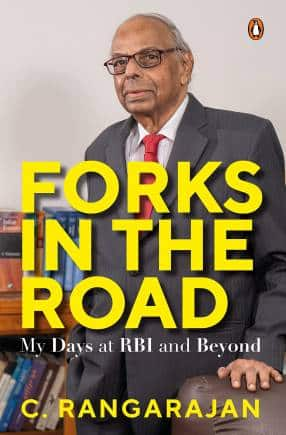

By any standards, Dr C. Rangarajan has been one of the most distinguished Indian economists of all time. Between 1982-1991 he was the Deputy Governor of the Reserve Bank of India (RBI), following which he served as Governor from 1992-97. A Padma Vibhushan awardee in 2002, Rangarajan was also Chairman of the Prime Minister’s Economic Advisory Council between 2009 and 2014.

Penguin Random House India is going to release Rangarajan’s book Forks in  the Road: My Days at RBI and Beyond on November 7 (Monday). It’s a thorough and engaging account of his long career with the RBI, as well as his thoughts and observations on the economic developments in India and elsewhere over the past decade or so.

the Road: My Days at RBI and Beyond on November 7 (Monday). It’s a thorough and engaging account of his long career with the RBI, as well as his thoughts and observations on the economic developments in India and elsewhere over the past decade or so.

Ahead of the release, Moneycontrol caught up with the author in a video interview. Edited excerpts from the conversation:

You begin the third chapter of the book by noting that “The 1980s saw a continuous ‘battle’ between RBI and the Ministry of Finance on the control of inflation and the need to contain the fiscal deficit (…)” Today, a similar conflict is playing out in India, where there’s a need to control inflation—but, as the government insists, not at the cost of development. What lessons from the '80s are applicable to today’s scenario?This has always been an issue. Governments have their own agenda—growth, development, etc.—while central banks make sure that inflation does not exceed a certain limit. Earlier there was no clear mandate given to the central bank but I think the introduction of the inflation targeting mandate has eased this conflict between the two institutions. Today, I feel we should focus on getting inflation back to within acceptable limits, around the 6 percent mark. It has been well above the 6 percent mark for a period of over nine months now. The question should be how fast, or at what pace should we bring it down, rather than saying, “We will continue at 7 percent or 7.4 percent for the next six months”. We should first focus on getting inflation below that threshold, before we can think about our next move, at the macro-level.

In the chapter on the Planning Commission, you write about how prior to the liberalisation of the economy, P.V. Narasimha Rao wanted “a by-pass arrangement whereby benefits reach the lowest rung of the social pyramid directly from the State.” How successful have we been in doing this, 30 years down the line?The important thing was that P.V. Narasimha Rao, as the Prime Minister of the country, wanted to take all people with him. There was a group of Congress people, for example, who were in support of the previous economic paradigm and they were wary of the reforms that Rao and Dr Manmohan Singh wanted to bring in. This is why Rao introduced the concept of the “by-pass arrangement” as he called it so that as growth and reforms proceed, we continue to take care of the most vulnerable groups in society. As I explain in the last chapter of the book, growth and reforms must happen hand-in-hand with social safety nets introduced to protect these vulnerable groups. I cite the numbers between 2004-5 and 2010-11, when the Indian economy had a growth rate of between 8-9 percent, the poverty ratio also came down (which is not exactly the same thing as inequality reducing, but it is an important objective).

You’ve written that policymakers should see agricultural loan waivers as a last resort—and that rescheduling loans is a preferrable course of action in most cases. Could you explain the rationale behind this and how it helps the economy?Large-scale waivers of agricultural loans create a problem with the repayment culture, which is ultimately harmful for the economy. If there are repeated loan waivers across a period of several years, people will simply assume that they don’t need to make their payments, that a waiver is around the corner eventually.

Now, to be sure, waivers are absolutely necessary in some cases—natural calamities and so on are outside the control of farmers and the impact of these calamities should be offset with waivers, of course. But it’s the repeated loan waivers that cause a problem.

There’s a tendency, among both regular people and policymakers, to conflate the price levels of crude oil with the overall scale of inflation—in the last chapter, you write about this phenomenon in the context of post-Covid inflation. What are the strengths and weaknesses of this approach, and do policymakers need to move beyond this?Obviously, the price of crude oil increasing in a sustained way triggers a fall in demand of other commodities; families with fixed incomes will buy less of the other commodities since oil is essential. Generally speaking, for individual commodities to affect prices across the spectrum, there has to be a shift at the macro level. During Covid, the US fiscal deficit increased by 3 times, for example. Clearly, when the fiscal deficit increases so much, it requires a level of borrowing that has to be accommodated by the central bank. The point that I wish to make is that the policy recommendation at that time was for governments to increase expenditure—India did it too, although not to the same level. The current, ongoing inflation is a result of all this increased liquidity and ultimately, that’s what policymakers in central banks have to bring down.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.