Downstream gas companies - Mahanagar gas (MGL) and Gujarat gas (GG) - reported resilient growth in Q1 FY19 owing to an uptick in domestic as well as industrial volumes. Sustained demand from the fertiliser and power sectors supported volume growth. With increased focus on clean energy and given that there is a substantial difference in the price of gas and that of petrol and diesel, we stay positive on the growth outlook for the sector and recommend keeping the stocks on one’s radar.

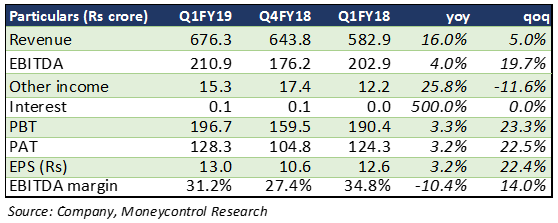

Mahanagar Gas: Result snapshot

The company reported a 16 percent year-on-year (YoY) growth in topline, driven by strong volume growth (11.9 percent) in the last 9 quarters to 2.87 million metric standard cubic meter per day (mmscmd). Earnings before interest, tax, depreciation and amortisation (EBITDA) saw a 4 percent uptick, though EBITDA margin saw a 360 basis points contraction due to one-time commission payment to oil marketing companies (OMCs) and uptick in other expenses. Higher price of motor fuels and domestic pipe gas, strong private vehicle conversion to compressed natural gas (CNG) and relicensing of auto/taxi in the Mumbai Metropolitan Region (MMR) led to a healthy 12.6 percent growth in CNG volumes to 2.12 mmscmd. High cost of alternate fuels drove volumes for the industrial segment.

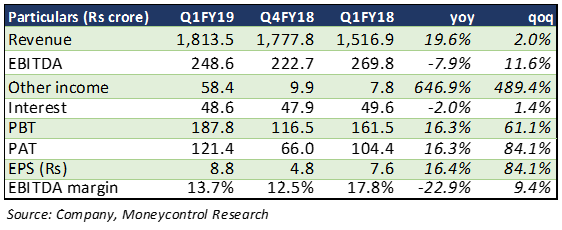

Gujarat Gas: Earnings at a glance

GG reported a healthy 19.6 percent topline expansion on the back of a decent 5.2 percent YoY volume growth to 6.44 mmscmd and price revisions during the quarter gone by. While piped gas and commercial sales saw a slight dip of 2 percent, industrial gas sales volumes grew 4 percent and CNG volumes saw a strong 11 percent uptick driven by commercialisation of 25 new CNG stations opened over Q4 FY18.

Going forward, GG plans to focus on growth of its CNG and piped gas segment. The company is aiming to add more than 200 CNG stations in current years to tap the opportunity of robust CNG vehicle conversions.

Sector trendsCrude oil sustaining at higher levels Global crude oil prices have sustained at higher levels in the last few months. With rising crude prices, natural gas becomes a cheaper and a more attractive fuel option. This was one reason that led to a substantial uptick in volumes during the quarter gone by. The same is expected to continue in coming months.

CGD bidding and environmental concerns With growing environmental concerns there has been immense policy support to promote the use of a relatively cleaner fuel like natural gas. The Petroleum and Natural Gas Regulatory Board in the latest round of city gas distribution (CGD) auction has put up 86 geographical areas for bidding. This is the highest ever and more than the current total.

Downstream companies have bid aggressively for areas. MGL has submitted bids for three areas one each in Andhra Pradesh, Telangana and Chennai. The company has been selective in choosing areas which are in line with its current geographies and have immense potential to usher higher volumes. GG has aggressively submitted bids for 21 areas (currently it has 19 areas) and is rapidly expanding its CGD presence. With potential new areas under coverage, we see long term growth potential in stocks.

Price hikes to protect margins Increasing input cost coupled with inability to undertake price hikes ate away margins of both MGL and GG in past quarters. However, both companies have taken appropriate price hikes: GG since January and MGL from April. This is a positive for both these companies and should help in protecting margins. Moreover, it reinstates our belief about the ability of companies to pass on high costs.

Outlook MGL and GG are positioned to benefit from regulatory, environmental, budgetary and global opportunities. Both operational as well as macro policy environment seems to be in favour of the sector as a whole.

After a steep correction in the last few months, MGL saw some recovery after its Q1 results. It is now trading 28 percent below its 52 week high and at a FY19e P/E of 17.8 times which is at a discount to domestic peers. We see it as a growth stock that has overcome past interruptions.

GG, on the other hand, has seen a 7 percent uptick in prices last month and around a 13 percent correction since January. The stock is now trading 20 percent below its 52 week high at a valuation of 21.4 times FY19e earnings.

MGL’s volume outlook remains stable going forward. GG though attractive might see some pressure to pass on hikes, given the upcoming election season. We find both stocks attractive but prefer MGL over GG given its cheaper valuations.

Follow @RuchiagrawalFor more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.