Bitcoin set a fresh record on Sunday for the first time since mid-August, as the US government shutdown drove investors to safe-haven assets in a migration dubbed the “debasement trade.”

The largest digital asset climbed to $125,689 over the weekend, according to data compiled by Bloomberg. It remained in touching distance of its all-time high on Monday morning in New York, changing hands at about $124,000.

Bitcoin’s advance coincided with a US government shutdown that began on Oct. 1 and has helped fuel demand for perceived safe-haven assets. The closure scuppered the planned publication of key economic data, including nonfarm payrolls. Gold surged to a record above $3,900 per ounce on Monday, extending a months-long rally.

Decreased liquidity in crypto markets over the weekend likely contributed to Bitcoin’s price momentum, Alex Kuptsikevich, chief market analyst at FxPro, wrote in a note Monday. “There was a similar pattern in July and August, when a sharp increase followed the update of highs at approximately these levels in sales,” he added.

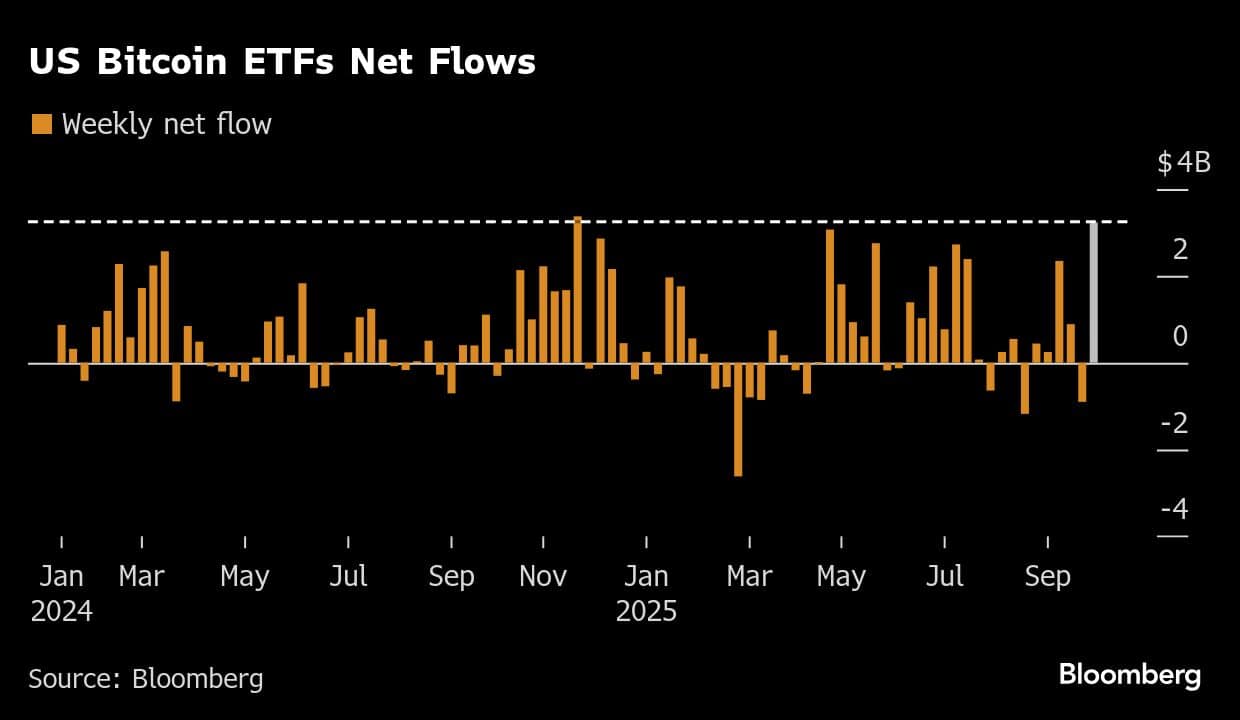

Investors poured $3.2 billion into a group of 12 US Bitcoin exchange-traded funds last week, the second-highest haul since they launched in 2024. Meanwhile, the notional open interest on BlackRock’s iShares Bitcoin Trust ETF rose to a record $49.8 billion on Friday, data compiled by Bloomberg show.

The total open interest on Deribit, a popular crypto derivatives exchange, and IBIT combined is now approaching the $80 billion mark, roughly ten times early-2024 levels, with most of that coming in the past six months, David Lawant, head of research at FalconX wrote in a Monday note.

“Option market dynamics are likely shaping the underlying market price action more than ever before,” he added.

From here, traders expect to see resistance at $135,000, with $150,000 “in sight if momentum holds,” said Rachael Lucas, analyst at BTC Markets. “But with leverage building, any sharp reversal could trigger volatility.”

Options markets are “skewing bullish” with over 60% of open interest in call options, a state of play “that reflects strong conviction but also raises the risk of liquidation cascades if momentum stalls,” Lucas added.

October — often trumpeted as “Uptober” by crypto traders — has historically been Bitcoin’s best-performing month. The token has delivered average gains of about 22.5% in October over the past decade, according to data compiled by Bloomberg.

Ether, the second-largest digital asset, was relatively unchanged at $4,560 as of 6:18 a.m. in New York on Monday. XRP was steady at just shy of $3.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.