BUSINESS

The quality test: Should you invest in smart beta funds focusing on quality?

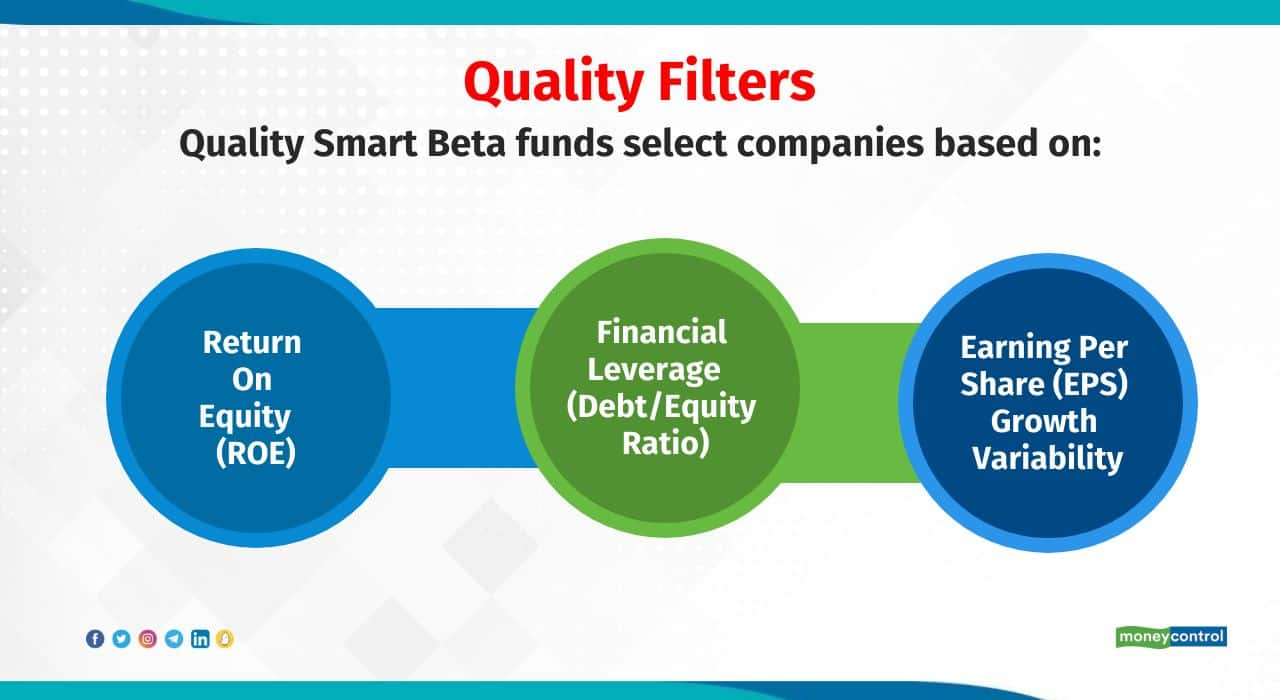

Smart beta funds focusing on quality prefer to invest in quality companies with high valuation and strong cash flows. These funds are likely to offer good downside protection and tend to outperform in bear markets

BUSINESS

Buy high, sell higher: Does momentum strategy work for Indian investors?

Momentum strategy follows a ‘buy high and sell higher’ approach of investing and exhibits high volatility in the short term. Investors with a high risk profile and long-term view can allocate 10-15 percent of their portfolio to momentum strategy. About 12 mutual fund schemes offer this play

BUSINESS

One year of interest rate hikes: Debt funds emerge a winner despite headwinds

The Reserve Bank of India started raining interest rates (repo rate) in May 2022. Since then, it has hiked the repo rate 250 basis points. Accrual funds benefitted from the rate hike cycle while, duration funds have been a mixed bag. Here, we analyse how debt funds responded to the rate hikes

BUSINESS

Budget 2023: Will there be a rise in exemption limit for long-term capital gains tax?

The exemption allowed for long-term capital gains on equity investments need to be further enhanced to account for inflation, rising income levels and to encourage more investors into equity markets, say analysts

BUSINESS

Budget 2023: Mutual funds ask for tax parity with insurance and listed bonds

AMFI, the Association of Mutual Funds of India, has asked for uniform capital gains taxation and better tax treatment for ETFs, from Budget 2023

BUSINESS

MC Explains | How mutual funds invest in RTA shares

Tech-enabled registrar and transfer agents are seen as a proxy for growth in the mutual fund business that they service

BUSINESS

Combining tax benefits with higher returns: Tax-saving funds that top the charts

Equity-Linked Saving Schemes (ELSS) or tax-saving equity funds are the only pure equity instrument in the basket of instruments eligible for Section 80C tax deduction benefits

BUSINESS

These low-volatility index stocks hold the ground when market goes wild

Stocks of certain consumption-focused companies have been part of the Nifty 100 Low Volatility 30 Index over the last five years

BUSINESS

These eight PSU stocks create a buzz in momentum index

Public-sector entities like NTPC, Bharat Electronics and Bank Of Baroda are now part of the Nifty200 Momentum 30 index, which appeals to the high-risk investor. Economic recovery has been an energy booster to the otherwise slow-moving Public Sector Undertaking (PSU) stocks

BUSINESS

Debt investment returns drying up? Check out these options with a 3-5-year horizon

Emerging mutual fund categories like target maturity funds, floating rate funds, as well as traditional investments now offer more options to investors

BUSINESS

How Invesco India mutual fund lost the debt game in India

The AMC has seen sustained outflows from debt schemes over the last five years.

BUSINESS

Will mutual funds subscribe to LIC IPO? Looks likely, going by their past behaviour

LIC IPO will not be the first listed insurance company for mutual funds to invest in. Already Rs 30,000 crore or 1.5% of the overall equity AUM is invested in shares of seven listed insurance companies.