India’s largest consumer staples firm Hindustan Unilever Ltd. is set to report its earnings for the third quarter of the current fiscal year on January 22. The delayed winter, rising commodity prices, and lagging urban demand are expected to result in the FMCG giant seeing flat earnings.

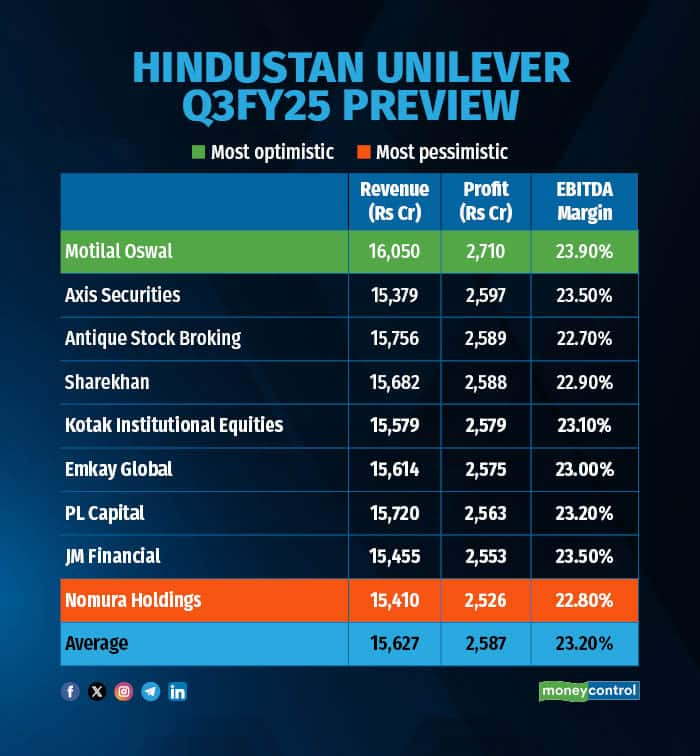

According to a Moneycontrol poll of nine brokerages, Hindustan Unilever is likely to report revenue growth in low single-digits, higher by 4.7 percent on-year, at Rs 15,627 crore. Net profit is likely to come in at Rs 2,587 crore, up from Rs 2,541 crore from the corresponding quarter last year.

Earnings estimates of analysts polled by Moneycontrol are in a narrow range, so any positive or negative surprises may elicit a sharp reaction in the stock. The most optimistic estimate sees HUL’s net profit jumping 6.7 percent on-year, but the most pessimistic projection suggests that net profit might sink.

What factors are impacting the earnings?Hindustan Unilever’s revenue is likely to remain flat on account of subdued performance across categories, as urban demand sees significant stress.

Volume growth: The overall demand for HUL will be muted, with underlying volume growth coming at around one percent, according to brokerages. The low volume growth comes as the domestic demand setting remained largely muted, affected by the sustained demand slump in urban markets.

Segment performance: The performance across segments is likely to vary. HUL's home care is likely to grow at 2.5 percent, leading growth while beauty and personal care revenues are also likely to rise by around two percent. “Food portfolio performance is expected to be stable. However, the continued weakness in the food drink portfolio could drag overall food & refreshment performance,” said Antique Stock Broking.

EBITDA margins: Higher raw material costs are likely to weigh on margins. “Prices of key inputs have seen an uptick in the last six months. Companies are gradually taking price hikes in the portfolio, which will not be enough to cover inflation in the input prices,” noted a Sharekhan report.

Analysts will closely monitor demand in metro areas and tier-3 towns. They will also pay attention to raw material prices and their effect on EBITDA margins, as well as the growing competitive pressure from unorganized players. The near-term outlook remains an important factor to watch, given the inflationary stress (particularly in foods and soaps portfolio) and demand slump.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!