Nitin Agrawal Moneycontrol Research

Highlights:

- Weak volume growth led to subdued topline performance - Negative operating leverage and raw material costs hurt operating margin - Business outlook for PV is weak for short-term, positive for long-term - Accumulate in a staggered manner--------------------------------------------------

Multiple macroeconomic factors led to weak demand for passenger vehicles (PV) and impacted the financial performance of Maruti Suzuki India Limited (MSIL), the country’s top car maker in Q3FY19. MSIL reported meagre growth in topline and realisation and significant operating margin contraction in an environment of rising raw material (RM) prices and negative operating leverage.

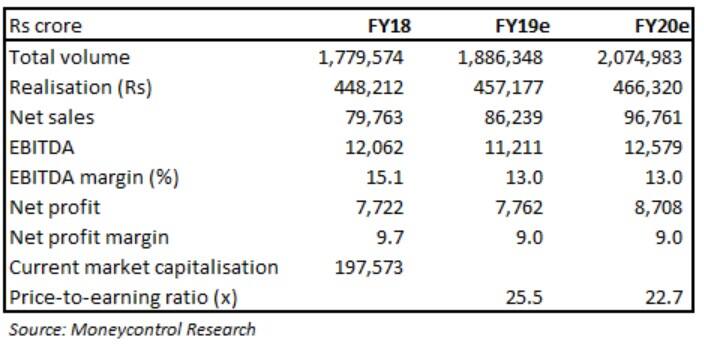

MSIL has a virtual monopoly in the PV market in India led by strong dealership network, brand loyalty on competitive prices and resale value. Demand is expected to be sluggish in near-term, however, the long-term outlook remains very positive. The stock currently trades at 22.7x FY20 projected earnings.

Quarter in a nutshell

Key highlights

A decline in volume; marginal growth in average selling price

MSIL posted a 0.6 percent year-on-year (YoY) decline in volume, primarily, due to subdued demand on the back of mandatory long-term insurance, rising interest rate and liquidity crunch. Average selling price (ASP), however, improved 2.6 percent YoY on the back of rich product mix. This led to 2.0 percent YoY growth in its net revenue from operations.

Significant EBITDA margin contraction – negative operating leverage

Earnings before interest, tax, depreciation and amortization (EBITDA) declined 36.4 percent YoY and EBITDA margin contracted 593.5 bps (YoY). This is primarily due to negative operating leverage, higher commodity prices, promotional expenses, adverse foreign exchange, and employee expenses (leave encashment, gratuity and other related expenses). The company has now taken a price increase across models to pass on the costs rise.

Outlook

Sluggish demand in the near term

Demand outlook continues to be muted for the PV segment due to multiple factors such as increasing costs of total ownership on rising interest rates, insurance costs, weak festive sales, and a liquidity crunch. The demand is expected to remain sluggish in the near term; however, the long-term outlook continues to be positive.

Low penetration and rising disposable income are expected to keep urban demand strong with an additional kicker from rural market led by government’s focus toward rural areas ahead of election and increase in minimum support price (MSP).

Weakening in commodity prices

Commodity prices have been hurting the company’s margin for long now and the competitive intensity didn’t let it pass on the same to customers. However, the good news is that commodity prices are weakening and the impact of this should be visible in the financials.

Focus on localisation

MSIL imports various electronics parts that hurt its margin in case rupee depreciates or due to any other global factor. Recent weakness in the rupee had pushed it to pursue localisation aggressively. The management said there are technological challenges in doing so but they are working on it.

New product launches to aid volume growth

MSIL continues to focus on widening its product portfolio to aid growth. It has planned multiple new launches over the next many years. Its new Swift and Swift Dzire are doing phenomenally well. Newly-launched Ciaz, Ertiga and WagonR are also getting strong traction.

Capacity expansion

MSIL has been focusing on increasing its capacity. Gujarat plant’s phase I has already started production and expected to produce 250,000 units this year. The second phase is also in process. The management expects to expand the capacity of this plant to 1.5 million.

Valuation

In light of subdued demand outlook, the stock has corrected quite significantly and is down 34 percent from the 52-week high. It currently trades at 25.5 times FY19 and 22.7 times FY20 projected earnings. We advise investors to accumulate the stock in a staggered manner as long-term outlook continues to be positive and MSIL is a strong franchise.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.