Kellogg’s garnered much public attention lately, courtesy of a viral meme that talked about its entry into traditional Indian breakfast fare such as upma after not tasting much success with its core offering of corn flakes in the country.

The meme, tweeted by Anand Mahindra, chairman of the Mahindra Group, also triggered a public discourse on Indian versus western food last week. Patriotism ran high in the hundreds of replies that followed Mahindra’s tweet, with people claiming that western breakfasts could never replace Indian fare.

The meme’s popularity would make one believe that there are few takers for breakfast cereals in the country. However, data on the cereals market paint a different picture.

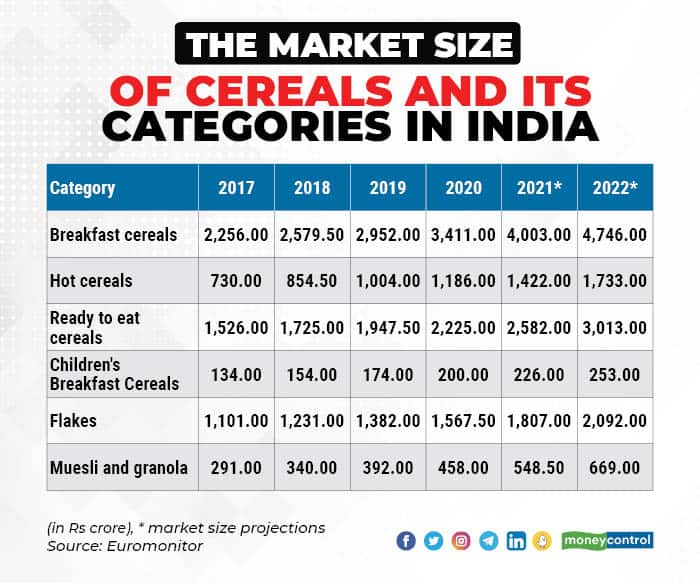

The breakfast cereals market in India, valued at Rs 2,256 crore in 2017, grew at a 12 percent CAGR to Rs 3,411 crore in 2020, according to Euromonitor International, a London-based market research company. In fact, the segment witnessed an accelerated pace of growth as the country battled with the Covid-19 pandemic, experts said.

“The growth rate of the breakfast cereals segment in the country almost doubled during the pandemic,” said Anand Ramanathan, a partner at Deloitte India. “From 11-12 percent growth that the category was witnessing in the pre-pandemic times, it has now moved to 18-20 percent, driven by the trend towards convenience foods.”

Euromonitor projects that the segment would continue growing at this momentum and is likely to reach Rs 4,746 crore in 2022

Nonetheless, the meme was not entirely wrong about the struggles of the cereals category in India. The segment, which gained recognition with the entry of Kellogg’s in the 1990s, had a difficult time finding its footing in the initial days. The struggle was even more pronounced for companies that sold products other than corn flakes, such as muesli and oats.

Bagrry’s, a company that introduced muesli in the Indian market in the 1990s, entered the more popular corn flakes segment in the early 2000s.

“We decided that we wanted to be an overall breakfast cereals brand and entered the more popular categories of corn flakes and chocolate-based cereals,” Aditya Bagri, director of Bagrry’s India, told Moneycontrol.

It turns out that oats has now emerged as the fastest-growing subcategory in the segment. According to Purnendu Kumar, practice leader, consumer and retail, Praxis Global Alliance, oats witnessed 24 percent growth in the past few years, outstripping the entire category.

Furthermore, the entry of Marico with its Saffola Oats and PepsiCo with Quaker Oats made cereals mainstream. Parle Products, the maker of the popular Parle-G biscuits, also entered the segment in September and introduced Hide & Seek Fills targeting children.

“While cereals have found it extremely challenging to replace the traditional breakfast fare, we have found the younger generation and millennials are more receptive to such categories,” said Krishnarao Buddha, senior category head at Parle Products.

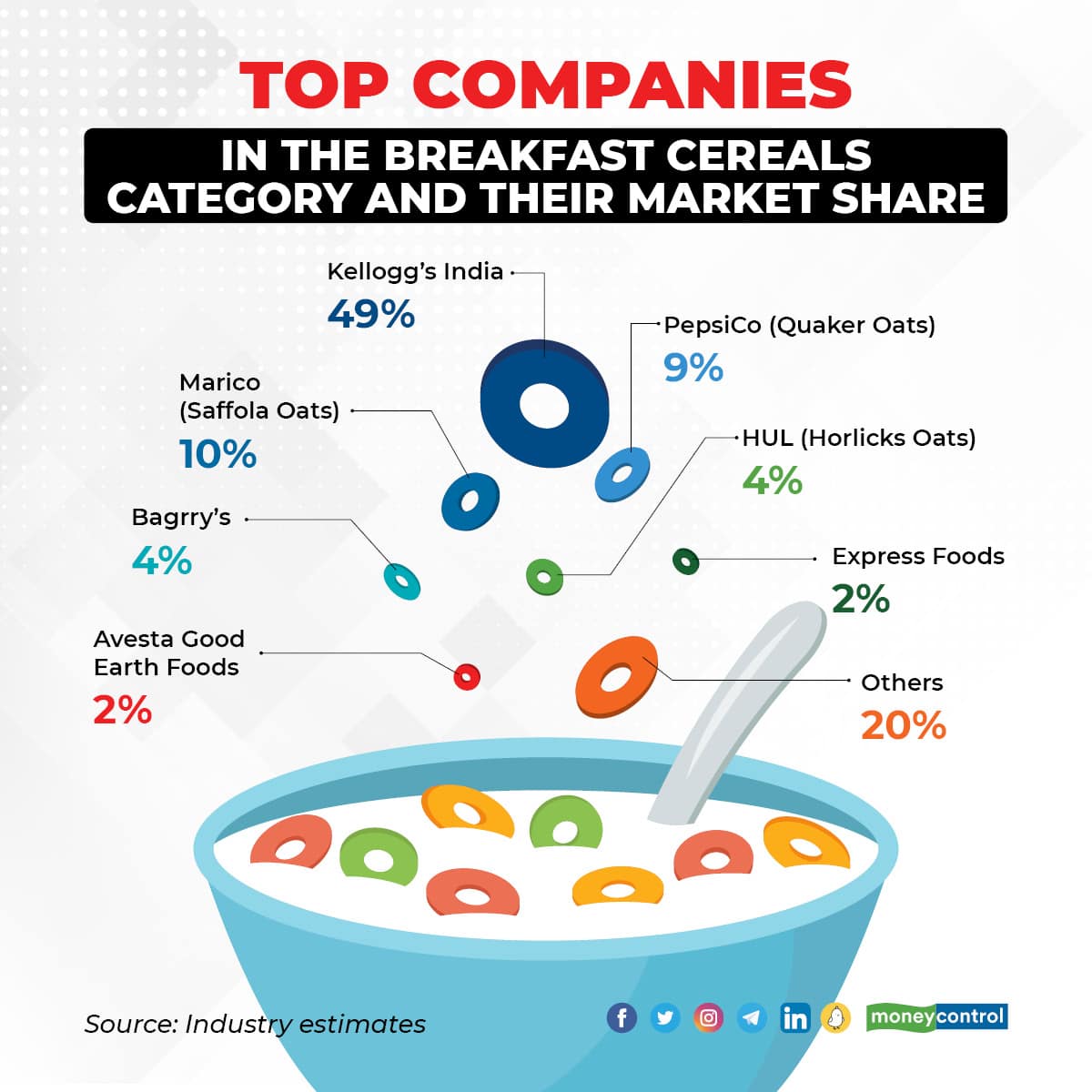

Today, Kellogg’s commands a 49 percent share of the cereals market in India, followed by Marico at 10 percent and PepsiCo at 9 percent, as per industry estimates. Bagrry’s and Hindustan Unilever (with Horlicks Oats), industry experts said, have 4 percent each of this market. (as shown below)

“Cereals were a niche play for several years but in the last five years, and especially in the latter half, fuelled by health consciousness due to the pandemic, consumers have flocked to the category,” said Bagri.

The increased demand for convenience foods as people stayed at home for longer hours and ordered less food from restaurants is another factor that boosted the popularity of cereals.

Toppings of innovationAccording to industry experts, constant innovation by companies and the mushrooming of startups are increasing the market size of the category. Marico entered the segment by introducing savoury masala oats instead of sweet flavoured cereals that were more prevalent in the market then.

Similarly, startups have been trying to disrupt the market. Some have even added an Indian touch by launching products with traditional staples. Tata Soulfull, a startup acquired by Tata Consumer Products earlier this year, offers Ragi Bites Cereals and Millet Muesli. Slurrp Farm has products such as Organic Millet Oat Porridge (daliya/suji substitute) and Organic Ragi & Rice Cereals.

The older companies have also not shied away from innovation. Kellogg’s launched Froot Loops, a multigrain cereal made from corn, wheat and oats, last month. Additionally, these companies are pushing the consumption of cereals for occasions beyond breakfast. Kellogg’s has introduced K Energy Bars and Tata Soulfull has Ragi Bites Snacks.

According to Mohit Anand, MD of Kellogg South Asia, the company’s foray into the upma segment is also an attempt at offering innovation.

“We are always looking to cater to the Indian consumer’s needs by providing authentic solutions that address their everyday nutrition demands for time-pressed consumer. To that end, our offerings and innovations are nutritionally differentiated and customised based on evolving consumers’ taste and preferences,” said Anand.

The spectre of traditional fareNotwithstanding the growth, traditional fare poses a threat to the breakfast cereals segment and remains its foremost challenge. Many companies have introduced traditional breakfast products at price points as low as Rs 20, which does not bode well for the pricier cereals segment, experts said.

Nestle has launched traditional breakfast items under its immensely popular Maggi brand, Marico under Saffola and ready-to-eat and ready-to-cook companies like MTR and Gits Food have launched poha and upma variants.

“The pricing of cereals is considered to be higher than traditional breakfast options, which are seen to be as healthy and tasty as cereals,” said Kumar of Praxis Global Alliance.

The high prices of cereals limit their market and the category remains an urban phenomenon.

“Companies need to make the products more accessible and affordable if they want to drive their penetration beyond the urban centres,” said Ramanathan of Deloitte India.

Despite the challenges, experts said the breakfast cereals category has huge potential in the country, especially as companies add an Indian touch by introducing traditional staples.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.