BUSINESS

Tata Steel: Uninspiring Q1 FY25 prompts revision of risk-reward opportunity

As global steel demand remains muted, excess cheap Chinese imports remain a concern.

BUSINESS

Coal India: Decent show in Q1 FY25; levers in place for long-term gain

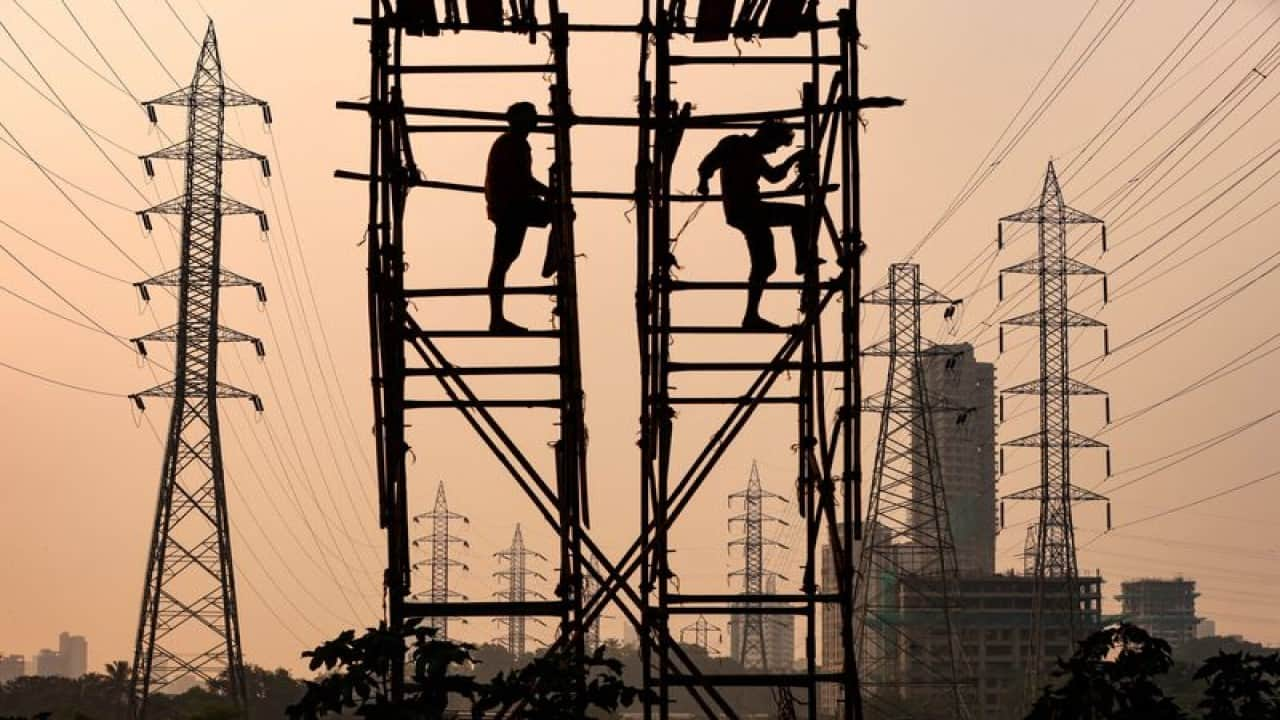

India’s power demand is expected to see solid growth in the coming years

BUSINESS

IPO: Should investors bet on the largest pharma contract manufacturer of India?

Successful execution of CDMO expansion and profitability of the API business need to be watched

BUSINESS

Jindal Steel and Power Q1: Resilient show in a tough market environment

JSPL’s cost-saving and capacity expansion projects, aided by high-margin products, should drive better earnings in FY25-26.

BUSINESS

The Budget policy measures for agriculture are too late, too little!

The much-needed initiatives that could boost farm income found no mention in the Union Budget

BUSINESS

JSW Steel: Q1 FY25 weaker than expected; levers in place for better FY25

Company’s focus on value-added special steel products should support realisation.

BUSINESS

Coal India revises e-auction norms: Is there more upside to the stock now?

Offering more volumes through the e-auction route should help cater to the unserved domestic demand

BUSINESS

What can the Union Budget do to address the woes of Indian agriculture?

Budget 2024-25: It is time for policymakers to realise that incentives will never be enough and will only increase the fiscal burden year on year. The sector will need viable solutions for a sustained growth

BUSINESS

Krsnaa Diagnostics: A stock to ride the theme of inclusive healthcare

With the ramp-up of new projects, the current revenue growth trajectory should continue into FY25-26

BUSINESS

Bansal Wire Industries IPO: Should you make it part of your portfolio?

Successful execution of its product expansion to new segments will be key to watch

BUSINESS

PI Industries adds another feather in its cap with this new acquisition

The acquisition of UK-based Plant Health Care will be value-accretive for PI as it will make the company an integrated agri-solutions provider

BUSINESS

Vraj Iron and Steel IPO: How should investors approach this flotation?

The new issue is coming at a time when the steel sector outlook is muted and valuations are at a peak

BUSINESS

Should you place your bet on the Max Healthcare stock?

Near-term earnings outlook remains supportive. However, valuations are elevated.

BUSINESS

Monsoon Watch: The 2024 rainfall season ends with a healthy surplus

With reservoir levels healthy and sowing activity robust, the monsoon’s impact on the Indian economy appears largely positive

BUSINESS

Medanta: Why the recent stock correction offers value

Medanta has strong capabilities to leverage its brand image and win the underserved and growing markets.

BUSINESS

Apollo Hospitals: A turnaround stock at a reasonable valuation

The company achieved EBITDA breakeven in the AHL business. Growth outlook remains solid

BUSINESS

Diamond in the Dust | Coal India: A stock that’s a catch on every drop

E-auction premiums have normalised. Price hikes in the FSA segment is keenly awaited by the Street

BUSINESS

Will Indian agriculture get disproportionate attention in the upcoming Budget?

India primarily remains an agrarian economy and specific, achievable goals need to be set to allow the sector to flourish

BUSINESS

Can Tata Steel be a rewarding bet in FY25?

India operations are likely to perform better; global demand key to watch

BUSINESS

Tata Steel: Weak Q4 FY24, but risk-reward favourable for FY25

India operations are likely to perform better going into FY25. Global demand is key to watch

BUSINESS

NMDC: Weak Q4 earnings, near-term concerns remain

The company took multiple price hikes, but EBITDA margins dropped because of multiple factors

BUSINESS

Hindalco reports strong earnings growth in Q4

Aluminum prices are seeing an upward trend because of the tightness in global supply and US and UK sanctions on Russia

BUSINESS

PI Industries: New products, pharma to define medium-term growth

PI has guided to a 15 percent top-line growth and 24-25 percent EBITDA margin in FY25

BUSINESS

Rainbow: Q4 FY24 weaker than expected; ramp-up of new hospitals is key

The company is best-placed to benefit from the synergies between paediatric and OB-GYN segments