Infosys shares slipped 2 percent in trade after the IT services major upset the Street with lower revenue for the quarter ended March 31, 2024.

Infosys reported a revenue of Rs 37,923 crore for the three months ended March, according to an exchange filing on April 18, falling short of analysts' projection of Rs 38,413 crore, based on an average of 13 brokerage estimates.

The net profit came in at Rs 7,969 crore, growing 30.5 percent over the previous quarter driven by income tax refunds, but overall missed analysts' estimates.

Experts said that the results were a “miss” despite strong deal wins. However, the revenue fell below expectations because of a one-time contract renegotiation of a large BFSI client at 1 percent of revenue. Infosys noted that 85 percent of the contract has been retained and the management is not seeing any further re-negotiation in the coming quarters.

As a result, the total revenue for FY24 grew at 1.4 percent, which missed the company’s guided growth band of 1.5-2.0 percent on-year in constant currency terms.

Infosys FY25 revenue guidance

The management’s commentary alluded to softening discretionary spends for the upcoming fiscal, despite strong deal wins. Clients are given more weight to projects that are focussed on cost optimisation and give them upfront return on investments.

Also Read | Infosys Q4 results highlights: Revenue misses estimates; CFO says hiring models have changed 'significantly'

There has been no change in client sentiment on technology spends for FY25 versus FY24, given uncertainty around macro conditions, according to Infosys.

As a result, the revenue guidance is weak, at 1-3 percent on-year in CC terms for FY25. “Amid persistent weakness in discretionary spending due to caution on macro recovery, Infosys provided an underwhelming USD CC revenue growth guidance for FY25, significantly below our estimates,” said Motilal Oswal.

The IT player also announced acquisition of in-tech Holding GmbH, a German ER&D company, with revenue of $180 million. Nuvama Institutional Equities added that once the acquisition has been closed, which is likely in H1FY25, it could add 1 percent to the revenue, which has not been included in the guidance.

H1FY25 needs to be strong

International brokerage Nomura noted that to achieve its revenue guidance, Infosys needs to deliver growth of 0.6-1.4 percent CQGR in FY25. Based on seasonality, the second half of the year for IT companies tends to see zero-to-negative growth. Therefore, Q1 and Q2 need to show 3 percent sequential growth. “Overall, we bake in 2.9 percent on-year USD revenue growth in FY25 for Infosys,” said the brokerage.

Infosys has won large deals worth $17.7 billion, with 90 large deals in FY24, which is the highest ever large deal wins for Infosys. By region, 16 were from North America, 10 from Europe, and four from the rest of the world.

Also Read | Infosys Q4 FY24: Disappointing quarter, attractive valuation

“Large deal wins are expected to support growth in FY25. In Q4, it signed eight large deals in communication, six each in BRSR and retail, four each in manufacturing and life sciences,” noted Motilal Oswal.

“The conversion challenges continue to persist in FY25 on account of slowdown in dictionary spends and delay in decision-making, which might lead to further pausing or deferring programs that are non-critical to business enterprises," Prabhudas Lilladhar said.

Outlook

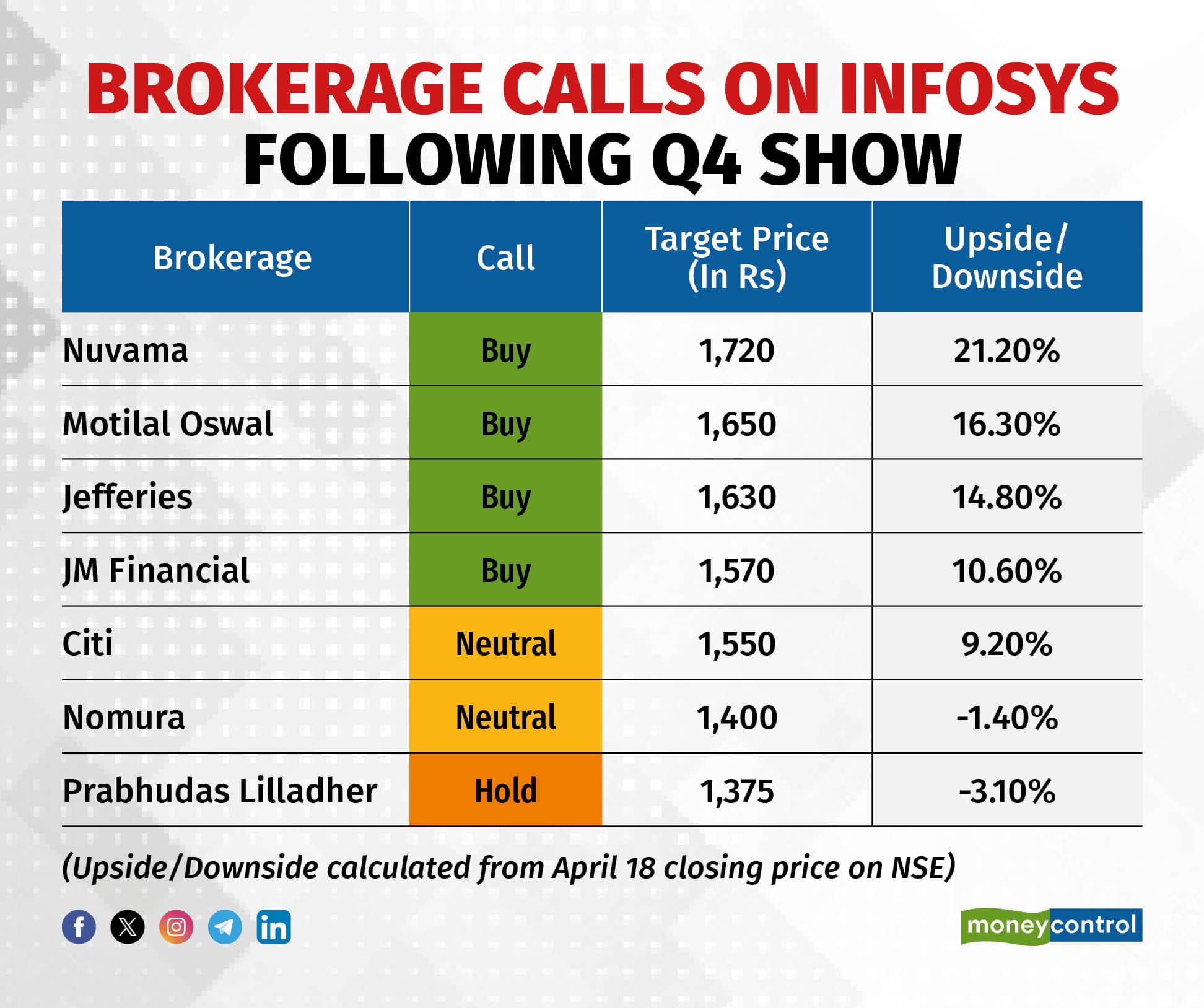

Despite the fourth quarterly earnings missing the estimates, brokerages maintained their ‘buy’ and ‘neutral’ calls on the stock. However, the target prices were slashed. To factor in the miss, Jefferies cut its estimations by 7-8 percent.

“Despite near-term weakness, we expect Infosys to be a key beneficiary of the acceleration in IT spending in the medium term,” said Motilal Oswal.

Nuvama Institutional Equities concurred, believing that Infosys’s growth shall pick up as discretionary spends revive in H2FY25. However, the brokerage said the stock may remain sideways until then and underperform peers such as TCS.

Citi added that if all things remain the same, investors should continue to accumulate Infosys shares on dips, at around Rs 1,350 levels. However, the brokerage has reduced the target multiple to 24x given the lower growth.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!