Agrochemical companies Coromandel International (CORO) and Sharda Cropchem (SCC) reported a mixed set of performance for the quarter-ended June. Both companies saw healthy topline growth. While CORO was able to expand operating margin by almost 120 basis points (bps) on the back of price hikes, the same for SCC contracted 270 bps due to supply disruptions from China for yet another quarter.

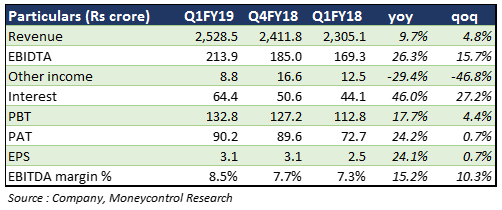

Coromandel International – Performance update

The company reported healthy performance with a 9.7 percent year-on-year expansion in topline. Despite higher phos-acid prices, earnings before interest, tax, depreciation and amortisation (EBITDA) improved 26 percent YoY, with a margin expansion of 120 bps, as the management was able to undertake price hikes and pass on the increased costs. Margin was supported by improved product mix, with higher complex grade fertilisers that have higher margins. Higher capacity utilisation at 79 percent brought in some additional operating leverage.

While margin in the nutrient and allied business improved 165 bps YoY to 8.1 percent, the crop protection business saw margin erosion of 330 bps YoY to 14 percent.

There was a substantial uptick in interest cost (46 percent YoY) due to higher working capital (WC) requirements for which the management has taken a loan from promoters at 10 percent interest. WC was greater due to elevated inventory levels, higher subsidy component and accumulation of Goods & Service Tax credit claim. While there have been some hiccups during implementation of the Direct Benefit Transfer scheme, the management said subsidy bills are being cleared within two weeks of being raised which would improve the its working capital situation in coming quarters.

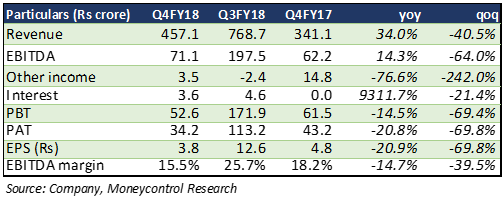

Sharda Cropchem –Performance update

Despite a decent 34 percent YoY growth in topline, SCC saw a 270 bps margin contraction. Strained supply from China ate away profitability for yet another quarter. While absolute EBITDA grew 14.3 percent, net profit contracted 20.8 percent owing to higher other expenses and substantially higher interest costs during the quarter gone by.

The company is now focusing on high value products. Improved product mix led to the topline growth (21 percent YoY). The company saw decent (4 percent) volume growth during Q1. The currency movement worked in its favour and contributed around 9 percent to topline growth.

In the international business, increased demand led to a 52 percent growth in Europe. The de-growth of 14 percent was due to storms, extended winters and higher base of last year in NAFTA (Canada, Mexico and United States). Latin America and Rest of the World saw a 67 and 55 percent growth in topline, respectively.

Business update CORO's management said Mancozeb inventory in Brazil has started to ease down. With this, the inventory channels are now clearer. This would help in passing on the increased price and help boost volumes in the region. The company has launched five new products across various segments, which should help maintain the growth momentum. It has a healthy pipeline of new products, with more differentiated molecules in the crop protection segment, which would help drive long term growth.

The management is undertaking phos-acid production expansion at Visakhapatnam which is expected to be completed by Q2 FY20. This plant will add 0.1 million tonne of additional capacity at Rs 276 crore. Total phos-acid demand is 0.85 MT. The management said captive phos-acid around $100 per tonne is cheaper than imports. Plans for an expansion of the Mancozeb facitlity in Dahej is also underway.

SCC saw 52 new registrations during the quarter gone by, pulling the total to 2,209 (March: 2,157). It has a robust pipeline of another 984 registrations across geographies, which will help drive future growth.

For consecutive quarters, margin has been impacted by supply-side disruptions from China. The management indicated that supply-side pressure, which had built-up last year, is now showing some signs of a revival.

OutlookCORO: We remain positive on its overall growth prospects. Pick up in monsoon from July onwards and higher reservoir levels, especially in south India where it has maximum exposure, augurs well for the company. Concerns over price hikes seem to be diminishing as the company has taken consecutive hikes in the last few months. The stock has seen an uptick of 12 percent in the last one month after which it is still trading 26 percent below its 52-week high and at a FY19e price-to-earnings ratio of 16.1 times. With growing share of the non-subsidy business, greater operating leverage and visibility of growth in the crop protection business, we expect a healthy topline growth in coming quarters.

SCC: The stock has corrected almost 11 percent in the last one year and is currently 27 percent below its 52-week high. It is trading at a FY19E P/E of 15.1 times. Supply disruption in China has been a major overhang for the stock. Though there is expectation of some relief from that front, it would take time to normalise. We expect the robust pipeline to provide respite to impacted margin in coming quarters.

Follow @RuchiagrawalFor more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.