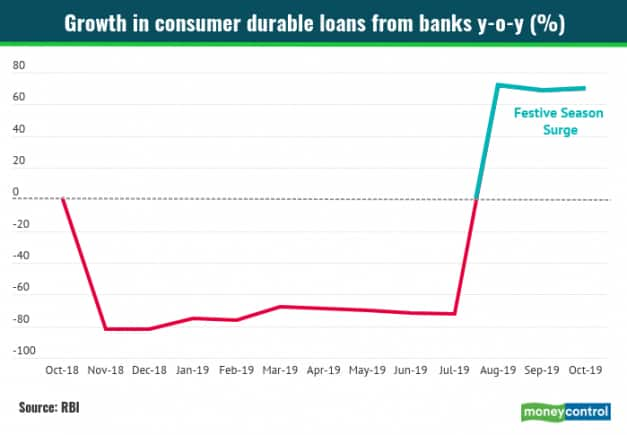

After a long spell of contraction, loans given by banks for purchase of consumer durable goods like washing machines, refrigerators and air- conditioners saw a sharp rise since the start of festive season this year.

Strong demand, fuelled by lucrative discount offers and backed by retail loan push from banks led to a boost in consumer durable loans in months of August, September and October.

Data released by the Reserve Bank of India (RBI) showed that bank credit to consumer durable segment under personal loans, increased by around 70 percent for all three months, as against deep negative growth seen during rest of the year.

"Our channel checks reveal that demand for washing machines was the strongest during the festive season, followed by demand for refrigerators and room air conditioners. Premium products saw healthy growth rates, driven by attractive offers, cashbacks and finance schemes, while sales of entry-level products were impacted by rural stress," said Naval Seth and Aakash Fadia, analysts at Emkay Global.

Typically, this segment was targeted by non-banking finance companies (NBFCs) that would offer loans to customers and convert their purchase into EMIs on the spot. But with the NBFC sector under liquidity pressure, it is likely that they were replaced by banks this year.

Also, this festive season saw several banks-both public and private- rolling out special loan offers on their debit and credit cards in partnership with a number of online shopping portals, which may have also contributed to the sharp rise.

With slump in demand for corporate credit, banks are leaving no stone unturned to tap the potential in personal and retail loan segments. However, it is unlikely that banks will be able to sustain high credit growth in consumer durable segment after the end of festive season.

Leading brands have already started rolling back discount offers. Emkay Global's report said that LG was the first to reverse discounts across product categories.

With the RBI slated to announce the monetary policy review on December 5, it is widely expected that the Monetary Policy Committee will deliver the sixth rate cut in a row to support loan growth across sectors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.