The outcome of the monetary policy committee (MPC) meetings are no big surprises these days. The decisions are easily predictable for most economists, compared with the past when nobody could hazard a guess.

In the run up to the policy announcements, there used to be great amount of excitement in financial markets guessing the rate action (or no action). These days, markets know what is coming and probably how much.

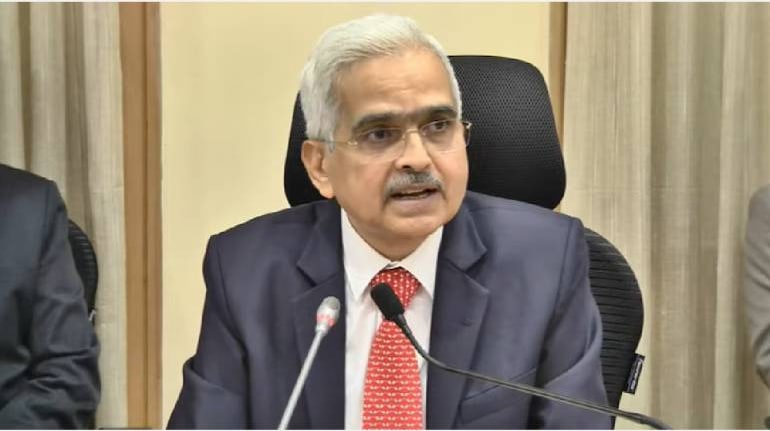

A big reason why the change in approach has happened can be attributed to the change at the central bank's top management. Shaktikanta Das, the former finance secretary turned RBI Governor, is a man who doesn't like to shock or surprise markets.

Unlike his predecessors at the RBI, Das' communication is not cryptic. As far as the rate decisions are concerned, when the MPC was introduced in 2016, the idea was to bring in different perspectives that will contribute to the collective thinking in policy making. To what extent the discussion process has widened is a matter of debate.

A closer reading of the MPC minutes over years suggests that majority of the panel members have always aligned with the Governor's (or the RBI management's) line on policy rate decisions and future guidance, except for one constant outlier in the group.

Cut to the present context, the 50 basis points hike didn't really come as a surprise. Every single economist worth his salt would have predicted this. If at all there was a debate, that was about the quantum of hike.

At a time , inflation is a clear danger, MPC didn't have much options on the table (as this Moneycontrol column argued). With that, the MPC has now done 190 bps hike in this rate hike cycle taking the repo rate to 5.9 per cent.

This rate hike will have to be necessarily passed on by banks to the end consumer--those who borrow from banks.

The idea is to make money more expensive and thereby cut demand. Will it alone work or not is another question. That's because inflation, in the current scenario, isn't a demand-driven phenomenon but largely triggered by external factors. The US Fed rate hikes and the Russia war have spooked the world markets, especially emerging economies, and India is no exception.

What next? For sure, another rate hike is likely by end of the year. Here again, the bet is on 35-50 bps, depending on the trajectory of inflation. Will that be the last of rate hikes in this cycle? It is unlikely. Thereafter, rate hikes may happen but in smaller doses. Inflation is likely to stay elevated in the near term and may easy only in next fiscal. But there are are lot of variables at play.

(Banking Central is a weekly column that keeps a close watch and connects the dots about the sector's most important events for readers.)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.