At a time when rising medical costs have made health insurance indispensable, the one thing policyholders expect is timely claim settlement.

To resolve the issue, the Insurance Regulatory Development Authority of India (IRDAI) made it mandatory last year for cashless claims to be settled within 3 hours at the time of claim settlement. For pre authorization the time limit of 1 hour was made mandatory.

Following this, the issue was raised in the Lok Sabha, where the member of Parliament, Sribharat Mathukumilli, sought clarity on how often insurers meeting the deadlines for cashless approvals, how many claims remain unresolved, and how many show-cause notices have been issued for improper deductions or rejections.

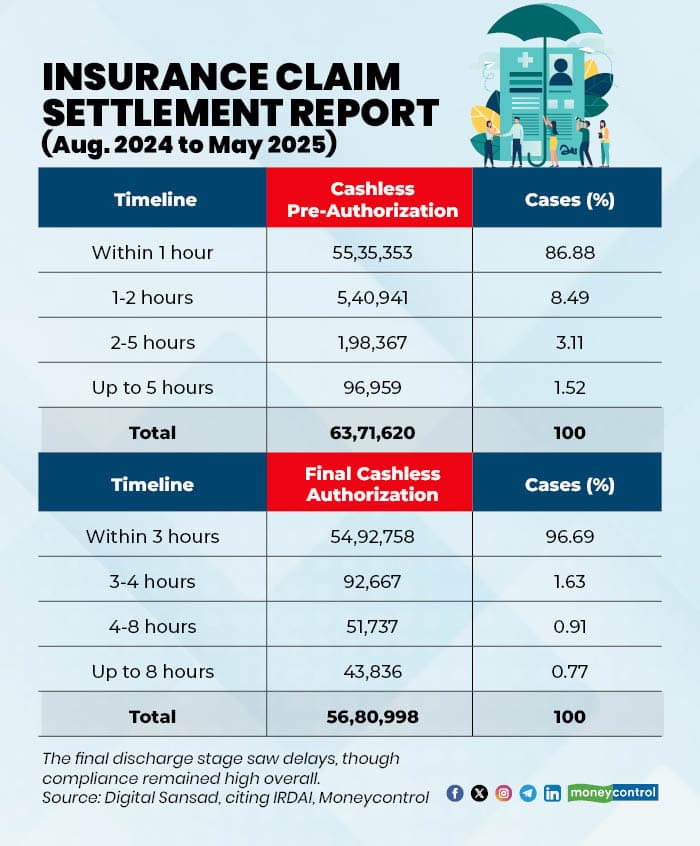

Responding to these questions, the government shared data on insurers’ performance under the IRDAI Master Circular on Health Insurance Business 2024. IRDAI’s data for August 2024 to May 2025 shows that while a majority of cashless claims were cleared within mandated timelines, thousands still breached the prescribed window, highlighting persistent gaps in service standards despite stricter regulatory oversight.

The data shows that cashless insurance claims meet 97 percent of IRDAI’s 3-hour mandate, and pre-authorization at 87 percent compliance.

Further, the government also drew attention towards the gaps in grievance resolution on the Bima Bharosa platform, which is integrated with insurers’ Complaint Management Systems.

According to the data, in FY25, nearly 2,57,790 complaints were received on the Bima Bharosa platform. Around 4,811 (1.87 percent) cases remained unresolved within the stipulated time of 14 days.

Similarly, for FY26 (up to Sept 30, 2025) total complaints received were 1,36,554 while cases which remained unresolved within 14 days of stipulated time were 532 (0.39 percent).

The Bima Bharosa platform is a complaint management system (CMS) developed by the Insurance Regulatory and Development Authority of India (IRDAI), which is integrated with the CMS of the insurers. This means, every complaint filed by insurers in their CMS is reflected on Bima Bharosa or vice-versa on a real time basis.

IRDAI Master Circular on Health Insurance Business had directed insurers to put in place the necessary systems and procedures to adhere to the mandated timelines for cashless requests by July 31, 2024. The 1-3 hour cashless authorization timelines were made effective from August 1, 2024.

11 show-cause notices served for improper claim practices

Highlighting regulatory action, the government confirmed that 11 show-cause notices were issued during 2024-25 on violations relating to Health and Policyholders related regulatory provisions including:

Unnecessary claim deductions

Improper claim rejections

The government also informed that 53,102 complaints have been filed with insurance ombudsman offices against insurance companies in FY25. Currently, the Bima Bharosa system is not integrated with the Insurance Ombudsman System.

Nonetheless, if insured is not satisfied with the resolution provided by the insurers, they can file a complaint with the Insurance Ombudsman either by visiting the nearby office or online.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!