Drugmaker Dr Reddy's Laboratories is expected to report marginal on-year growth in its revenue and a low double-digit increase in net profit for the October-December quarter. The pharmaceutical company is slated to release its third quarter (Q3) earnings on January 30.

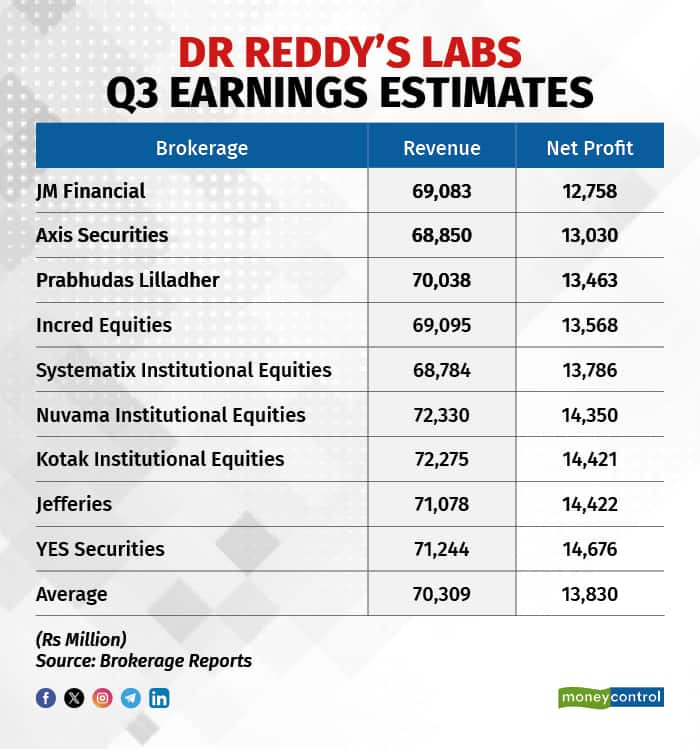

The drugmaker is expected to report a net profit of around Rs 1,383 crore, up 12 percent from Rs 1,237.90 crore recorded in the same quarter of the previous fiscal year, according to an average of estimates of nine brokerages.

Revenue is expected to record a marginal 4 percent on-year rise to Rs 7,030.90 crore, dragged by weak sales from the domestic market and price erosion in other key products in the US. However, the contribution from the blockbuster cancer drug Revlimid is expected to remain stable, offsetting the loss of revenue from other segments.

The pharma major had posted a topline of Rs 6,789.80 crore in the year-ago period.

Among the brokerage estimates collated by Moneycontrol, JM Financial rolled out the most bearish growth projections for Dr Reddy's Q3 performance, while YES Securities was the most optimistic.

Revlimid contribution remains steady, others not so muchThe generic version of the cancer drug Revlimid will continue to remain the star contributor to the drugmaker's US revenue for yet another quarter, with analysts estimating its contribution to come to around $100 million for Q3. However, lower sales of Ciprodex (used to treat ear infections) due to an unfavourable seasonality effect and Suboxone (used to treat opioid addiction) due to high price erosion are likely to weigh on the overall revenue growth in the US business.

Also Read | Cipla shares rally 8% to hit 52-week high on strong Q3 earningsStill, JM Financial believes that a ramp-up of the company's recently acquired Mayne portfolio should support incremental growth in the drugmaker's base business in the US to reach $279 million in Q3.

The company's India business is likely to report mid-single-digit on-year growth in Q3, adversely impacted by a sporadic acute season during the quarter. Brokerage firm Nuvama Institutional Equities predicts a mere 7 percent on-year growth in Dr Reddy's India business due to a weak acute season and lost sales from divested brands.

Dr Reddy's had divested nine dermatology brands to Eris Lifesciences in the last quarter of FY23.

Margins to remain stableWith a sustained contribution from the high-margin Revlimid, analysts expect Dr Reddy's operating margin in Q3 to remain stable year-on-year (YoY). On that account, Kotak Institutional Equities pegged 2 percent on-year growth in the company's consolidated earnings before interest, taxes, depreciation, and amortisation (EBITDA) at Rs 2,100 crore, with the EBITDA margin expanding 20 basis points (bps) sequentially to 29.1 percent.

Going ahead, brokerages also believe that the drugmaker's commentary on its US base business and margin trend will remain the key monitorable, especially at a time when the contribution from Revlimid is expected to gradually taper off through the coming fiscal.

Also Read | Cipla tumbles 3% after Samina Hamied steps down as VCDisclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.