BUSINESS

Swiggy dishes out strong numbers in Q2 FY25

Both food delivery and quick commerce are doing well

BUSINESS

SJS Enterprises: Riding fast on premium products

Strong performance in second quarter despite challenges

BUSINESS

Coal India: Long-term outlook remains attractive

The second quarter of FY25 was weak due to a dip in sales volume as well as realisation

BUSINESS

Landmark Cars: Decent quarter, encouraging outlook

New offerings by OEMs and preference for premium vehicles augur well for the company

BUSINESS

Hero MotoCorp Q2: A smooth ride in tough times

Customer preference for personal mobility, focus on EVs, and a slew of launches, especially in the premium segment, are likely to boost demand, going forward

BUSINESS

Hyundai’s Q2 FY25: Performance drops, valuation reasonable

Demand for utility vehicles stronger than that for entry-level segments. This impacted volumes of more economical models, which generally make up a significant part of overall sales.

BUSINESS

Hindalco reports in-line numbers in Q2, moderate outlook

Delivered in-line Q2 FY25 results, showcasing muted top-line growth and a marginal improvement in the EBITDA performance

BUSINESS

Ashok Leyland Q2 FY25: Benign commodity cost offers margin relief

Profitability in line with expectations, but revenue growth lagged in a challenging quarter

BUSINESS

A tough ride for Tata Motors in Q2 FY25

JLR growth was impacted and domestic PV business slowed

BUSINESS

MapmyIndia: Investment in future at the cost of profitability; outlook positive

The company’s position as a leader in the mapping and geospatial technology industry, and its growing adoption by the government and industry players are the key drivers

BUSINESS

Tata Steel: Lower realisation hurts, challenges to persist

The Indian operation is stable, but overseas performance disappointing

BUSINESS

M&M Q2 FY25: Decent quarter, valuation at fair level

The company is targeting mid-to-high teen growth. Challenges include potential urban demand slowdown and international markets. M&M’s navigation plan includes a strong product lineup and adaptability

BUSINESS

Jindal Steel and Power: Decent quarter in a challenging environment

Operating performance to get better on the back of cost savings, capacity expansion, and high-margin products

BUSINESS

Swiggy IPO — How tasty will it be for investors?

The size of the issue could limit listing gains, but the offer looks attractive for long-term subscription

BUSINESS

Two-wheelers, auto exports remain in top gear in October

The only segment which saw a declining trend was commercial vehicles. Companies say that the government's emphasis on infrastructure, construction, and mining activities provide further hope for the auto sector

BUSINESS

Airtel Q2 FY25: Strong show in India, Africa continues to be the Achilles' heel

Tariff hikes and a growing share of high-value customers to drive ARPU growth

BUSINESS

Maruti’s Q2 FY25: Can festive demand add speed to its momentum?

Better product mix helped realisations inch up though there was a slight dip in volumes

BUSINESS

JSW Steel: Weak Q2; levers in place for better FY25

The recently announced broad stimulus measures by the Indian government to boost liquidity, consumer sentiment, and improved housing sales are expected to lower exports from China, thereby reducing pricing pressure.

BUSINESS

IndiGo Q2 FY25 numbers fly at a low altitude

Grounding of aircraft and rising fuel cost hurt financials, though growth levers are intact

BUSINESS

TVS Q2FY25: Continues to cruise on a fast track, but valuation sticky

The current trend indicates modest growth in Q3FY25. However, the management is optimistic that demand will pick up ahead of the Diwali festival.

BUSINESS

Zomato Q2 FY25: The menu is getting tastier by the day

Strong growth in revenues and healthy expansion in operating margins

BUSINESS

Hyundai versus Cochin Shipyard: Are retail investors in the IPO market that smart?

A debate is unfolding on social media whether retail investors are taking informed decisions on new issues

BUSINESS

Bajaj Auto Q2 FY25: Strong positioning helps defy challenges

Capacity expansion to fuel growth, but stock valuation is expensive

BUSINESS

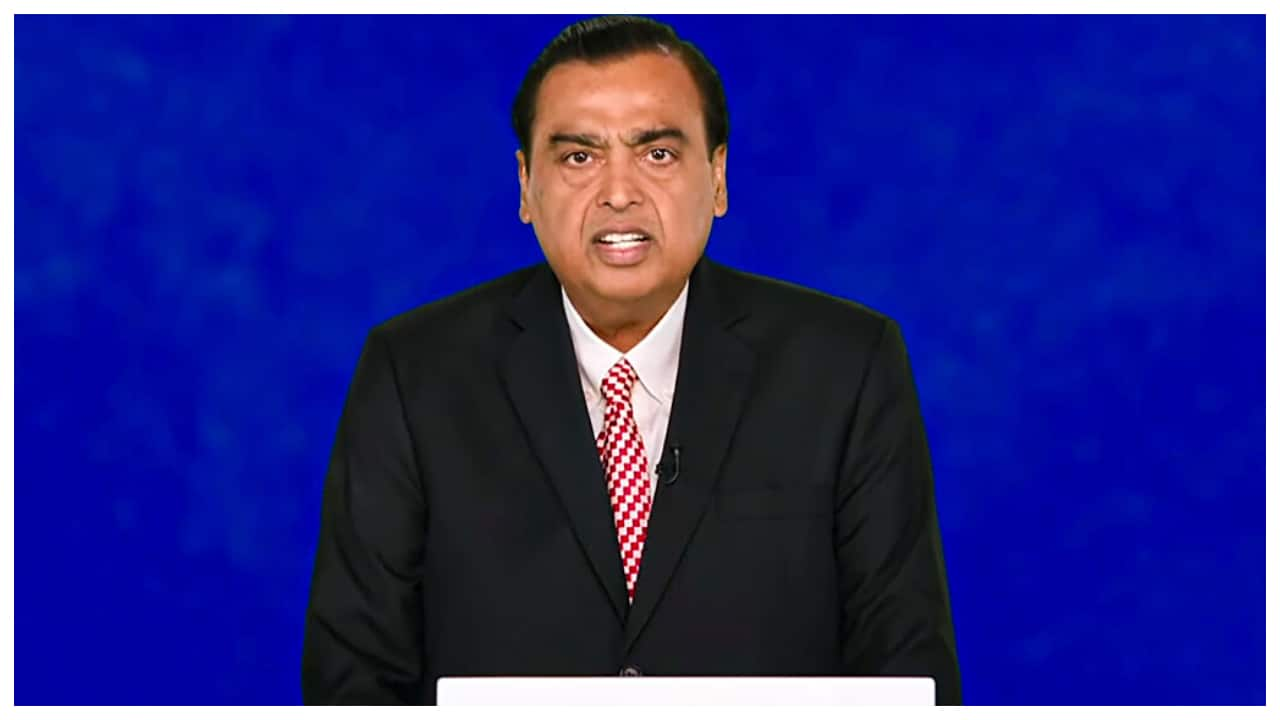

Reliance Industries Q2: Consumption-oriented segments telecom, retail drive growth

While a subdued global economic environment has affected its O2C business performance, improving prospects for consumption growth and progress in new energy business will drive the stock outlook