The engineering, procurement and construction (EPC) major, Larsen & Toubro (L&T), is seen reporting lukewarm numbers on a year-on-year (YoY) basis, but the sequential performance could enthuse the Street, indicates a poll of brokerages conducted by Moneycontrol.

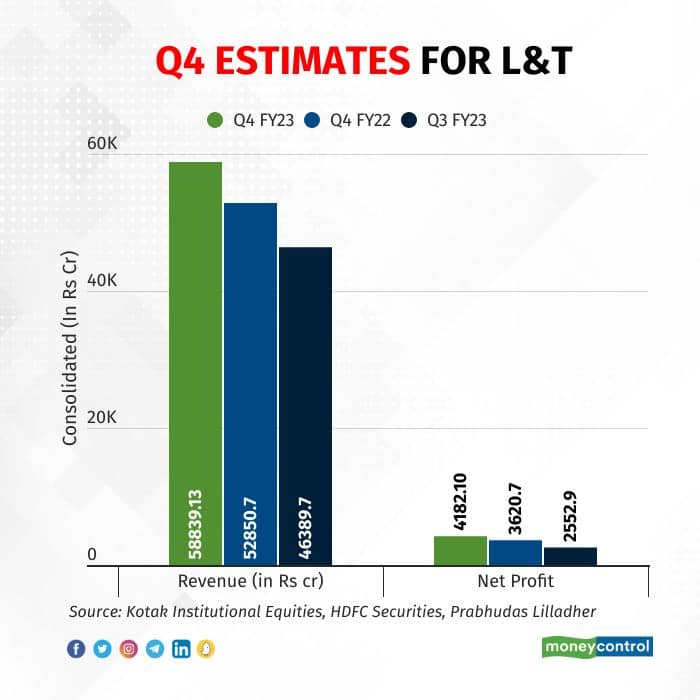

As per the poll, the company’s consolidated revenue for the March quarter is expected to come in at Rs 58,839.13 crore, a growth of 11.3 percent YoY, and 26.8 percent quarter-on-quarter (QoQ). Some analysts highlighted that a pick-up in execution could drive revenue growth. Net profit is likely to rise 1.6 percent YoY, and 63.8 percent QoQ to Rs 4,182.10 crore.

L&T estimates for Q4

L&T estimates for Q4

Kotak Institutional Equities sees a 10 percent YoY improvement in core EPC revenues, as it bakes in improved construction activity across projects in Q4 FY23. It believes the earnings before interest, taxes, depreciation and amortisation (EBITDA) margin of the company’s core engineering and construction business will expand 40 basis points (bps) YoY to 10.4 percent, driven by lower commodity prices.

Overall, the brokerage firm sees margin at 12.4 percent in the March quarter, up from 10.9 percent in the previous quarter, and 12.3 percent in Q4 FY22.

Talking about sales, Prabhudas Lilladher expects consolidated revenue growth of 11.6 percent YoY, led by growth in IT, energy projects, hi-tech manufacturing, and developmental projects.

L&T is well-placed to benefit from overall diversified tender prospects with better order conversion in the domestic market, significant traction in capital expenditure (capex) from oil exporting countries, mainly the hydrocarbon segment, and expected uptick in private capex, the brokerage firm said. It expects L&T to report a compounded annual growth rate (CAGR) of 12.2 percent and 19.8 percent in revenue and profit after tax, respectively, between FY22-FY25.

Order inflow

Analysts believe that order inflow for most capital goods companies is expected to be robust, as those announced by companies like L&T, KEC International, VA Tech Wabag, ISGEC Heavy Engineering, and BEL have been encouraging.

“Strong tender pipeline from domestic as well as exports markets is likely to drive order inflows,” according to brokerage house Prabhudas Lilladher.

Read more | Cheaper pizzas, burgers! Zomato starves in trade as ONDC poses a threat

During the quarter, L&T announced orders in the range of Rs 21,000-34,000 crore.

Kotak Institutional Equities has factored in inflows of Rs 63,000 crore for Q4 FY23. Announced order inflows for the quarter so far are lower, and mostly includes orders from hydrocarbon, water, B&F, metals and mining, and transmission, the brokerage firm said.

“Players like L&T and KEC are expected to report strong double-digit growth rates for FY23 inflows,” ICICI Securities said.

HDFC Securities is of the view that L&T will witness improved order inflow and likely improvement in core margins owing to improved bid discipline, commodities price correction, and large-size order wins.

Key monitorables

As per analysts, management outlook on order pipeline, margin trajectory, working capital, and cash flow management would be key monitorables.

“Management commentary on status of non-core assets like Nabha Power, Metro ridership and financial assistance will be key monitorables,” Prabhudas Lilladher said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.