At a time the Indian Railways (IR) is betting on privatisation of its stations, passenger trains, freight terminals, railway tracks and other assets to unlock value, one of its showcase public-private partnerships (PPPs), the Pipavav Railway Corporation (PRCL), has run into trouble.

PRCL is a special purpose vehicle (SPV) formed to build, operate and maintain a 271 km long, Rs 373 crore broad gauge railway line between Surendranagar and Pipavav port in Gujarat. Indian Railways has a 50 percent stake in the company and investors like Gujarat Pipavav Port, General Insurance Corporation of India and New India Assurance Company hold the remaining stake.

PRCL and Western Railways (WR) have been squabbling since the latter started demanding that more and more passenger trains be run on the track, according to documents reviewed by this writer. PRCL has protested repeatedly since October 2020, pointing out that the concession agreement executed between PRCL and Indian Railways was being violated.

“Clauses of the concession agreement were not adhered to by Western Railway,” a person familiar with the development said on condition of anonymity.

Mails and messages sent to PRCL and Western Railways seeking comment on the ongoing friction have remained unanswered.

PRCL’s resistance rests on three factors – that the track was being increasingly used to operate less profitable passenger trains; that the special purpose vehicle was being bypassed in the making of major decisions, and that WR was not sharing the increased cost of maintaining the track.

When PRCL took on the job of maintaining the link around 2003, it was required to introduce and widen the track to run only freight trains, according to the concession agreement. For passenger trains, the agreement permitted running of only those trains that were being operated at the time.

This PPP, which converted the 271 km metre gauge rail track between Surendranagar and Pipavav to broad gauge, ended up handling way more passenger trains running on its track (in the pre-COVID period) than had been agreed between PRCL and Indian Railways in the contract, said a second person aware of the development.

Running more passenger trains would adversely affect the financials of PRCL, the person said. First, increasing the number of passenger trains means lower track capacity for running freight trains, which are more profitable for PRCL’s railway track, in which non-railway investors have infused money.

Second, more passenger trains mean slowing the speed of freight trains because the former receive priority on Indian Railways. More passenger trains also increase the wear and tear of the rail track, the maintenance of which is being paid for entirely by PRCL.

‘Death knell’ of PPPs?

As the trains are being introduced by Western Railway Zone, WR should start sharing the cost of maintaining the tracks, PRCL told the railroad operator on July 29.

PRCL also informed WR in a July 29 document reviewed by this writer that it will not agree to run more trains until the Western Railway Zone shares costs, and sought the forming of a joint committee to work out an amicable solution.

The strongly worded document said that if the fundamental pending issues were not resolved, then “it will surely spell the death knell of the concept of PPPs in Indian Railways”.

That’s not the end to the disputes. There are also skirmishes between PRCL and Bhavnagar division of WR on the amount of money that had to be spent on maintaining the PRCL rail track.

PRCL is contesting a sudden, unilateral, seven-fold increase in its maintenance cost in FY2021 from the previous year, the July 29 document sent to WR by PRCL showed.

The manifold increase in maintenance cost raised eyebrows in PRCL because 2021 was an exceptional financial year, hit by the COVID-19 viral disease during which fewer trains were operated with less traffic. Railways and its units, including PRCL, had adopted austerity measures in the wake of the pandemic.

Additionally, the SPV said in its annual report for 2019 that new passenger trains were being introduced without taking PRCL on board – going against the terms of the contract.

PRCL’s original mandate was to invest in converting the metre gauge rail track to broad gauge and get its share of revenue from the freight moved on the line. The project is supposed to be handed back to Indian Railways in 2033.

There are many other areas of disagreement between PRCL and Railways that include differences over new assets being created with PRCL’s funds, method of calculating the cost of crew in the period starting July 2020, method of computing the expenditure on medical services which more than trebled in the pandemic year of FY2021 from FY2020 despite a drop in staff strength, which the company pointed out to WR in a series of letters around May-June 2021.

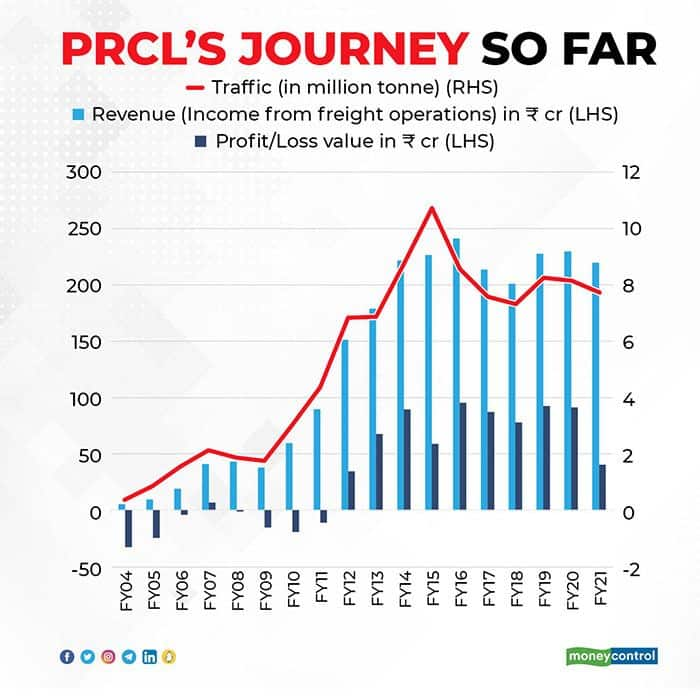

PRCL has been booking profits for several years and has been largely perceived as a successful PPP story within and outside Railways until now. The company registered profits for 11 years until FY2021. The Comptroller and Auditor General of India (CAG), in February 2020, termed PRCL an ideal SPV compared to its peers.

Privatisation – past and future

The friction between PRCL and Indian Railways assumes greater significance because it comes at a time the public transporter is looking to attract private participants to upgrade its assets and operations.

Under the recently unveiled National Monetisation Plan (NMP), in the Railways, the government is looking to monetise 400 stations, 90 passenger trains, 1,400 km of tracks and overhead electricals; 265 goods sheds, 741 km of the Konkan Railway, 15 rail stadiums, and an unspecified number of railway colonies between FY2022 and FY2026.

Early this year, however, the government’s invitation for bids to run passenger train did not elicit much response from the private sector, prompting Railways to rework the terms. Station redevelopment is another area – where winners of several redevelopment projects that have been farmed out have sought relief after the disruptions triggered by COVID-19.

“What’s unfolding in PRCL now is a cautionary tale of what may go wrong in PPPs in Indian Railways, and why private sector players remain wary of investing in Railways,” said an industry leader who declined to be named.

In the last few decades, Indian Railways has hived off container train operations, private freight terminals, tourist trains, catering services and maintenance of stations to non-Railway entities including public sector enterprises and private companies.

Private investors have for long sought a regulator in the railway sector. In 2017, Railways issued a gazette notification on a rail development authority. Four years later, a regulator is not yet in place.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.