August 18, 2022 / 14:13 IST

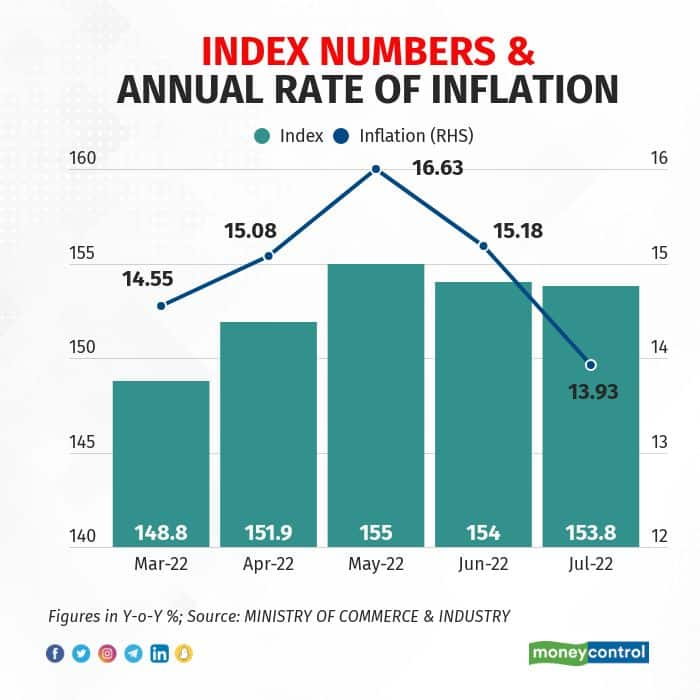

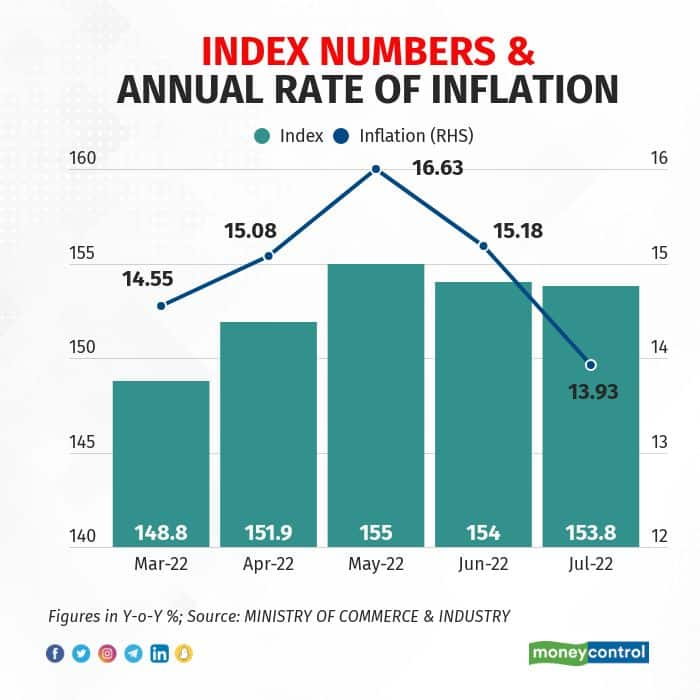

India's inflation based on the Wholesale Price Index (WPI) declined to 13.93 percent in July, recording a five-month low, as per data released by the commerce ministry on August 16.

The WPI inflation was 15.18 percent in June, down from an over three-decade high of 16.63 percent in May.

Story continues below Advertisement

In July 2021, WPI inflation stood at 11.57 percent.

While the wholesale inflation rate has declined for primary articles and manufactured products, for fuel and power it shows an increasing trend, which is a fallout of the imported inflation and global uncertainty. Globally, natural gas and energy prices have skyrocketed.

Another month of double-digit increase in wholesale prices in July means WPI inflation has remained above the 10-percent mark for 16 months in a row.

With the WPI coming down for the first time in five months, here are five highlights of the recent WPI inflation data, as pointed out by economists:

- What to expect in upcoming policy meet: Though inflation shows a softening trend, still it is above the comfort zone of the inflation mandate. “Given the fears of slowdown in China’s economy due to property downturn and COVID-19-induced lockdowns, crude prices have slipped lower due to dent in global demand. The RBI will closely monitor the domestic and global factors at play. However, as CPI (consumer price index) inflation continues to remain above the target range, it will warrant the RBI to continue to tighten the monetary policy,” added Jahnavi Prabhakar, economist, Bank of Baroda. Economists expect a 35 bps repo rate hike in the next policy announcement.

- Low WPI inflation led by food prices: The cool-off in WPI inflation has been led by food prices, with vegetables inflation at 18.3 percent compared with 56.8 percent in June 2022. Overall, the moderation in crude prices and steady commodity prices bode well for the economy. “One needs to be watchful of the sowing area as deficient rainfall in eastern and north-eastern regions poses risk to inflation outlook, especially lower acreage of rice,” said Prabhakar.

- Improved CAD/external balance: The policies of the government of India on duty-free imports of soya oil and imposition of export duty on steel and steel products have able to soften the inflation rate of basic metals and vegetable oils. This is likely to have an impact on the external balance. “While the softening of the inflation trend is a positive for the Indian economy, a decline in imported inflation may help improve the CAD/external balance,” stated Sankhanath Bandyopadhyay, economist, Infomerics Ratings.

- Festive season demand boost: With the festive season in India set to kick off hardly a month from now, fall in WPI inflation will encourage people to buy things. “There will be a boost in demand of items in the festive season, but there won’t be an extreme kind of situation. This will help maintain balanced demand during the festival season,” said Bhavya Mitra, former economist at the Department of Economic Affairs.

- No immediate impact on CPI: The pass-through to the CPI has not yet been realised and will only be seen gradually as prices remain sticky, according to economists. They predict that it may happen during end-September 2022, provided global oil prices remain softened and range-bound, as well as no further geopolitical tension develops that may lead to borrowed inflation in India.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!