Highlights:-

- Reliance Industries is in talks to acquire Hamleys worldwide operations

- Hamleys is a global retailer of toys, gifts and games

- The acquisition could complement Reliance Retail’s organic expansion in India

- Globally, the toys market could be worth over Rs 120 billion by 2023

- The deal could be valued at close to Rs 600 crore

--------------------------------------------------

Reliance Retail’s (RR) multi-product portfolio, large brick-and-mortar store presence and strong omnichannel network have helped it create a niche for itself. Thanks to continued investments in scaling up the business by Reliance Industries (its parent company), RR remains on track to achieve robust top-line growth organically.

As reported by Moneycontrol, RR may acquire Hamleys’ worldwide operations from C Banner, Hamleys promoter and a large Chinese fashion conglomerate. Due diligence for the transaction is underway at this point. RR already has the franchise rights to sell Hamleys merchandise in India.

Headquartered in the UK, Hamleys is the oldest retailer of toys, games and gifts in the world. Its outlets (owned and franchise-run) are spread across Europe, Middle East nations, Asia, North America and South Africa.

Should the deal get through, RR stands to benefit by way of favourable spending patterns by the masses, augmentation of Hamleys EBO (exclusive brand outlet) network, cross-selling opportunities at existing RR outlets and a large set of prospective buyers to cash in on. The acquisition would also underscore RR’s ambition to look at markets beyond India in a bid to achieve the next leg of growth.

How does Reliance Retail benefit?

Brick-and-mortar expansion in India

Presently, in India, Hamleys has 49 stores that are situated in 21 cities. To capture a higher share of the retail industry, more Hamleys points-of-sale would be opened across the country. As per preliminary reports, RR plans to augment the Hamleys store network to over 200 in the next 2-3 years.

Additionally, RR would be able to leverage its strong warehousing and distribution capabilities to ensure that Hamleys products are made available throughout the country. As on Q3 FY19-end, RR has around 8 million square feet warehousing space and its 100 distribution centres spanning 23 states.

International foray could gain momentum

Amid rapid expansion within India, RR has set its eyes on tapping the potential that foreign regions have to offer. Understanding buying preferences and intricacies in other nations could set the tone for retailing of RR’s private labels (across different categories) and its other international licensed brands (such as Marks and Spencer, Superdry and Diesel, among others) that have been sold only in India so far. The takeover of Hamleys, a brand that enjoys recognition globally, could be a starting point.

A promising market awaits

As per an IMARC (a market research firm) report, India’s toys market was worth Rs 10,500 crore in 2018, growing at an average annual rate of around 16 percent. The market size is anticipated to cross over Rs 23,000 crore in the next 5 years. With a large and young population base that is only growing by the day, industry trends for branded toys appear positive for Hamleys (and consequently RR).

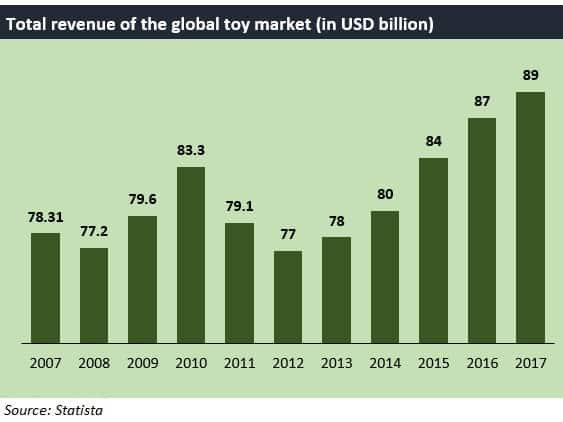

Globally, the toys market is slated to reach a revenue size of over $120 billion by 2023, as against $89 billion in 2017. This translates into a CAGR of nearly 5 percent for the 6-year period.

In India, celebration of festivals at regular intervals during the course of the year necessitates purchase of premium gifting products. From a worldwide perspective, increased adoption of social media-driven advertisements, use of toys for educational purposes and higher disposable incomes in the hands of consumers are the added growth levers.

Expected valuation and conclusion

On an average market cap-to-2018 sales multiple of 1.3 times, Hamleys could command a market capitalisation of nearly $86.19 million, which amounts to Rs 598 crore.

Hamleys’ turnover is visibly lower than its global counterparts. Since its margins and profitability have been a cause of concern in the last 2 calendar years, there is a possibility that the deal may be valued at a lower multiple and amount.

Though the transaction seems symbolic in terms of RR’s growth intent, execution of the same won’t move the needle for RR. This is because the contribution of toys to RR’s annual sales would be insignificant.

For now, this development can be merely regarded as a change in business intent. RR, which has been Hamleys’ India-focused brand licensee so far, will become an international brand owner. What follows next will be keenly watched.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.