A jump in banks' outstanding loans to farmers through the Kisan Credit Cards (KCC) warrants a cautious lending approach, industry experts said.

The KCC scheme was introduced in 1998. It aims to provide cash to farmers to purchase agricultural inputs and meet their production needs.

The caution advised by experts follows a notable jump in non-performing assets (NPAs) in farm loans in recent years. A major chunk of the farm loans is disbursed through the KCC channel.

The repayment cycle of such loans is such that farmers, at the end of the tenure, can repay only some part of the loan, and not the entire amount of the loan. In other words, these loans are carried forward after the end of the initial tenure.

Also read: Banks go aggressive on green finance through partnerships, deposit schemes

The numbers

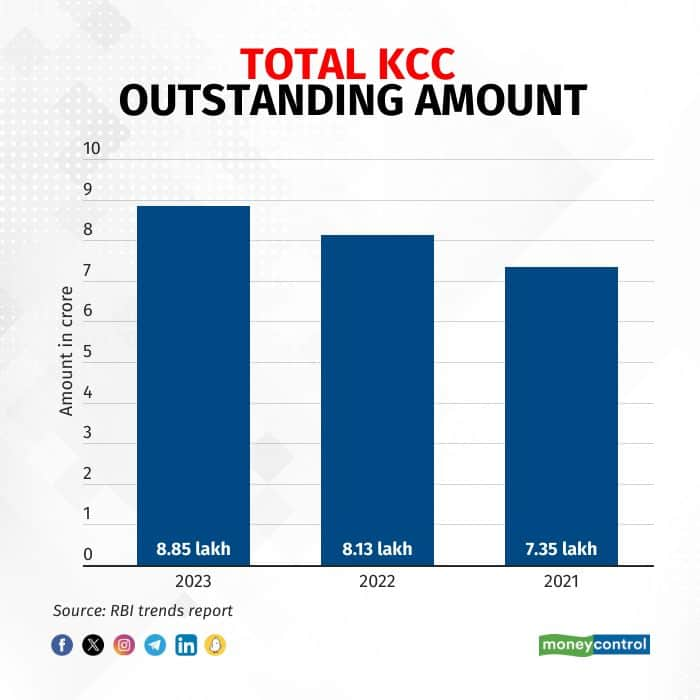

The total outstanding amount under the KCC scheme rose to Rs 8.85 lakh crore for 2023 from Rs 8.13 lakh crore in 2022 and Rs 7.53 lakh crore in 2021, according to Reserve Bank of India (RBI) data. In terms of the number of cards, total KCCs by the end of 2023 stood at 7.35 crore, up from 7.13 crore in 2022. In percentage terms, the total outstanding amount has increased by 9 percent in 2023, compared to an aggressive 20 percent in 2022.

Experts said that lending to the agriculture sector always needs a cautious approach as it has higher chances of turning non-performing assets (NPAs). A loan is declared an NPA when there is no payment of interest or principal for 90 days.

Anand Duma, Senior Analyst, BFSI, Emkay Global Financial Services, said that NPAs in the agri-loan portfolio of banks could rise worryingly due to extreme weather changes. “It has been observed that weather changes have affected farm production; consequently, there has been a rise in agri-NPA numbers."

How does KCC work?

Under the scheme, cardholders can use KCCs to buy allied and non-farm activity tools like vehicles for logistical support, etc. But often, these loans are used for consumption purposes.

Also read: Banks’ aggressive lending to farm sector under El Nino cloud; experts warn of rise in NPAs

“KCC loans are sometimes used for purposes other than agriculture, farm production, and logistics. This disturbs the overall repayment cycle,” said Vijay Singh Gaur, a BFSI expert.

RBI caution

The RBI's latest financial stability report (FSR) also noted that the NPA from the sector remains high. “The improvement in banks’ asset quality has been broad-based. The GNPA ratio of the agriculture sector remains high at 7 percent,” the FSR report said.

In terms of lending, according to data from the RBI’s latest sectoral credit data, total lending to agriculture stood at Rs 19.31 lakh crore in November 2023, compared to Rs 16.33 lakh crore in November 2022.

Data from banks shows a rise in credit to the agriculture sector. For example, the country’s largest bank, the State Bank of India (SBI), had an agriculture loan portfolio of Rs 2.73 lakh crore in the July–September quarter of the financial year 2023–24, up 15 percent from Rs 2.38 lakh crore from the corresponding quarter last year. The Bank of Baroda’s advances to the sector jumped 13 percent from Rs 1.14 lakh crore to Rs 1.3 lakh crore during the same period.

Additionally, experts highlighted that a change in the KCC scheme can bring more clarity to the repayment process.

Some recovery

Industry players said that there was pressure on KCC loans during the peak of COVID-19, but now recovery is good.

Shripad Jadhav, President and Head of Tractor and Farm Equipment, Crop Loans, and Gold Loans at Kotak Mahindra Bank, said, “After COVID-19, banks are seeing recovery from old NPAs and accounts. The pace of recovery of these loans is also improving.”

Gaur also highlighted that under priority sector lending (PSL), banks have to lend some percentage of their loans to the agri sector (among other sectors). “A good pace of recovery will help banks reduce their NPAs,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.