These eight PSU stocks create a buzz in momentum index

Public-sector entities like NTPC, Bharat Electronics and Bank Of Baroda are now part of the Nifty200 Momentum 30 index, which appeals to the high-risk investor. Economic recovery has been an energy booster to the otherwise slow-moving Public Sector Undertaking (PSU) stocks

1/11

One of the favoured strategies that aggressive investors, typically, follow is momentum investing. As against fundamental investing where you wait for companies to demonstrate a profitability and sales track record and investors to reward them with higher share prices, a momentum strategy aims to make money by buying securities when they are rising and selling them when prices start to decline. In this backdrop, it may surprise you that that the stocks of government-owned companies, or PSUs, not known for their speed or agility, are now in a momentum index. Historically, momentum investors did not chase PSU shares. For a decade ending in CY2020, the shares of PSUs were ignored by momentum investors. Stock prices went down, primarily due to selling pressure under the disinvestment programme of the government in one form or the other. However, these stocks are now gaining attention as the economy turns and investors are making a beeline to buy them. Eight of these stocks have made it to the popular Nifty200 momentum 30 index, which tracks the performance of 30 high-momentum stocks across he large and mid-cap space. These stocks are selected based on the momentum score calculated from their recent 6-month and 12-month price returns adjusted for volatility.

2/11

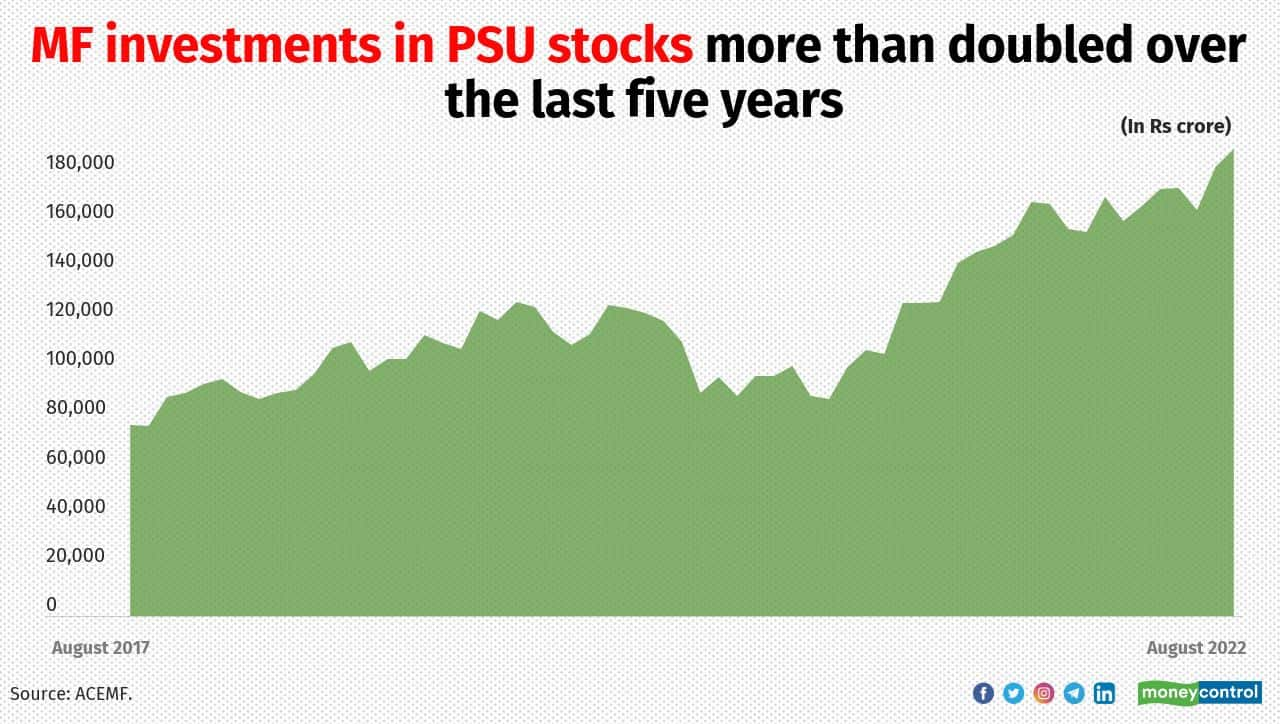

Mutual funds have been investing in shares of PSUs for a long time. However, their investments in these oscillated, depending on the expected earnings and company fundamentals. Over the last couple of years, mutual funds have been rather positive on PSU stocks, expecting them to benefit from an impending upcycle in capital expenditure. Along with five dedicated PSU equity schemes that managed assets about Rs 21,000 crore as of August 31, 2022, equity schemes of various mutual fund schemes have allocated about Rs 1.90 lakh crore to shares of PSU stocks.

3/11

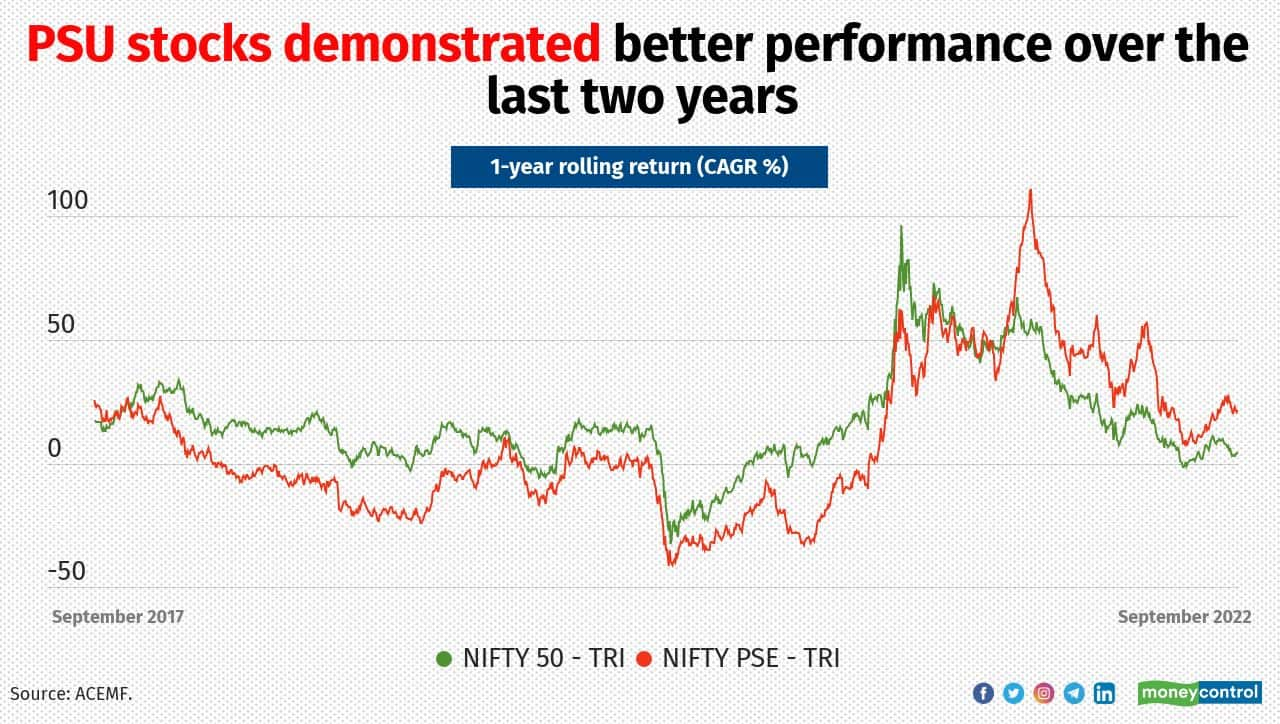

Nifty PSE TRI (Total Return Index) is up 135 percent since March 2020 lows while the Nifty 50 TRI gained 122 percent. The Index has 20 constituents from sectors such as oil and gas, power, services, metals and mining, financial services and consumer services. PSU is a fairly diversified theme and many of these sectors tend to do well when the economy is in an upswing. At the current price, the Nifty PSE index trades at attractive valuations of 7.2 times earnings, which is at around a 25 percent discount to its five-year average of 9.6 times. Following are the eight PSU stocks that are part of the Nifty200 Momentum 30 Index. Weightage of the stocks shown in the below slides were based on the portfolio of the UTI Nifty200 Momentum 30 Index Fund. Values were as of August 31, 2022. Source: ACEMF.

4/11

NTPC

Weightage of the stock: 5%

Sector: Power

Total number of active equity schemes that held the stock: 188

NTPC is a Maharatna company engaging in generation of electricity and allied activities.

Weightage of the stock: 5%

Sector: Power

Total number of active equity schemes that held the stock: 188

NTPC is a Maharatna company engaging in generation of electricity and allied activities.

5/11

Power Grid Corporation Of India

Weightage of the stock: 4.5%

Sector: Power

Total number of active equity schemes that held the stock: 87

It is a Maharatna company and India’s largest electric power transmission utility across different states of India.

Weightage of the stock: 4.5%

Sector: Power

Total number of active equity schemes that held the stock: 87

It is a Maharatna company and India’s largest electric power transmission utility across different states of India.

6/11

Coal India

Weightage of the stock: 4.5%

Sector: Minerals and mining

Total number of active equity schemes that held the stock: 68

Coal India is a Maharatna PSU, the largest coal producer in the world.

Weightage of the stock: 4.5%

Sector: Minerals and mining

Total number of active equity schemes that held the stock: 68

Coal India is a Maharatna PSU, the largest coal producer in the world.

7/11

Bharat Electronics

Weightage of the stock: 3.9%

Sector: Industrial capital goods

Total number of active equity schemes that held the stock: 152

Bharat Electronics is a Navratna PSU under the Ministry of Defence. It manufactures electronic products and systems for the Army, Navy and the Air Force.

Weightage of the stock: 3.9%

Sector: Industrial capital goods

Total number of active equity schemes that held the stock: 152

Bharat Electronics is a Navratna PSU under the Ministry of Defence. It manufactures electronic products and systems for the Army, Navy and the Air Force.

8/11

Oil & Natural Gas Corporation

Weightage of the stock: 3.9%

Sector: Oil

Total number of active equity schemes that held the stock: 59

ONGC is a Maharatna PSU under the Ministry of Petroleum and Natural Gas. It is the largest crude oil and natural gas company in India.

Weightage of the stock: 3.9%

Sector: Oil

Total number of active equity schemes that held the stock: 59

ONGC is a Maharatna PSU under the Ministry of Petroleum and Natural Gas. It is the largest crude oil and natural gas company in India.

9/11

Hindustan Aeronautics

Weightage of the stock: 3.1%

Sector: Diversified

Total number of active equity schemes that held the stock: 65

A Navaratna PSU under the Ministry of Defence, Hindustan Aeronautics is one of the oldest and largest aerospace and defence manufacturers in the world.

Weightage of the stock: 3.1%

Sector: Diversified

Total number of active equity schemes that held the stock: 65

A Navaratna PSU under the Ministry of Defence, Hindustan Aeronautics is one of the oldest and largest aerospace and defence manufacturers in the world.

10/11

Bank Of Baroda

Weightage of the stock: 1.8%

Sector: Banks

Total number of active equity schemes that held the stock: 100

BoB is one among the largest PSU banks in India in terms of market capital and business.

Weightage of the stock: 1.8%

Sector: Banks

Total number of active equity schemes that held the stock: 100

BoB is one among the largest PSU banks in India in terms of market capital and business.

11/11

Indian Railway Catering And Tourism Corporation

Weightage of the stock: 1.4%

Sector: Services

Total number of active equity schemes that held the stock: 2

IRCTC is a PSU providing services such as ticketing, catering, and tourism services for Indian Railways.

Weightage of the stock: 1.4%

Sector: Services

Total number of active equity schemes that held the stock: 2

IRCTC is a PSU providing services such as ticketing, catering, and tourism services for Indian Railways.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!