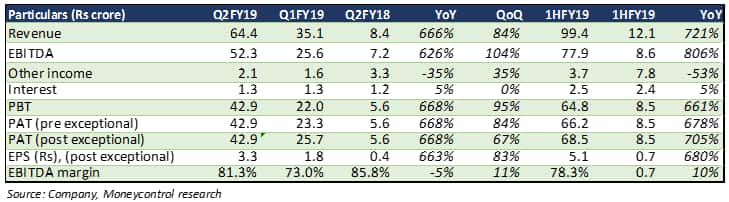

Hindustan Oil Exploration Company (HOEC) reported a healthy performance for yet another quarter and the results were a substantial beat over our expectations. Revenue improved to 84 percent sequentially on the back of increased production volumes, higher offtake and improved realization with gas price and crude oil price ticking up. Earnings before interest tax and depreciation (EBITDA) margins saw a further sharp uptick, 830 basis points sequentially.

The company has further ramped up its production from the Dirok basin. Post the successful drilling at PY1, the block has starter contributing to growth. With stabilising production, improving volumes and an overall supportive macro pricing environment, the company is at the cusp of a fast paced turnaround.

Companies major assets are now in the production phase which is ramping up rapidly. The company expects to rapidly ramp up production from PY1 block in the current quarter which we believe would be positive for the stock.

Dirok blockDirok is the main producing asset of the company. The revenues are rapidly growing from this basin which is driving the company’s overall performance. The company expanded its production capacity by installing a 12-inch pipeline in April this year, post which there has been a rapid ramp up in production.

The company achieved average production of 32.6 million standard cubic feet per day (mmscfd) and 792 barrels of oil per day (bopd) during the quarter. The company has submitted a revised development plan for new well drilling in this block with which the production is expected to touch 55 mmscfd. The gas prices have been revised upward from 1 October 2018 onwards. We believe this would help in improving the realisations and bottom line in the current quarter.

The company has now acquired a new block (AA-ONHP-2017/19) adjoining the Dirok block under the latest round of open acreage licence policy (OALP) of the government. Though the block is still to be explored, the management has strong confidence in finding reserves given its proximity to the Dirok basin. With an invested and a developed infrastructure in the region, any incremental production from this block would contribute directly to the bottomline in the longer run.

PY1Post successful drilling of two wells, the PY1 block in the Cauvery basin is now a producing asset. The average production during the quarter was around 9.8 mmscfd. The management plans to increase this further in the current quarter. Being an offshore basin, it fetches a higher realisation. HOEC has a 100 percent stake in the block and production is expected to contribute significantly to incremental revenues. Moreover, total reserves in the basin are now believed to be much higher than initial projections which would also work in favour of the company in the long term.

Post the approval of the field development plan for the B80 basin, the development work is on track and the management expects to commence production from the block from April 2020. This block would help in substantially increasing the exposure of the company to oil. The management expects to produce 5000 barrels of oil per day from this block from the Q1 of FY21. HOEC holds 50 percent stake in this block.

Production from KharsangThe acquisition of Geopetrol in April gives HOEC 30 percent participating interest in Kharsang block in Arunachal Pradesh. The block produced 711 barrels per day of crude during first half of the year.

The management is expediting the expansion of this block with expectation of additional reserves. The blocks vicinity to the kharem field bodes well with the already invested infrastructure.

OutlookHOEC is now rapidly monetising its assets and the revenue and profits of the company are increasing by leaps and bounds. With production ramping, the company is now focusing on steady and sustainable off take of the produce.

HOEC has a debt free balance sheet and plans to fund further expansion through internal cash generation. This would mean a relatively stable position in the current market volatility.

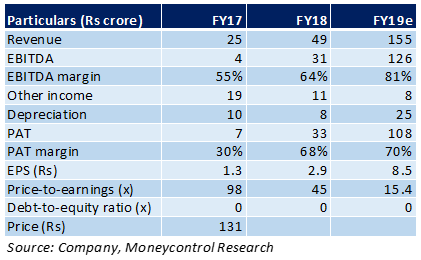

The stock has run up 58 percent in the last 12 months and is currently 14 percent below its 52-week high. It is trading at a FY19e price-to-earnings of 15.4 times. The monetization plan for the discovered blocks has been moving faster than the plan and with production volumes ramping up we see immense scope for rerating in this growing business. HOEC is a growth stock. Investors with a penchant for investing in high growth businesses should look to add this on any weakness in the current market volatility.

Follow @RuchiagrawalFor more research articles, visit Moneycontrol Research page.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.