The government will release data for India’s July-September quarter (Q2FY25) gross domestic product (GDP) on November 29 and experts suggest the numbers are expected to show moderation due to excess rainfall, weak corporate earnings and subdued rural and urban consumption.

The Indian economy is likely to have decelerated to a six-quarter low of 6.5 percent in the second quarter of this fiscal (FY25), compared with 6.7 percent in the previous quarter, according to a Moneycontrol poll of 11 economists.

Over the last one month, India Inc. too has been expressing similar sentiments. Here is what CXOs have said about the economy’s growth:

Nestle India Chairman Suresh Narayanan has expressed concern over a “shrinking middle class”. “There used to be a middle segment – the middle-class – where most of us FMCG companies used to operate in. That seems to be shrinking,” he told reporters on October 22, while adding that the slowdown has continued for several quarters now which is unusual.

Nestle India Chairman Suresh Narayanan

Nestle India Chairman Suresh Narayanan

Nestle India's net profit for Q2 FY25 on October 17 stood at Rs 899 crore, falling marginally from Rs 908 crore for the corresponding quarter of the previous year. Revenue from operations for Q2FY25 was Rs 5,104 crore as compared to Rs 5,037 crore a year ago, a rise of 1.3 percent.

Amit Syngle, MD and CEO of Asian Paints said on November 11 that urban centres are definitely seeing stress and an overall low demand has impacted seasonal markets as well. “We have seen that the overall Diwali season did not go the way we would have anticipated it.”

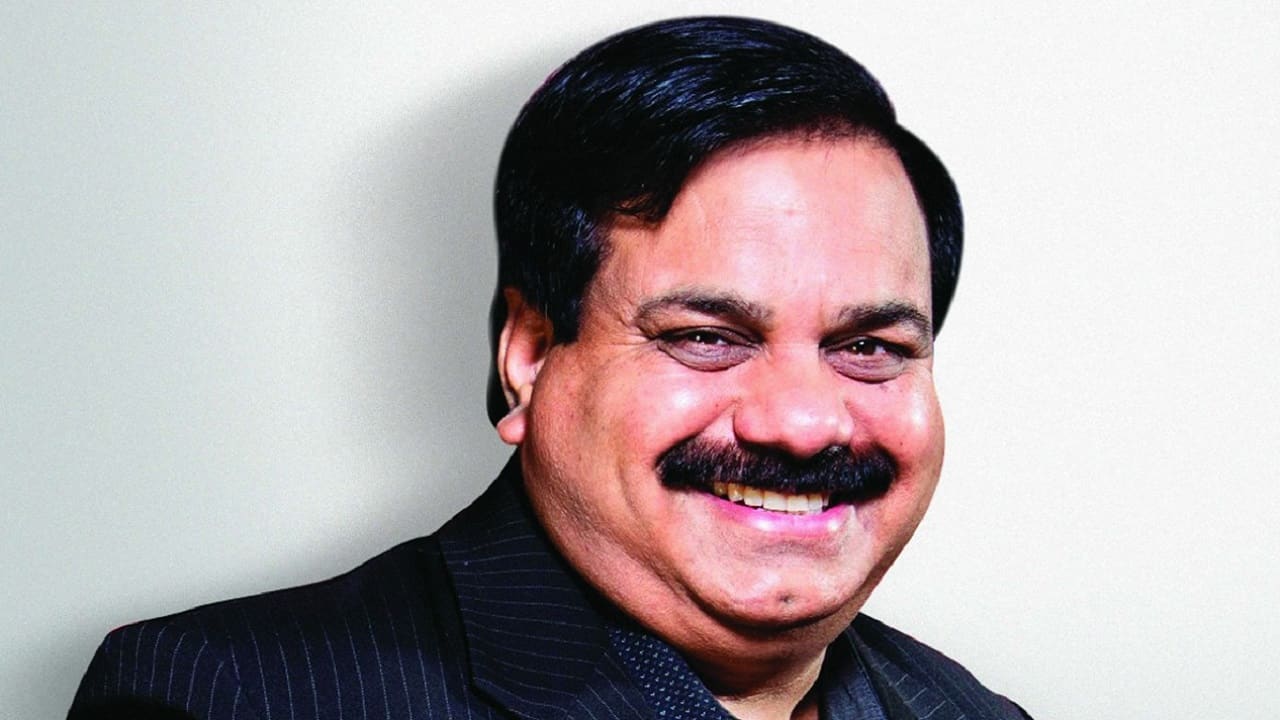

Amit Syngle, MD and CEO of Asian Paints

Amit Syngle, MD and CEO of Asian Paints

“I think the real demand has been affected and this is something which is being borne by a lot of consumer industries. This got accentuated by the effect of the extended monsoon especially in the month of August. We saw floods in some parts of the country, and this has affected the overall demand conditions, which we have seen in the month of August and September,” he said during a conference call after releasing the company’s Q2 results.

Asian Paints’ Q2FY25 financial results saw a 42.4 percent year-on-year dip in consolidated net profit, which came in at Rs 694.64 crore, down from Rs 1,205.42 crore a year earlier. Quarterly revenue from sales slipped 5.3 percent to Rs 8,003.02 crore, compared to Rs 8,451.93 crore in the same period last year.

TV Narendran, CEO and MD of Tata Steel Limited said on November 7 that he expects the second half of FY25 to be better than the first half. “The first six months were weaker than we thought, because construction activity was a bit slower. I think this was partly due to monsoons and partly because government expenditure was a bit less, maybe because of the General Elections. We've been told that the second half will be much better, and that's good for construction, which is good for steel, because 60 percent of the steel goes there.”

TV Narendran, CEO and MD of Tata Steel

TV Narendran, CEO and MD of Tata Steel

He also said the urban demand had struggled a bit more. “In automotive, motorcycles, which have struggled for the last 2 – 3 years, have started picking up well over the last few months, which suggests that rural demand is back. The urban demand is what has struggled a bit more,” Narendra said after releasing the company’s Q2 results.

Tata Steel reported a consolidated net profit of Rs 759 crore for the quarter ended September 30, 2024, returning to profit having posted a net loss of Rs 6,511 crore in the year-ago period. The company's revenue declined 3 percent year-on-year to Rs 53,905 crore in Q2FY25, as the Indian steel industry continued to battle sluggish pricing due to cheap imports, mainly from China.

Rohit Jawa, CEO and MD, Hindustan Unilever Limited said on October 23 that the market volume growth trajectory remained muted in the July-September quarter. “In the September quarter, FMCG demand witnessed moderating growth in urban markets while rural continued to recover gradually… We remain watchful of gradual recovery in consumer demand…”

Ritesh Tiwari, CFO of HUL, said no further acceleration in pace of growth is expected in the near-term outlook. “We continue to be watchful of various macroeconomic indicators that could impact the pace of recovery, such as real rural wage growth, food inflation and employment levels… If commodity prices remain where they are, we expect a low single-digit price growth in the near term.”

Ritesh Tiwari, CFO of HUL

Ritesh Tiwari, CFO of HUL

HUL’s consolidated net profit in Q2 FY25 declined 2.4 percent to Rs 2,591 crore from Rs 2,668 crore in the same quarter a year ago. The FMCG giant's second quarter consolidated revenue expanded 2.1 percent on-year to Rs 16,145 crore.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.