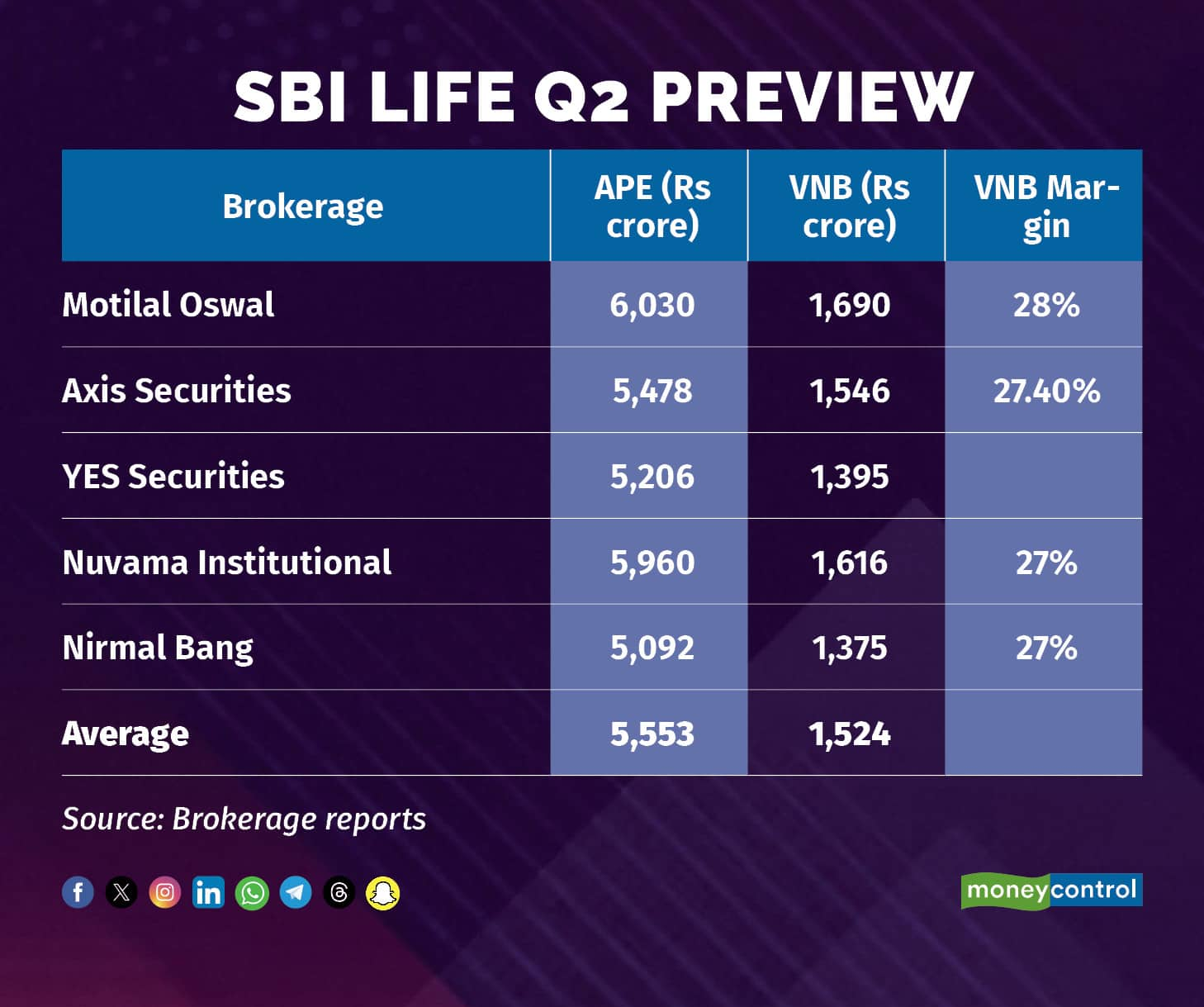

According to a Moneycontrol poll of estimates from five brokerages, SBI Life is expected to report a 6 percent year-on-year (YoY) increase in Annualised Premium Equivalent (APE) to Rs 5,553 crore in Q2FY25, up from Rs 5,230 crore in the same period last year. APE, which reflects premiums from various policies on an annualised basis, is a key growth indicator.

This robust APE performance is anticipated to boost SBI Life's Value of New Business (VNB)—a measure of the profitability of newly sold policies—by 2 percent YoY, rising to Rs 1,524 crore in Q2FY25 from Rs 1,490 crore in Q2FY24.

New Business Premium: Analysts anticipate steady growth in SBI Life's new business premium income for the September-ended quarter. Axis Securities projects a 43 percent sequential increase and a marginal 0.1 percent year-on-year (YoY) rise in NBP for Q2FY25. NBP represents the premium income generated from new policies issued during a specific period.

VNB to aid margins: Motilal Oswal analysts predicted that a consistent VNB growth is expected to aid sequential expansion in margins in the September-ended quarter. The firm pegged VNB margins to expand to 28 percent in Q2FY25 versus 26.8 percent in Q1FY25, but slight contraction is seen from 28.5 percent in Q2FY24.

AUM growth: Motilal Oswal analysts pegged SBI Life's AUM to rise by a staggering 25 percent YoY to Rs 4.3 lakh crore in Q2FY25 from Rs 3.4 lakh crore in the year-ago period.

What to look out for in the quarterly show?Management commentary on growth, product mix and margins will be key to watch out for. Sluggish growth in the SBI channel has been an area of concern, making the outlook in this area crucial.

In the July-September quarter, shares of SBI Life surged over 22 percent, significantly beating benchmark Nifty 50's 1 percent rise.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.