Oil prices have been rising to new highs in the last few years over global political uncertainties. The horrific images from Israel over the weekend have only added to the tensions and Israel’s resolve to launch operations deep inside Gaza only promises to make it worse for oil - a must want commodity which reached new lows at the beginning of the pandemic and has since seen new highs!

Any increase in oil prices does not bode well for the aviation industry in general and Indian aviation in particular. With India being an importer of oil, the increase in oil prices puts pressure on the finances. Coupled with a rupee which has weakened against the dollar, the impact is multi-fold.

What is happening with ATF?

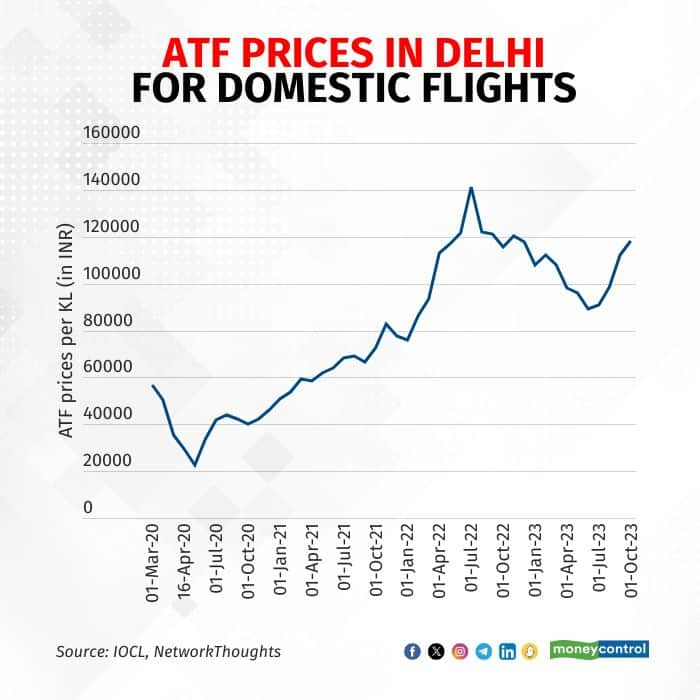

The Aviation Turbine Fuel or ATF prices are steadily increasing after showing some signs of softening. As India went into Covid lockdown in March 2020, the price per Kilolitre of ATF in Delhi was Rs 56,859. The lack of demand led to a sharp drop in prices in subsequent months, reaching a low of Rs 22,544 in May 2020.

One thing has led to another, starting with pickup of demand for oil in 2021, followed by war in Europe in 2022 and the latest Israel conflict in 2023. The pre-Covid prices have been breached since early 2021 and in some months, even doubled those rates.

The peak price was reported in July 2022 at Rs 1,41,232 per KL (in Delhi). The current prices are 16 percent lower than the peak price, yet the pinch is felt harder because of the rupee which has slid by five percent during the same period.

The average ATF price this year has been north of Rs 1 lakh per KL, which was the case in 2022 as well. This may look like the new normal but a spike awaits, which may put additional burden on finances.

IndiGo has already started charging fuel charges on its tickets, a fixed fee depending on distance. Other airlines may either follow suit or increase their base fares.

Why does it matter?

IndiGo - the country’s largest airline and one of the two listed airlines in the country, saw its fuel expenses at 37.15 percent of total expenditure. In absolute terms, the airline has spent Rs 5,228 crore on fuel in the first quarter of FY 24. This was the best quarter for IndiGo in its history but the going may not be the same in every quarter.

Additionally, airlines are also impacted by the sliding rupee. The lease rentals for the airlines are dollar denominated and airlines in India largely rely on leasing for their fleet requirements. In the case of IndiGo, 300 of its fleet of 314 aircraft were on operating lease at the end of June. A slide of one percent in the rupee against the dollar could set the airline back by about Rs 20 crore-30 crore each quarter.

More risks?

One wonders if the situation will normalise soon or if this will be a prolonged war, something similar to the Ukraine and Russian conflict. Either way, chances of disruption of supply lines looks distant at the moment but another oil shock cannot be ruled out.

Over the last three decades, conflict and the Middle East has been synonymous. Thankfully no doomsday scenario has seen the light of the day. This time too, there won’t be a doomsday scenario in the offing for the world, though airlines could fold up as it becomes extremely difficult to operate in a high-cost environment.

What should consumers do?

As the country heads into a festive season with fares reaching the roof during peak travel dates, consumers will be stretched to their ends to find cheaper deals. From an airline perspective, this is the time to earn, for they know that such fares may not find takers in the following quarters and the uncertainty around oil and geopolitics is here to stay - making it difficult to make ends meet.

As such, passengers should look to book as early as possible instead of waiting and taking chances for last minute drop in fares. The nature of the business is such that airlines risk losing passengers for an increase in price but with capacity also limited due to supply chain constraints, the situation remains unpredictable.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.