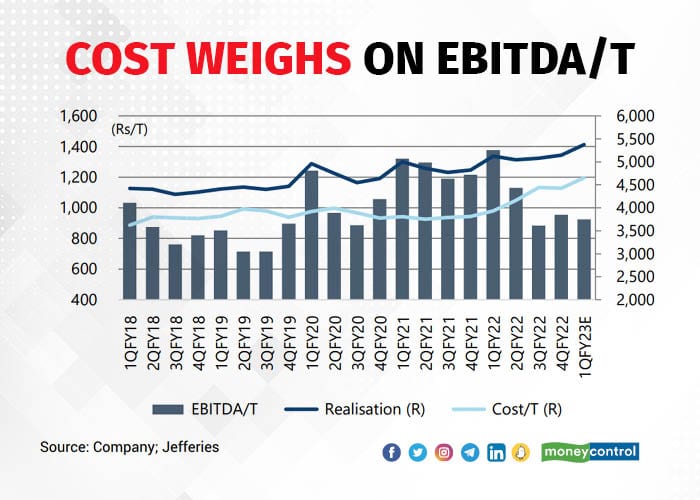

With a significant rise in input costs, the cement sector could experience a steep decline in its operating profit per tonne in Q1FY23, when compared to what was a year ago. In fact, the year-on-year decline would be the deepest in the past 10 years.

Jefferies estimated that the average Ebitda/t for this quarter for cement companies under its coverage will decline ~Rs 451 YoY / Rs 45 QoQ to Rs 958 (the YoY decline would be one of the highest in the past 10 years). Despite revival in volumes, an increase in input costs weighed on the margins. International pet coke and coal prices are up 25-30% QoQ for 1QFY23. The brokerage’s analysts expect the increase in energy prices to reflect to some extent in Q1FY23 but for its full impact to be felt in Q2FY23.

Also read: Cement margins to crack despite rising demand: Fitch Ratings

“We expect our cement universe to report a 21% YoY EBITDA decline for 1QFY23, largely matching 4QFY22 YoY decline. YoY fall reflects lag in passing costs even as vol growth recovers to mid-teens YoY (soft base),” said the brokerage’s analysts in a recent report.

Companies have struggled to pass on the costs, especially those with exposure to the southern markets. Companies in the southern market could experience a sharper decline in their unit Ebitda. Companies with exposure to other geographies–North, East, and Central - were able to take small increases for a short period in this quarter. They had to reverse the price increase in the non-trade segment in April 2022.

“Cement producers in the North increased prices, largely matching the cost increases in the month of April but they could not sustain the increase for the entire quarter… Prices were also increased in Eastern and Central regions in April, but a tad lower versus the North and prices could not be held thereafter April either,” said the report.

Overall the QoQ price increase at the all-India level is ~5% with North/Central/East prices higher 5-9% and West/South prices flat to negative QoQ, stated the report.

The southern region is expected to report the highest volume growth year-on-year this quarter because the region was the worst hit during the lockdowns. Overall, volume growth y-o-y for the companies under the brokerage’s coverage is in the mid-teens, or around 16% for Q1FY23, on a soft base. But quarter on quarter, their volume growth doesn’t look as promising. In fact, the fall in q-o-q growth in volume for June 2022 quarter was the highest for a June quarter in 10 years, excluding COVID years, according to the analysts.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.