In FY18-19, there were barely five electric buses plying the roads of Mumbai. Fast forward to 2022, and there are a total of 1,954 battery-operated public buses deployed across the country, according to the ministry of heavy industries. In Mumbai alone, the number is poised to cross the 10,000 mark in the next three years.

Industry observers reckon that while the FAME 2 policy bootstrapped the EV sector with budgetary support, Convergence Energy Services (CESL) aggregated e-bus demand across cities, and helped procure them at compelling rates, massively boosting deployment across the country.

Aided by subsidies and lower running costs, the total cost of ownership (TCO) of electric buses is lower than that of diesel ones. Consequently, besides the union government, many states have also announced their own EV policies.

``Given the government support and push towards electrification, the penetration of e-buses in India has picked up,” said Rohan Kanwar Gupta, vice president and sector head - corporate ratings, ICRA.

Mahua Acharya, MD & CEO, CESL, believes there are roughly 1.4 million registered public buses, at least 50,000 of which are end-of-life and need to be taken off the roads.

“We are deliberating the way forward. The target is to replace these with e-buses by end-2030,” she told Moneycontrol recently.

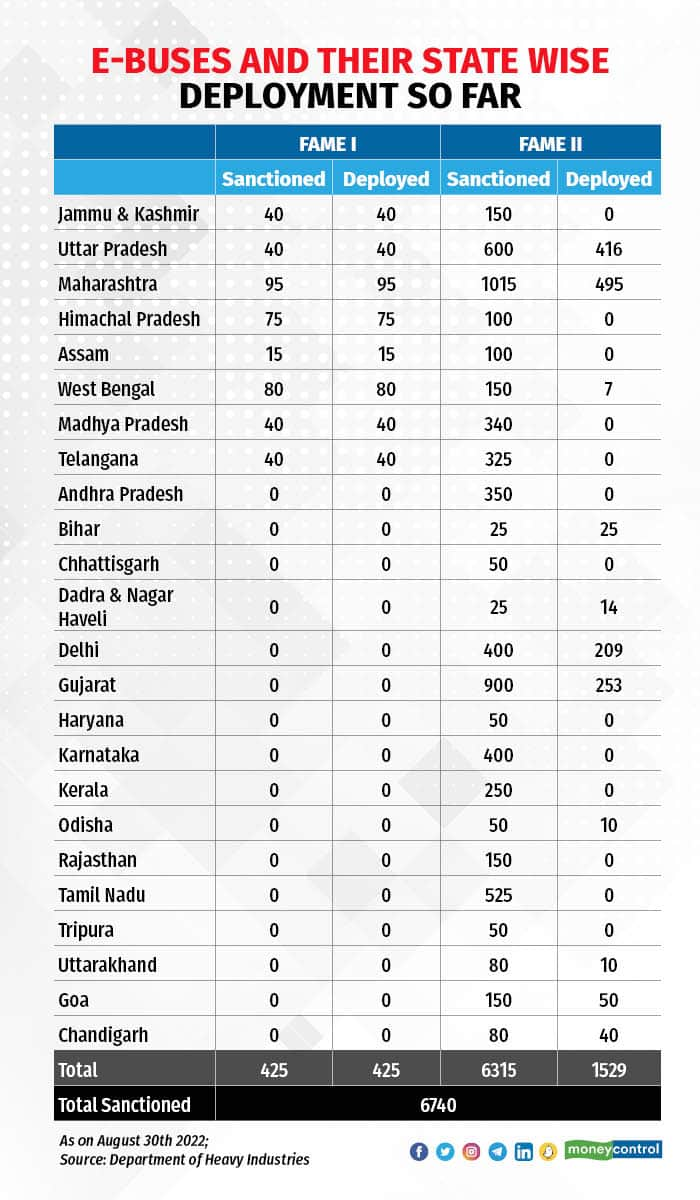

While a total of ~1,954 buses have been deployed across the country as of August 2022, another 6,315 are in the pipeline.

Transport corporations placing record orders

While only eight states had deployed e-buses under FAME 1 (2015-March 2019), subsequently, around 25 states have decided to electrify their fleets after the implementation of FAME 2 (from April 2019).

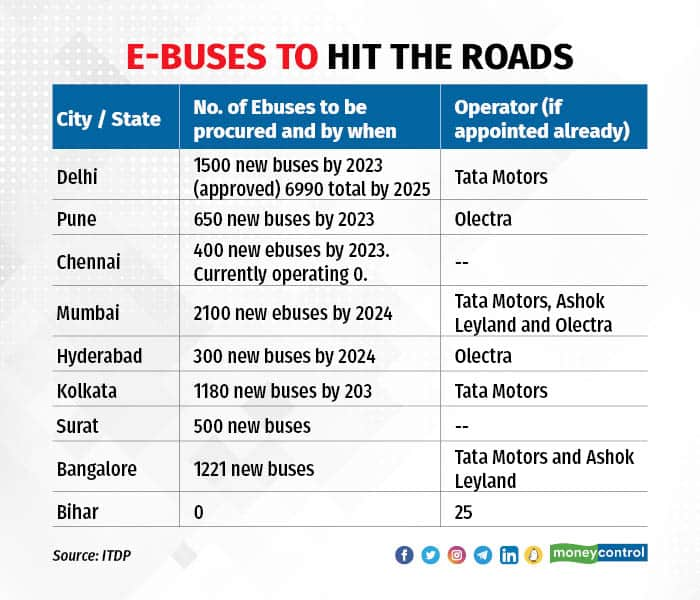

Delhi Transport Corporation (DTC), which had zero electric vehicles in its fleet until FAME 1, now aims to have 8,000 e-buses (comprising 80 percent of its fleet) by 2025. It currently has 250.

“DTC has ordered another 1,500 e-buses, which will be deployed by end-2023,” said Ashish Kundra, principal secretary, government of Delhi, adding, “We will be coming up with a large tender for e-buses, 2,000 of which will be smaller nine-metre-long vehicles meant for last-mile connectivity.’’

Mumbai’s Brihanmumbai Electricity Supply and Transport (BEST), a civic transport and electricity provider, intends to have 10,000 buses running on electric powertrains by 2026.

“Our key objective is to provide a pollution-free environment. We were among the first transport corporations to have electric buses. At present, we have 3,672 e-buses in our fleet. By 2026, we hope to have a fully electric fleet of about 10,000 buses, at least 10 percent of which will be double-deckers,’’ said Manoj Varade, public relations officer, BEST.

Bengaluru Metropolitan Transport Corporation (BMTC), a public road transport corporation owned by the government of Karnataka, has already inducted 75 AC and 90 non-AC e-buses (total 165), and is looking to deploy another 225 non-AC e-buses by the year-end. The Telangana State Road Transport Corporation (TSRTC) is looking to deploy 300 e-buses.

Bulging order books

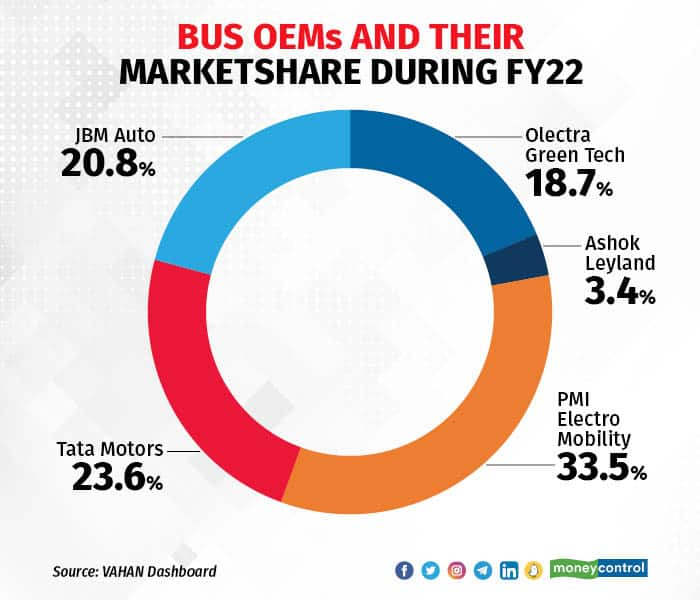

Given the push for e-buses, manufacturers’ order books are naturally bulging. They feel that pan-India numbers could double by FY23, and treble to 6,600 units by FY24.

Tata Motors, Switch Mobility (a step-down subsidiary of Ashok Leyland), Volvo Eicher, Foton-PMI, JBM-Solaris, Olectra Greentech, and BYD, are among the manufacturers who have started shipping their products.

Tata Motors has deployed more than 715 electric buses, which have cumulatively clocked more than 40 million kilometres. Under the CESL tender, it has won an additional order of 3,601 e-buses, 1,500 of which are for DTC, 1,180 for West Bengal Transport Corporation (WBTC), and 921 for BMTC.

“We have a robust product portfolio in e-buses, both in the 9- and 12-metre segments. The extensive on-road experience of our e-buses has helped us further refine our products,’’ said Rohit Srivastava, vice president, buses, at Tata Motors, in response to queries sent by Moneycontrol.

Switch Mobility has an order book of 6,000 e-buses globally, including 5,600 for India, largely from BEST and BMTC, while the rest are from corporates for employee transportation.

“When we started manufacturing, we had 65 orders. Today, we have 6,000. We have a healthy order book. We are looking at 20-30 percent market share in e-buses by the next financial year.

“Over the next two years, we will come up with multiple models to cater to the increased demand,’’ Mahesh Babu, CEO, Switch Mobility India, told Moneycontrol.

JBM Auto delivered its first e-bus in 2019. The homegrown manufacturer has since deployed its e-buses across Ahmedabad, Mumbai, Delhi, Bangalore, Jhansi, Port Blair, GIFT city, and multiple airports. The company claims its vehicles have logged 50 million km thus far.

“We have received contracts for 1,000 buses, 700 of which have already been delivered. The remaining ones will be despatched within the year,’’ says Nishant Arya, vice chairman, JBM group, adding, ``Electric buses will completely replace diesel ones in the future. Pre-Covid, the bus market stood at 90,000 units per annum. By FY26-27, more than 50 percent of the buses sold will be electric, which is about 50,000 per annum.”

The road ahead

ICRA expects e-bus market share to grow from ~4 percent in FY22 to ~12 percent in FY25 and ~35-40 percent by FY30.

In terms of value, market research firm Research and Markets predicts that the Indian e-bus market will gallop from $94.3 million in 2020 to $1,364.4 million by 2025, at a CAGR of 48.8 percent.

While projections show sustained growth, analysts are cautiously optimistic about the commercial viability of e-buses. They feel that moving ahead, it is important for states to identify a sustainable source of funding to keep the service up and running.

For instance, ICRA reckons that e-bus OEMs have a limited operational track record, hence their ability to supply and maintain these buses per agreed specifications remains to be seen.

“Any under-performance with respect to specifications / targets, especially those impacting bus availability and reliability, has the potential to impact the viability of operations and deter adoption,” Kanwar said.

Likewise, the Institute for Transportation and Development Policy (ITDP) is of the view that as cities procure more and more e-buses, it is essential to focus on peer-to-peer learning and capacity development for effective operations and maintenance of e-buses.

“There is a requirement for knowledge transfer between STUs to learn from each other's experience,” says Vaishali Singh, deputy manager, transport systems and electric mobility, ITDP.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.