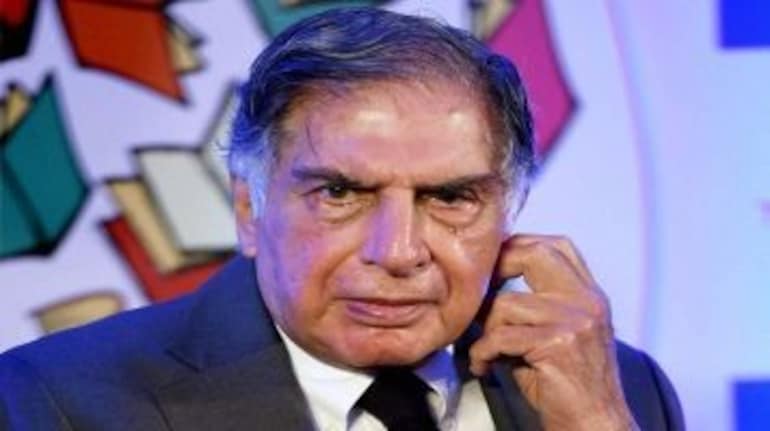

Moneycontrol BureauFollowing allegations that Tata Group Chairman-Emeritus Ratan Tata violated insider-trading norms by requesting access to group firms' sensitive financials even when he was not in an executive role, the market regulator seems to have absolved the industrialist of the charges.A report in Mint says that Securities and Exchange Board of India (SEBI) held a meeting on January 14 to discuss the allegations and concluded that insider trading regulations “allow communication of unpublished price sensitive information if it is in furtherance of legitimate purposes, performance of duties or discharge of legal obligations.” The issue was raised by previous Tata Sons Chairman Cyrus Mistry and Nusli Wadia who claimed some trustees of Tata Trusts including chairman emeritus Tata had sought information on the operating firms. The Sebi note said sharing information with a chairman emeritus is normal course of business. “Though such a person has left the company, the benefit of his expertise would be invaluable to the company. Sometimes agenda items and other sensitive papers pertaining to board and committee meeting could be circulated to him,” the note reporedly says. However, Sebi has also written to four group firms seeking clarifications and comments on Wadia’s complaint about some trustees for Tata Trusts such as Ratan Tata and Noshir Soonawala seeking information, the board note said.In a letter addressed to Tata Steel shareholders, Wadia said Tata Sons and trustees of the Tata Trusts sought information and received briefings with regard to Tata Steel, which are material and price-sensitive. “This, I believe, was before the introduction on January 15, 2015 of the insider trading regulations. I believe that Tata, Soonawala and the board of Tata Sons, even post-notification of the regulations on January 15, 2015, sought access to information and documents of Tata Steel, Tata Motors and other Tata companies,” Wadia alleged.Sebi's observation is the second positive development in the week for Ratan Tata. On Wednesday, the National Company Law Tribunal on Wednesday dismissed the contempt petition filed by Cyrus Mistry.In December, Mistry's investment companies had moved NCLT to protect interests against mismanagement and oppression of minority shareholders at Tata Sons. A day before, Mistry had resigned from Boards of various Tata companies as Chairman. Mistry’s investment firms Cyrus Investments Private Corp and Sterling Investments Pvt Corp Limited own 18.4 percent in Tata Sons. Mistry’s petition ought the Tribunal’s intervention because of a breakdown in governance at Tata Sons. Mistry has also contested the legality of the Tata Sons board meeting held on October 24 to oust him as his removal was not part of the board’s agenda. However, Mistry is not seeking his reinstatement but to put in place a governance structure.The hearing for the main petition will begin on January 31.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.