Ulhas Kamathe wolfs down 4-5 gulab jamuns from a large bowl. A few seconds later, he announces, ‘chicken leg piece’, his accent heavy, before he devours a succulent chicken leg piece on camera.

Part plain gluttony and part funny, this series of chicken-leg piece videos, which was initially on TikTok, now on YouTube, has 5.4 million views.

For gym owner Kamathe, these 'chicken leg piece' videos catapulted him to TikTok fame a couple of years ago. Kamathe’s mukbang videos, a Korean term for videos where the host eats large amounts of food, became such a rage on the short-video app that he racked up 6.8 million followers, and close to a dozen brands collaborating with him.

But on June 29 last year, a diktat by the Union Government banning TikTok, and 58 other Chinese apps, taking away Kamathe's influencer stature in one fell swoop, a blow that he probably still hasn't fully recovered from, be it building his follower or brand collaborations.

Kamathe’s story resonates with other creators, many of whom are yet to get the mojo back even as a host of made-in-India apps have strived to fill the void TikTok's ban created, with Instagram’s answer to TikTok, Instagram Reels, emerging as one of the closest rivals to the Chinese short video app.

Moneycontrol spoke to creators, industry experts, and investors to understand TikTok’s enormous presence in India, how the ban changed the Indian social media landscape, and how TikTok’s Indian counterparts, creators are faring a year after the ban.

TikTok banIndia was ByteDance-owned TikTok’s largest market in terms of the number of users. Data from app analytics platformSensorTower revealed that as of April 2020 there were 611 million app downloads in India, which accounted for about 30 percent of the global TikTok downloads of 2 billion. India, followed by China at 196.6 million and the US at 165 million, were the three largest markets for the company.

Indian short video apps such as Roposo, Trell and Mitron TV were already in existence but barring Roposo, download numbers for the other two were not significant. For instance, Trell and Chingari had 5 million and 5.7 million downloads at the time of ban. Roposo’s downloads stood at 60 million, according to data from SensorTower.

So when the Indian government banned TikTok along with 58 other apps on June 29, 2020, amid the ongoing border tensions between India and China, it was a shot in the arm for local firms and also global players.

New short-video platforms such as Daily Hunt’s Josh, and MX Takatak were launched shortly after the ban and Sharechat’s Moj was launched around the time of the ban. Global players hardly pass up this opportunity. Instagram launched Reels, its version of TikTok, and Snap came up with Spotlight. All of these have gained traction in recent times.

However, it hasn’t been an easy transition either for the brands or creators, who have made TikTok their home over the years, or as lucrative as it used to be.

Not an easy transitionTake Kamathe, who was cited earlier. The shift to other platforms hasn’t been as promising as TikTok.

“After TikTok was banned, for the first five to six months I didn't join any other app hoping for TikTok to come back. Then went on other apps like YouTube, Facebook, Moj, and Tiki,” shares Kamathe. However, the ride to starting from scratch on the platforms was bumpy, to say the least.

A year later, Kamathe is nowhere near the 6.8 million followers he had amassed on TikTok. He has a million followers on YouTube, 300,000 on Facebook, 2.3 million on Moj and 250,000 on Tiki app, another short-video platform.

His collaboration with brands has come down from 10-12 on TikTok to just a few over the year, and so has brands he associated with due to the shift. “I had associated with brands like KFC while on TikTok. No big brands have approached me yet,” he says.

Meet another content creator and motivational speaker Geet. She was a well-known face on TikTok with content on relations, love and life and also taught English through her short videos.

Geet had three TikTok accounts. Her motivational account had 7 million followers, while her English teaching videos had 6.7 million. Her third account had 400,000 followers. While she has moved on to other platforms, she hasn’t been able to gain the same following in the local short video platforms.

“On TikTok, there was organic growth that you could get. None of these (other) platforms have that,” Geet shared with Moneycontrol.

For popular influencer and a TikTok star Nagma Mirajkar, the shift was tough emotionally given that she had grown with the platform. Mirajkar, who was popular for her lip sync videos, had close to 15 million followers on TikTok.

“I think the shift was very difficult emotionally. My journey began with Musical.ly and then TikTok. So to suddenly not have to be on it (TikTok) was weird!”

So, she took some time off and eventually hopped on to new platforms such as Sharechat’s Moj and MX player’s Takatak. When Instagram and YouTube came out with Reels and Shorts, she joined them too. She got creative with content and worked with the opportunities that were before her.

“New challenges needed more creativity and that’s what I focused on. Improving myself and giving the audience what they want – Entertainment,” she told Moneycontrol.

However, it did come at a cost. While Mirajkar said that her brands association eventually followed with the move, her earnings dipped and COVID-19 did not help the cause. While some of the brands she was associated with moved with her to other platforms, she lost others.

Also her following in other platforms is not as high as TikTok. “I am working hard for it (to get followers) every day. But the numbers are not as high as TikTok. There was a massive loss of people rather than brands. (I) Lost millions (of followers),” she shared. On Instagram, she has 5 million followers and 837000 on YouTube.

The void TikTok createdClearly the void created by TikTok’s ban hasn’t been easy to fill, even with half a dozen or more players crowding the market.

“Since the ban on TikTok in India, a lot of local apps have jumped to capture the vacuum created in the market. Some of them have been able to create a niche for themselves but no app has been able to reach the scale similar to TikTok in India,” said Hanish Bhatia, Senior Analyst - Devices & Ecosystem, Counterpoint Research.

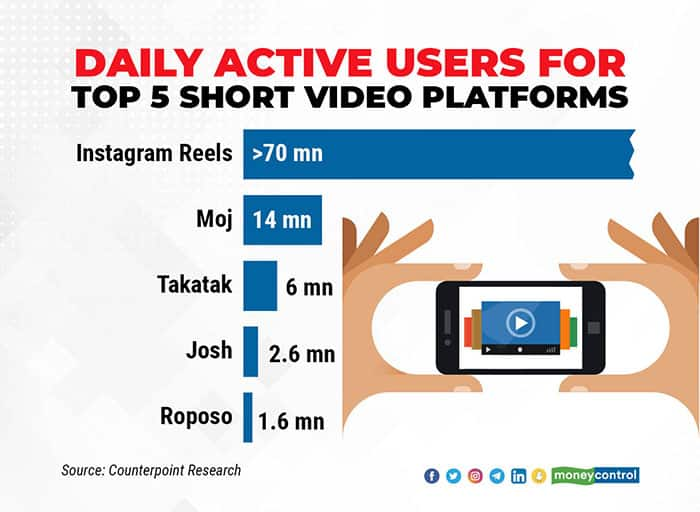

While the download trends have so far been positive, the daily active user (DAUs), which experts say are a better metric for performance, backs Bhatia’s commentary.

Downloads spiked for the local players since the ban, but their daily active users are far behind Instagram’s Reels. Local players who are faring better include Sharechat’s Moj with 14 million DAUs, Daily Hunt’s Josh with 2.6 million and Roposo at 1.6 million.

This reflects in how brands look at engaging with customers too.

Brand partnerships

Brand partnershipsM Raja Marthandan, CEO, Red Consulting, which works in the digital marketing space with global and Indian brands, shared that before TikTok ban, all he had to do was find the top influencers on TikTok for a marketing campaign that fit the client’s budget.

It wasn’t hard since most of the influencers had significant presence on TikTok, without much competition in the market. For brands, from global to local, who are looking to launch marketing campaigns in smaller towns, there was a fit for everybody.

All that changed when the ban was announced. A lot of Indian apps came into existence and now Marthandan’s company works with at least three or four short-video platforms to reach the consumers it once did with just TikTok.

This is how it works now. Say a global clothing Company A has to do a marketing campaign for festival clothes and has a budget of Rs 5 lakh for creators. It earlier selected 5-10 TikTok influencers to do short videos. So entire Rs 5 lakh was divided between the 5 or 10 TikTok influencers the companies used for the campaign.

Now, Company A will have to work with multiple platforms to reach the same audience. This could be Instagram Reels and two other platforms.

However, this combination might not work for other brands, pointed out Marthandan. So he might have to use a different combination, say all of the local short video companies, to reach the target audience.

This meant that they needed the top 5 or 10 influencers in the three or four platforms. “But the budget remains the same. So each influencer gets less than what they used to before,” he explained.

Another digital marketing executive, who did not want to be named, shared how much the company pays its influencers across the platforms. Category A influencers, those with over 50,000 followers, are paid the highest. It used to be Rs 15,000 to Rs 25,000 minimum for TikTok creators, and Instagram influencers earn as much as Rs 50,000 for the same followers. However, for the local Indian platforms, the firm strikes a minimum deal between Rs 8,000 and Rs 12,000.

Also, the payment goes up with increased followers, and also have a much wider reach. The executive said, for example, Instagram creators charge as high as Rs 1 lakh if they have followers of 3 lakh and above.

The higher payment to TikTok and Instagram was also a function of the global audience they have, whereas local players are largely limited to India, and also more daily active users.

Explained Bhatia: “A lot of apps provide Monthly Active Users or MAUs as a key metric for their growth, but actual daily engagement level remains hidden behind those numbers. For apps like Instagram, we can’t expect to see strong growth in app downloads or MAUs, due to the high penetration of the app that already exists. Thus, Daily Active Users (DAUs) or engagement time (in the number of minutes) is a key metric while comparing these apps, especially for advertisers.”

“We expect “Instagram Reels” to be far ahead of local Indian apps when it comes to daily active users as well as “daily engagement levels”, which are the key industry metrics for advertisers,” he added.

What of the local players?Unlike the West where the market has matured, the Indian social media landscape has seen significant growth in recent times.

“Sometimes you need a catalytic event to bring in a big change in the social media ecosystem. We had not one, but multiple such events last year,” said a Bengaluru-based investor, who has invested in social media companies in India and did not want to be named.

One such event was the ban on TikTok. The investor further explained that what also helped was the pandemic induced lockdown, which led to increased internet consumption for entertainment.

With the ban, the content space was filled by existing and by a string of newer apps that came forth like Moj, Josh and others. “As a result, companies like Sharechat and DailyHunt were able to raise money at a very high valuation reinforcing the social media content ecosystem in India,” the investor explained.

Regional language-focused features of the local apps presented the users with familiarity and adherence to the local rules, said Siddarth Pai, founding partner, 3one4 Capital, which has invested in Mitron TV, a short video app launched in April 2020, and Koo, a regional language microblogging platform.

Marthandan, the digital marketing executive quoted earlier, said certain brands that are looking to penetrate smaller towns can take advantage of the audience in the Indian short video platforms, since they have local influencers in the specific regions that help them engage with the consumers better.

Taking different routesWhile most of the short video apps started as TikTok clones, many are innovating and looking at different models.

Of the half a dozen Indian short video apps, Moj is by far leading in terms of downloads and active users, going by the data shared by third-party analyst firms cited earlier.

Ankush Sachdeva, CEO and Cofounder, ShareChat and Moj, said that the company is investing in artificial intelligence capabilities, and partnered with US-tech majors like Snap for Augmented Reality tools for Moj. “We have also created an Rs 100 crore fund for our creators to help them monetize their content on the platform,” he said.

“Given the scope of clubbing with ShareChat, we are able to offer an even larger reach and a wider variety of ad offerings,” Sachdeva added. In addition, the company is also launching other monetization levers like livestream virtual gifting in the next few months.

Chingari has introduced a video-commerce feature in the videos, where users can shop directly from, early this year. Sumit Ghosh, co-founder & CEO, Chingari, sharing the feature in a tweet said, “When we gained popularity last year after the TikTok ban, we were just being called clone/copycat and no one thought we could build anything innovative, we are proud to launch this feature and become the first short video app globally to make short videos shoppable via AI/ML.”

The other platform Trell, though it benefited from the TikTok ban, now has different ambitions and is focusing on the commerce aspect, where they are doing shopping-related work, said the investor quoted above. TikTok never did that.

These firms, in their own way, are forging ahead into newer paths. However, user monetization is one of the key challenges facing Indian players.

Monetisation struggleNeil Shah, Vice President – Research, Counterpoint Research, pointed out that these platforms need millions of users to attract ads. A RedSeer analysis, which was shared at the event Ground Zero on June 30, pegged that a platform might require 100 million daily active users to build digital ad business at scale.

Abhinav Mohan, VP – Monetisation, Glance, which also owns short video app Roposo, explained during the event that, India has low average revenue per user compared to countries in the West like the US or Europe. But daily active users in the country are high as many of them are from tier-2 and 3 cities, termed next billion users, are now on social media. It was largely made possible by accessibility to cheaper smartphones and data plans driving the need for vernacular content.

This is a huge market and also an opportunity, especially for the Indian firms focused on the regional language market, if they can get their monetization model right. Tier-2 and other smaller towns account for about 60-65 percent of the short-form video market in India, according to a RedSeer report that pegged its size to be $215 million.

If companies can crack how to monetize this huge market, by having different user experiences or content, this would be a huge opportunity, Mohan added.

Many of these models such as live shopping experiences like Chingari, or livestream virtual gifting options that ShareChat Moj is looking to implement, are still evolving.

That is why the next few years would be telling.

“The question is, over the next 2-4 years will these platforms be successful in whatever they are trying to do. Everyone is forming their own direction and own goals. From that lens, how well these companies do is yet to be seen. It is too early to say now,” says, the Bengaluru-based investor.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.