India's second-largest software firm Infosys grew faster than its bigger rival TCS in revenue for the third year in a row, a trend that is likely to continue in the near term as the Bengaluru-based firm aims to become the country's IT bellwether again.

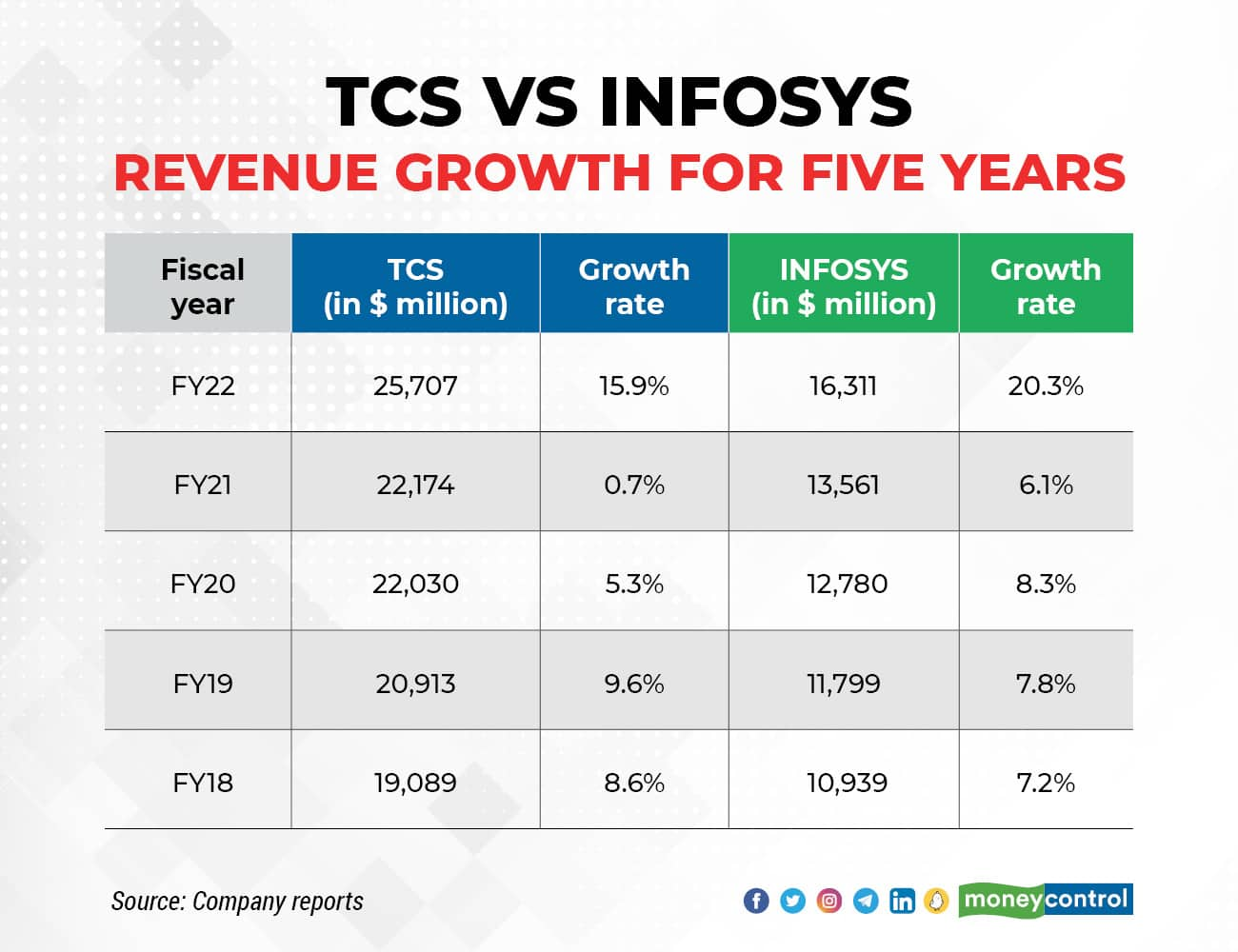

Infosys registered revenue of $16.3 billion, growing 20.3 percent for the year ended March 31, 2022, whereas TCS grew 15.9 percent with the revenue at $25.7 billion. Infosys has maintained that trajectory for three years in a row, starting FY20.

This is also the highest growth the company has registered in close to a decade. Infosys registered a 25 percent growth in FY11.

To be sure, TCS also has a higher base, when compared to Infosys but its faster growth clip could bridge the valuation gap between the two companies.

“The valuation gap will get bridged because of the outperformance. The consensus among analysts is that Infosys will continue to grow faster than TCS in the near term,” an analyst tracking the companies said.

TCS is valued higher than Infosys, despite Infy delivering a superior growth rate. “TCS trades at 31 times one year forward PE–10 percent premium to Infosys despite having 3 percent lower earnings growth,

PE is the price to earnings multiple. Whether Infosys can narrow this valuation gap depends on several factors, one of which will be its performance and outlook for FY23.

An industry source who did not want to be named said Infy's growth was thanks to the investments it made earlier sacrificing the margins. Since Salil Parekh took over as the CEO, the company has also made significant acquisitions and developed technical capabilities that pressured the margins.

Wipro, under CEO Thierry Delaporte, is also investing in digital capabilities that would help the firm grow faster. A case in point is the firm’s $1.45 billion acquisition of Capco. These would impact the margins and it is expected to be in the range of 17-19 percent.

On the other hand, TCS has been conservative when it comes to investing and continues to maintain the margin in the 24-26 percent range. In addition, the company has grown to a size where it is harder to be the fastest-growing.

But this is not to say that TCS has been performing subpar to its peers. With the scale almost twice of its peers, the IT performance has been at par with the competitors, analysts added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!