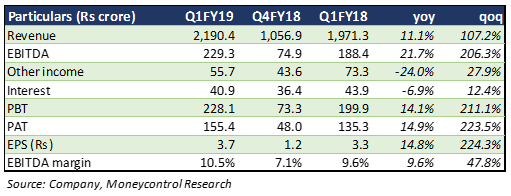

Chambal Fertilisers & Chemicals reported a healthy growth in Q1 revenue and profits both on a year-on-year (YoY) and sequential basis. Revenue increased 11 percent on the back on an uptick in urea production and sales volumes, even though traded fertiliser volumes saw a slight dip. Earnings before interest, tax, depreciation and amortisation (EBITDA) margin saw a 90 basis point improvement on the back of higher urea volumes pushing up EBITDA by 22 percent. The quarter gone by saw higher gas prices and rupee depreciation versus the dollar which drove up raw material expenses.

Uptick in urea volumes

Urea production volumes increased 30 percent YoY to 5.5 lakh tonne. In the year-ago quarter, the company had lost almost 1 lakh tonne of volumes due to maintenance shutdowns. With a hike in phos-acid prices, the company postponed imports of complex fertilisers leading to a decline in traded fertiliser volumes (diammonium phosphate/nitrogen, phosphorous, and potassium and muriate of potash) which declined 34 percent YoY to 2.2 lakh tonne. Lower trading volume and higher production and sales of urea drove EBITDA per tonne to Rs 2,658, up 19.5 percent YoY.

New project to usher margin improvement The company is in the process of commissioning a new project - Gadepan 3, which is nearing completion and is expected to get fully commissioned around January next year. Higher volumes from this project are expected to provide a push to margin in the coming year. The new project is expected to be operationally efficient and the management expects it to usher a 300 basis points EBITDA margin improvement from the first year. With the project nearing completion, the debt related to the project rose to Rs 3,330 crore towards June-end. Working capital loans also saw a substantial uptick.

Subsidy situation During the quarter gone by, Chambal received Rs 480 crore towards urea subsidy and Rs 558 crore towards NPK subsidy. The outstanding subsidy amount towards the end of the quarter was higher both YoY and sequentially. While there was substantial uptick in the outstanding subsidy for urea, the same for phosphatic and potassic fertilisers decreased due to lower sale volumes.

Urea imports The company imports a substantial portion of its urea requirement from China, which is mostly manufactured through the coal route. Over the past couple of months, there has been a drop in supply due to closure of factories owing to stricter environmental laws in China. This is one major reason for the uptick in raw material costs. This, coupled with an upward trend in gas prices and depreciating rupee-dollar, is straining margin in the urea segment.

Outlook In the last three months, the stock has corrected 32 percent. It is currently trading at FY19e price-to-earnings of 12.2 times. We expect greater urea volumes, better operational efficiency and higher utilisation to support future margin. Although the urea subsidy situation is comfortable (subsidy reimbursements are expected to improve in the longer run), we see raw material and procurement prices remaining an overhang. The recent correction makes the stock attractive.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.