The June quarter earnings of Divi's Laboratories are likely to come under pressure because of base effect. Despite expectations of a decline in the bottomline on a year-on-year basis, analysts hope for a modest recovery sequentially when the pharma major will announce its results on August 11.

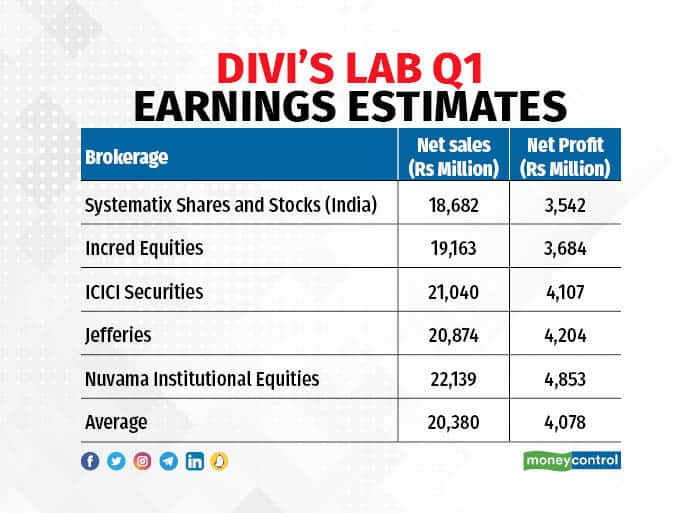

An average of estimate of brokerages polled by Moneycontrol pegged the net profit for the company at Rs 407.8 crore, nearly 42 percent downside from Rs 702 crore recorded in the base quarter last fiscal.

Divi's Labs enjoyed higher revenues and margins in the base period due to contribution from Covid-related sales of Molnupiravir, which boosted its profit numbers.

Revenue for the drugmaker is estimated at Rs 2,038 crore, nearly 10 percent lower than Rs 2,254.5 crore clocked a year ago.

On a sequential basis, net profit is expected to rise 28 percent from Rs 318.79 crore, while revenue may reflect a nearly 7 percent jump from the previous quarter's Rs 1,908.17 crore.

Among the brokerages polled by Moneycontrol, Systematix Shares and Stocks had the lowest growth projections for Divi's Labs, while Nuvama Institutional Equities had the highest.

Incred Equities also anticipates a sequential improvement in operating profit margins on the back of some normalisation in logistics and raw material costs. "While Q1 is historically a weak quarter, the revenue trajectory this time around should improve backed by the commencement of commercial supplies for a Sartan product and possibly the custom synthesis product, for which customer qualifications were completed last quarter," the brokerage said.

On the expectation of a margin recovery, Nuvama estimates the EBITDA margin at 30.6 percent for the April-June period that is substantially lower than its historical run-rate of 34-35 percent.

Going ahead, Prabhudas Lilladher believes the management's outlook on margins and growth in its custom synthesis business will remain key monitorables for Divi's Labs.

Expectations of subdued earnings on a year-on-year basis also dented the investor sentiment. At 11.14am, the stock was trading 1.2 percent lower at Rs 5,635 on the National Stock Exchange. The stock is also down over 2 percent for the past year, mainly on account of persisting pressure on its earnings and margins.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.