Krishna Karwa Moneycontrol Research

After acquiring Hypercity from Shoppers Stop, demerging ‘Home Town’ (home furniture segment) into Praxis Home Retail, undertaking cost rationalisation initiatives in eZone (electronics segment), entering into a franchise agreement with 'WH Smith' (a UK-based bookstore brand) to foray into travel retailing, and selling 6 percent of its stake to ‘PremjiInvest’ for $251 million, Future Retail is in the news yet again.

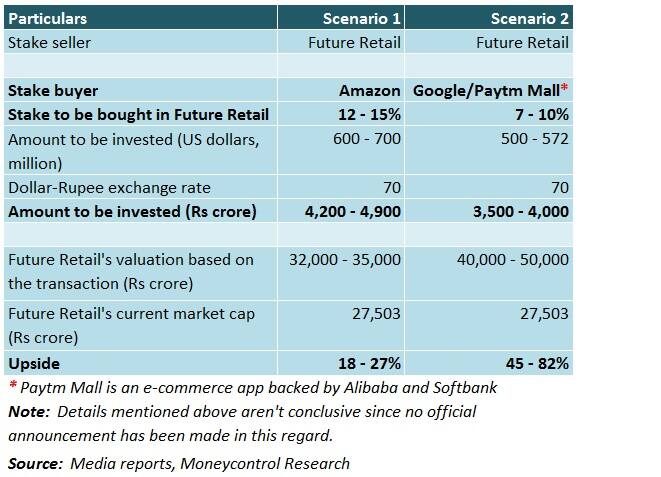

As per media reports, the Kishore Biyani-led company is considering offloading a part of its stake to either Amazon or Google-Paytm Mall over the next 2-3 months. This may be done via a combination of a primary issue (leading to a dilution in earnings of Future Retail’s existing shareholders) and secondary issue.

How will Future Retail benefit?

The move should help Future Retail pare its debt, which stood at Rs 1,224.74 crore as on March 31, 2018. This, in turn, will improve profitability.

Furthermore, the company can bolster its omnichannel presence by having dedicated product pages (or a separate section on the webpage) for its own private labels as well as other brands on e-commerce platforms such as Amazon and Paytm Mall.

By streamlining its operations and boosting revenue generation prospects, Future Retail would be better-positioned to take on deep-pocketed competitors such as Reliance Retail and Walmart-Flipkart.

How can Amazon/Google-Paytm Mall benefit?

By virtue of the stake purchase in Future Retail, the online giants can reap the benefits of physical retail, an integral aspect in the Indian context (given the importance of ‘touch and feel’ before buying), without investing heavily in real estate.

Amazon/Google-Paytm Mall will be able to set up product display, consumer experience and grievance redressal centres in Future Retail’s 1,035 outlets (Fashion at Big Bazaar, Big Bazaar, Hypercity, eZone), which are spread across 26 Indian states and attract nearly 500 million customers annually.

The arrangement should help Amazon even more, as it attempts to tap the grocery retailing network aggressively in India, after failed attempts to take over Big Basket in the past. Consequently, the Jeff Bezos-led retailer hopes to replicate the success it achieved in retailing food items in the US by acquiring ‘Whole Foods’, in India.

Which of these 2 prospective deals could augur well for Future Retail?

On the valuation front, Future Retail stands to benefit. This is apparent from the steep premium that Amazon and Google-Paytm Mall are willing to offer as consideration. The underlying theme of this development underscores the importance of having the right blend of brick-and-mortar and online presence in a business where margins, more often than not, can be very thin.

Prima facie, scenario 2 (Google-Paytm Mall) appears to be more favourable for Future Retail since it is likely to raise more funds for the latter. However, from a qualitative standpoint, there are numerous other factors (terms related to profit sharing, product differentiation, discounting, overhead apportionments, display space, among others) that would determine the partner-of-choice for Future Retail.

Clearly, the landscape of Indian retail seems to be changing for the better as the country’s leading names expand their footprint, consolidate their strengths, explore inorganic growth opportunities and leave no stone unturned to grab a higher pie of the market. A formal announcement by Kishore Biyani in this regard, is, therefore, one to watch out for.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.