BUSINESS

Tech Mahindra Q2 FY26 – strong execution, confident outlook

There’s room for re-rating, as the company delivers on its promised turnaround strategy

BUSINESS

HCL Tech Q2 FY26: Time to reverse the underperformance

With a diversified industry exposure and strong focus on AI, the company looks well placed to grow

BUSINESS

TCS Q2 FY26 – What does the pivot to AI mean for investors?

There could be relief rally, but the IT major is unlikely to come out of its sluggish growth phase in a hurry

BUSINESS

Can Q2 FY26 earnings bring back FIIs to Indian markets?

The fiscal and monetary measures announced this year could help companies overcome challenges

BUSINESS

Will banking stocks react to a tepid Q2 FY26?

A pick-up in demand, along with fiscal and monetary measures, to support credit growth

BUSINESS

Is this the unexpected Navratri gift of RBI to banks?

Further easing of the regulatory environment to boost the performance of lenders

BUSINESS

IKS Health – Why you should look at this healthcare BPO, post correction

The company’s core business is largely insulated from technology disruptions

BUSINESS

Should one look to buy the oversold IT stocks, post Accenture’s in-line report?

A re-rating of the sector as a whole looks unlikely till there is a new technology cycle with meaningful earnings visibility

BUSINESS

Will the Indian IT sector crumble under the new H1B visa guidelines?

Though the reliance on H1B is coming down, there are other headwinds to be tackled

BUSINESS

Muthoot Finance – How long can the glitter last?

Gold financing is a long-term structural opportunity and established players should do well

BUSINESS

Can Control Print be a stock worth printing for the long term?

The company has a strong balance sheet and a unique core business that cannot be ignored

BUSINESS

IRCTC – Can it leverage the consumption push to gain speed?

Most of the businesses have matured and offer modest organic growth opportunities

BUSINESS

What to expect from Indian equities, post GST 2.0?

It is unlikely to be a one-way street, given the conflicting forces at work

BUSINESS

Why does this IT service growth leader merit attention?

Industry-leading earnings growth and the AI edge should help the stock do well

BUSINESS

Safari Industries – Is it a good time to pack the bag with the stock?

Heightened competitive intensity and the entry of new players have eroded the profitability of incumbents

BUSINESS

Will VIP be able to overcome the rough patch with the change in ownership?

The company likely to report gradual improvement

BUSINESS

Wipro bolsters its ER&D footprint with an acquisition

The transaction should add about 3 percent to the company’s top line

BUSINESS

Can the GST overhaul counter the tariff pain for Indian equities?

The proposed tax rejig could lead to a fiscal stimulus of roughly 50 basis points of the GDP

BUSINESS

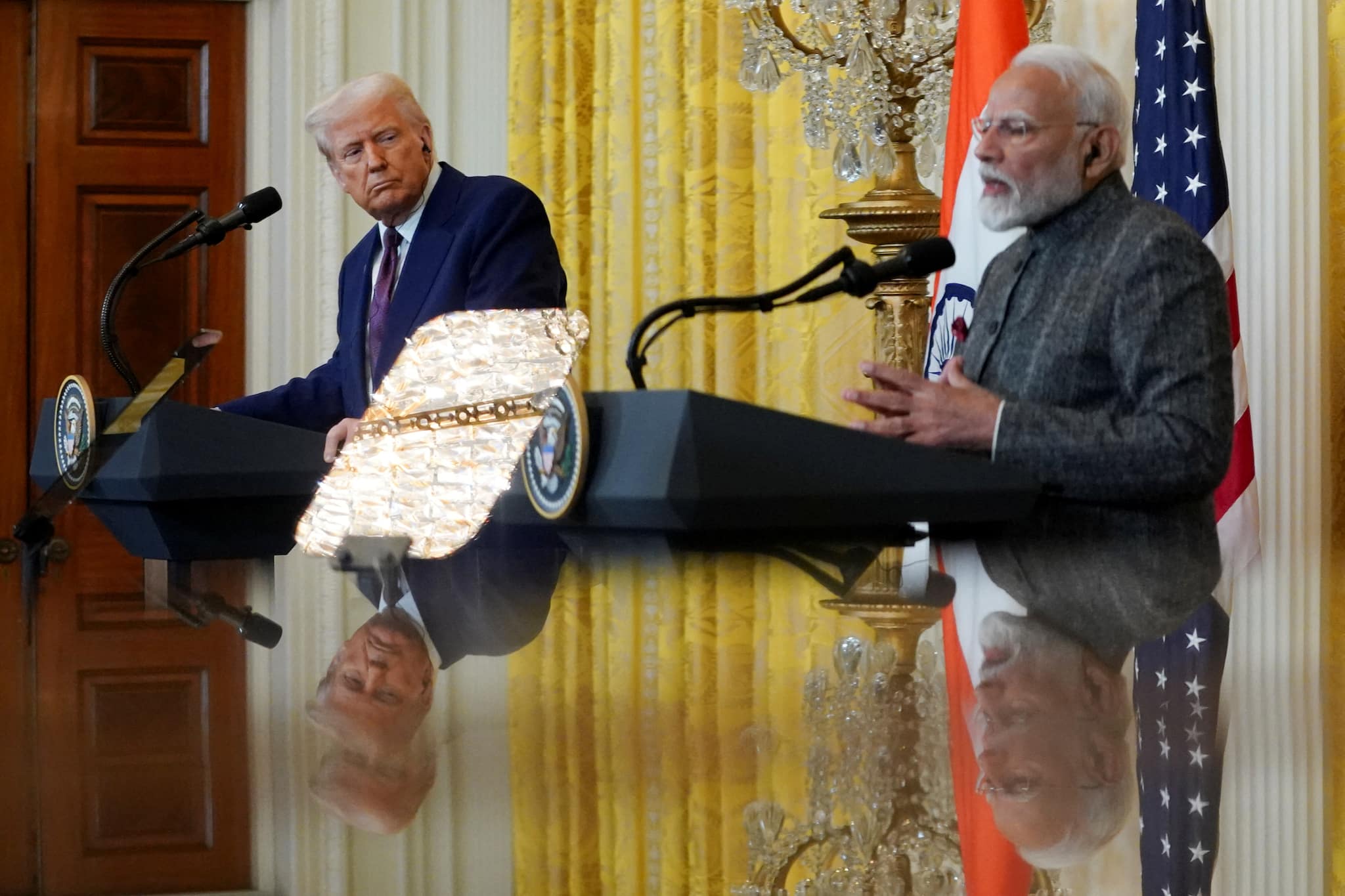

Can Trump’s tariff derail India’s China Plus One ambition?

Trump’s punitive tariff could cloud India’s ambition of becoming a viable alternative to China unless trade negotiations succeed. However, it could well turn out to be India’s 1991 moment, forcing the country to take long-pending economic reforms to leap into the next level

BUSINESS

Can Trump’s tariff derail India’s China Plus One ambition?

China has built a moat around its manufacturing that is hard to replicate, and a favourable tariff differential was a way to eat into that pie.

BUSINESS

How should investors navigate the additional 25% US tariff jolt?

Equities are not cheap but if the penalty tariffs go into effect, then pockets of opportunity could arise. Here’s a guide on how to navigate these choppy waters

BUSINESS

IndusInd Bank – Will the new leadership pave the way for a rerating?

The bank faces the tall and arduous task of scaling up the battered business profitably

BUSINESS

Federal Bank Q1 FY26 – weak quarter with reassuring guidance

The bank’s bid to improve the asset-liability mix, along with fees, should start delivering results gradually

BUSINESS

IndusInd Bank Q1 FY26 -- The worst may be behind, but is it worth waiting for the best?

In view of the slack in loan growth, especially in the unsecured high-yield business, the bank is growing its deposits cautiously, de-focusing on high cost bulk deposits, and focusing on granular deposits