Ruchi Agrawal Moneycontrol Research

- Decent topline growth, improved realisations - Weak monsoons impact volumes - High input cost continue to impact margins - Finance cost up with high working capital - Capacity expansion on track

-------------------------------------------------

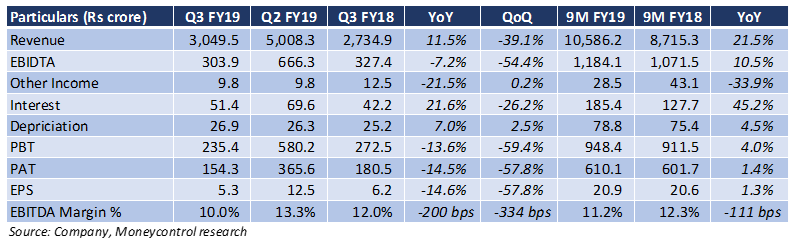

Coromandel International (CORO) reported disappointing third-quarter performance with margin contraction on increased input costs and an inability to raise prices sufficiently despite inventory gains. Weak monsoon led to lower volumes that further impacted performance.

Key positives

-The revenue grew a decent 11.5 percent year-on-year (YoY) led by a 12 percent YoY growth in nutrient & other allied business. Growth in crop protection business remained subdued at 3 percent YoY. Majority growth was driven by exports; domestic market performance remained weak.

-Despite a fall in volumes, the company was able to grow its market share due to its strong marketing initiatives.

Key negatives

-Both operating and net margins saw a substantial contraction due to lingering pressure of high input costs. The supply issue from China remains a problem for the raw material.

-Higher other expenses from a higher spend on marketing and one-offs for strategy consulting ate away a portion of the quarter’s profitability. Rupee depreciation and premium on hedging instruments led to foreign exchange losses.

-Price hikes taken during the quarter proved inadequate when compared to the steep hike in raw material costs. Despite leaner channel inventory, the company was not able to fully pass on high input costs.

-Weak monsoons impacted the Rabi acreages and soil moisture which led to contracting volumes across industrywide. There was a 13 percent YoY decline in volumes, with NPK+DAP segment declining around 5 percent YoY.

-Higher working capital requirement coupled with higher borrowing costs led to an uptick in finance costs.

Other observations

-According to the management, the DBT implementation has now stabilised; the subsidy claims are getting settled soon. This should be positive for the increasing working capital in the future.

-The company has added a 10,000MT capacity in the Mancozeb segment taking the total installed capacity to 45,000 MT. The management expects good demand for Southeast Asia, Africa and Central America and is also planning to explore Brazil currently dominated by UPL.

-The commissioning of the backward integration project is on track (planned for 2QFY20). This will boost the phos acid manufacturing capacity from 250,000 tonnes per annum (TPA) to 350,000 TPA. CORO currently fulfils its additional phos acid requirement (550,000-600,000 TPA phos acid above the 250,000 internal capacity) through its JVs (Foskor and TIFERT) and from imports from Morocco and Jordan.

Outlook

-The prices of certain key raw materials have now started to cool down. This should be of relief for the company’s margin.

-The company is now shifting towards a high margin product mix (more NPK, less DAP) which bodes well for margin improvement in the longer term.

-Price hikes taken in Q3 along with low discounts stand to ease some pressure on the margins in the longer term.

-the management expects to recover Rs 18 crore in the form of insurance claims which was expensed in Q2FY19. Moreover, there are no expected one-offs for Q4.

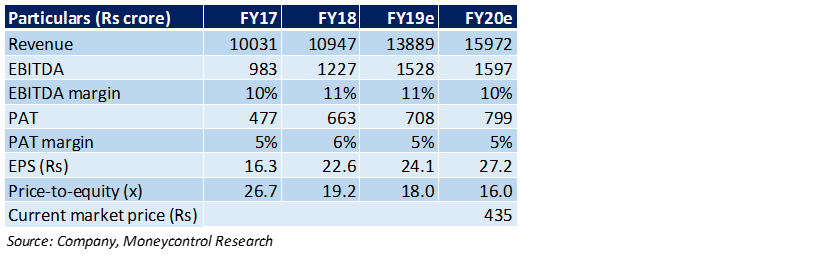

The stock has corrected 25 percent from its 52-week high and is trading at a 2020e (estimated) PE of 16x. Though we expect the pressure on margins to continue in the short term, we expect improved growth in the long period due to the growing share of the non-subsidy business, greater operating leverage and visibility of growth in the crop protection business.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.