One of India’s largest consumer staples firm Hindustan Unilever Ltd. is set to report its earnings for the first quarter of the the current fiscal year on July 31, 2025. Rising commodity prices, increased competition, and lagging urban demand are expected to result in the FMCG giant seeing tepid earnings for the quarter.

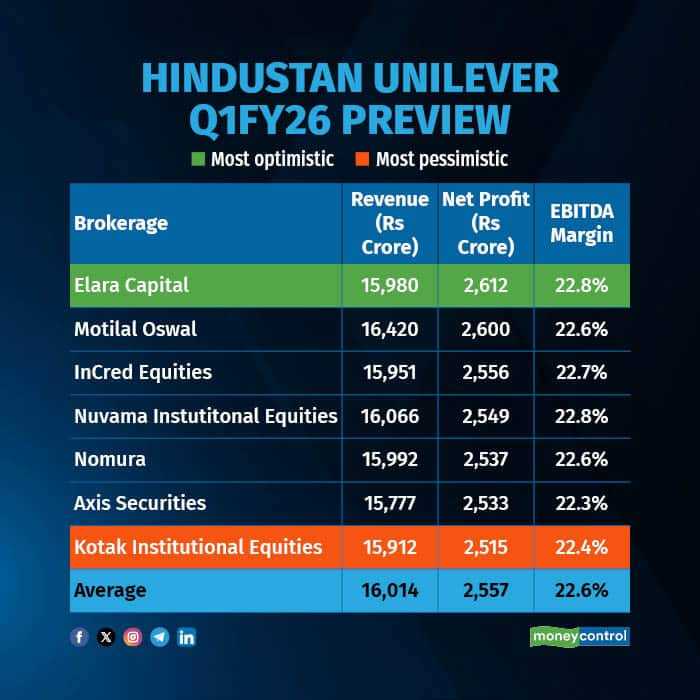

According to a Moneycontrol poll of seven brokerages, Hindustan Unilever is likely to report revenue growth in low single-digits, higher by 4 percent on-year, at Rs 16,014 crore, as against Rs 15,339 crore in the June quarter of the previous year. Net profit is likely to come in at Rs 2,557 crore, down 0.4 percent from Rs 2,572 crore from the corresponding quarter last year.

Earnings estimates of analysts polled by Moneycontrol are in a narrow range, so any positive or negative surprises may elicit a sharp reaction in the stock. The most optimistic estimate sees HUL’s net profit rising 1.6 percent on-year, but the most pessimistic projection, rolled out by Kotak Institutional Equities, suggests that net profit might fall 2.2 percent YoY.

What factors are impacting the earnings?

Volumes

Hindustan Unilever’s revenue is likely to remain flat on account of subdued performance across categories, as urban demand sees significant stress.

Brokerages noted that demand trends remained consistent QoQ with muted growth, and rural areas continued to outperform urban areas. "There have not been any change in urban/rural demand versus last quarter. We expect Q1 to be largely in line with management's guidance on Q4 call," said Kotak Institutional Equities.

Segmental performance

According to Kotak Institutional Equities, the Home Care (HC)s segment's growth will clock in at 2.5 percent year-on-year (versus 1.8 percent in Q4), as volume growth will be offset by negative pricing and higher promotional intensity.

"In Home Care, negative pricing for the entire quarter is likely versus one month of negative pricing in Q4FY25. However, we do see this Home Care price intervention as a driver of volume growth," added Nuvama Institutional Equities.

Beauty & Personal Care (BPC) revenues will see 5 percent year-on-year (versus 3.7 percent in Q4), aided by price hikes in soaps. The Foods & Refreshments (F&R) segment may report 2.8 percent growth (versus a 0.4 percent decline in Q4), driven by price hikes in tea.

Margins

According to expectations, gross margins are likely to contract as a result of increasing consumer protection. Brokerages project that advertising and promotional spends will be up to 11 percent of sales in the quarter.

This impact will flow through to the EBITDA, leading to an EBITDA margin contraction. While Moneycontrol's estimate suggests EBITDA margin may contact 90 basis points, the range is between 70-110 basis points of contraction.

What to look out for in the quarterly show?

The key focus will be on HUL's growth outlook, and experts will be watching closely for commentary on inflation and pricing outlook in both soaps and tea. Additionally, demand recovery in urban consumption will be eyed.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!