BUSINESS

What GST rate cuts for the ‘Common Man’ mean for consumer categories, companies

GST rationalisation strengthens the consumption story by boosting affordability, accelerating the shift to organised players and creating volume-led earnings tailwinds

BUSINESS

GST Reforms: Who wins big in the textile market shake-up?

The rate cut should lower procurement costs, improve cost efficiency, and enhance operating margins

BUSINESS

Can V2 Retail sustain its growth in value fashion?

Aggressive store additions, expanding margins, and improving return ratios underpin growth visibility

BUSINESS

Is this dairy player nourishing enough for portfolio addition?

Weak summer demand and higher procurement costs dented Q1 margins, but Africa growth and diversification into eastern and western India keep the structural growth story strong

BUSINESS

Page Industries: Margins hold strong, but growth lags

Volume recovery rather than margin resilience to determine the stock performance going forward

BUSINESS

Growth momentum, strategic expansion to drive DOMS

Near-term costs like employee additions, distribution spends, and inorganic integration may weigh on margins, but backward integration and scale efficiencies should cushion profitability.

BUSINESS

MapmyIndia: Growth visibility improves with margin traction in Q1 FY26

Despite subdued performance in the IoT segment due to restructuring, the company saw continued traction across fintech, logistics, public sector, and automotive verticals.

BUSINESS

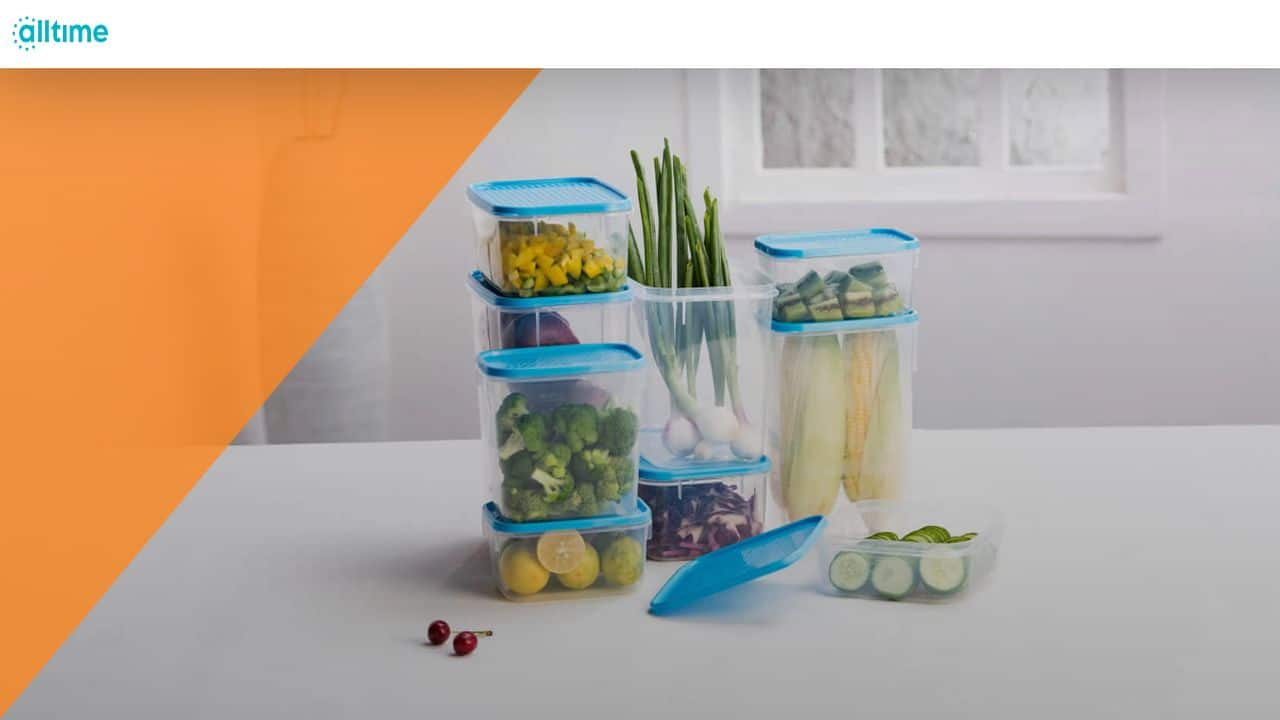

All Time Plastics IPO: Should this flotation be on investors’ radar?

The company is operationally strong, has a sound setup, and trusted by clients

BUSINESS

Growth continues at Baazar Style Retail with margin support

With strong execution, growing private label contribution, and a clear focus on high-return expansion, the company is structurally positioned for long-term growth in the organised fashion retail space.

BUSINESS

Will Saregama’s content-led strategy drive the next phase of growth?

The company delivered a steady Q1FY26, confirming its leadership in the monetisation of entertainment IP

BUSINESS

Swiggy Q1 FY26: Steady performance, but profitability remains a concern

Near-term focus of the company shifts to driving efficiency and narrowing losses

BUSINESS

Aditya Infotech IPO: Big vision, bigger valuation — Should you bet on it?

Heavy dependence on imported raw materials and exposure to Chinese component supply are key concerns

BUSINESS

Bikaji Q1 FY26: Slow but steady margin comeback

A sharp increase in input costs impacts gross margin. However, adjusted revenue growth remains strong

BUSINESS

Shanti Gold International IPO: Will it glitter on the bourses?

SGIL has a reputed and experienced management team and is well-placed to capture growth opportunities.

BUSINESS

GNG Electronics IPO: Is it a good value proposition?

One-of-its-kind flotation that’s an interesting play on the refurbished electronics segment

BUSINESS

Eternal Q1 FY26: Scaling up fast, but can it deliver margin consistency?

While the transition to an inventory-led model and continued store expansion could drive long-term margin expansion, execution risks remain elevated

BUSINESS

Can CEAT regain margin traction after Q1 FY26?

Strong volume-led growth offset by margin pressure. The company eyes on H2 as Camso, exports, and premiumisation take hold

BUSINESS

Is Heritage Foods set to become a high-margin dairy brand?

Rising value-added product mix, stronger margins, and strategic western expansion mark a structural shift at HFL

BUSINESS

Travel Food Services IPO: Should you subscribe?

TFS runs a dual-vertical business model — QSRs and lounges — at airports. As of March 2025, it operates across 18 Indian airports, including Delhi, Mumbai, and Hyderabad, as well as international hubs in Kuala Lumpur and Hong Kong

BUSINESS

Crizac Ltd IPO — Is this EdTech flotation worth the bet?

Tech-driven, asset-light B2B platform targeting global student mobility, with efforts underway to reduce UK dependence

BUSINESS

Is this agrochemical IPO a good bet?

The company plans to invest in a new dry flowable manufacturing plant to add newer formulations in its portfolio.

BUSINESS

From Lead to Lithium: This battery maker is building the next growth engine

Strong lead-acid cash flows anchor the transition as Amara Raja builds vertical capabilities in lithium, energy storage, and grid solutions

BUSINESS

Is Dodla Dairy becoming a more consistent performer?

With value-added products gaining traction, Africa expansion, and feed integration, Dodla is well-positioned for continued expansion

BUSINESS

Can Page Industries earn back its premium valuation in FY26?

Volume-led recovery and digital-led retail strength support FY26 optimism amid valuation concerns