BUSINESS

Fundamental picks: 5 stocks on which brokerages initiated coverage in November

Technically weak stocks which are unable to sustain above 200- or 50-DMA should be avoided, suggest experts

BUSINESS

Bargain hunting: SBI, Indian Hotels among top 10 buys for 1-2 years horizon

The upcoming results of state elections in December and general elections in 2019 will give enough entry points for investors as markets are likely to remain volatile, suggest experts

BUSINESS

Earnings estimates show Nifty could touch 12K by FY20; 15 stocks to watch

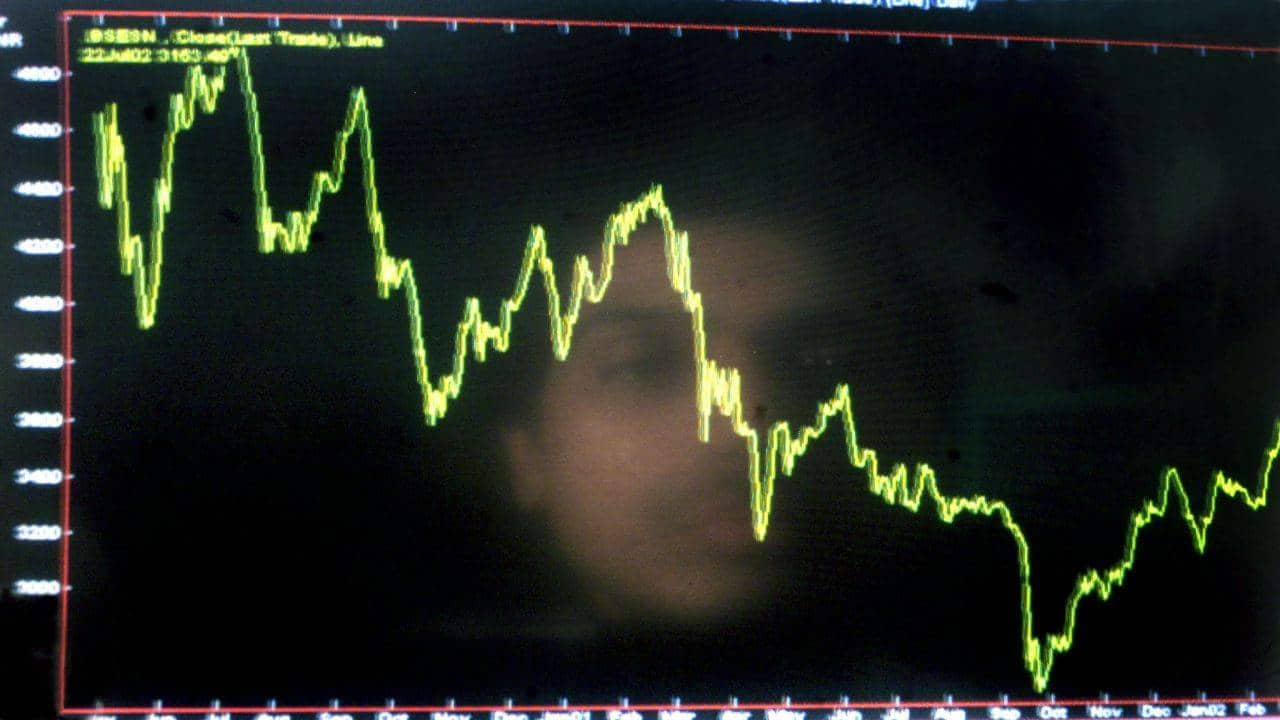

The S&P BSE Sensex lost over 1200 points while for the Nifty the cut was a little over 400 points or 3.7 percent since September 28.

BUSINESS

December series picks: 10 moneymaking ideas which could return 4-14%

Technical experts feel that the week is likely to remain volatile due to November F&O expiry, but bulls will be able to take control only if Nifty closes above 10,700-level and 200-DMA.

BUSINESS

Use rallies to short Nifty, November series expiry could be in the range of 10,450-10,550

The Nifty witnessed weakness for the third consecutive day with forming lower highs and lower lows formation and corrected almost 250 points from the weekly high of 10,774

BUSINESS

Sensex breaks 35K but 26 stocks give 10-30% return in 4 days

Volatility is expected to remain high due to scheduled derivatives expiry on November 29.

BUSINESS

'A breach of 10,239 levels on downside may take Nifty to sub-10,000 next week'

The larger trend is down and in favor of bears but there seems to be a critical support on the long-term charts around 10,239 levels where bulls may put up a strong fight.

BUSINESS

These midcaps have fallen 10-40% from 52-week high but can give double-digit returns

Companies have been taking a hit on their margins due to rising prices of commodities, rupee depreciation and high competition

BUSINESS

Brokerages hand out earning downgrades for quality stocks: Time for investors to exit?

Earnings upgrades were mainly seen in IT and Pharma, helped by the rupee depreciation, while major downgrades were in auto, telecom, cement, and select financials.

BUSINESS

Good bargain: Motilal Oswal picks 10 largecaps trading much below 52-week high

Motilal Oswal sees an upside of 9-40 percent on these 10 large-cap stocks which include names like RIL, HDFC and Infosys

BUSINESS

FIIs, MFs bet on 138 stocks in last 1 year; should you buy?

Out of the 138 stocks which witnessed increase in weightage on a year-on-year basis, as many as 14 stocks saw a correction of 20-80 percent in the last 1 year

BUSINESS

Nifty reclaims 10,600; these 10 stocks rise 10-34% in 5 days

The S&P BSE Sensex rose 0.85 percent while the Nifty50 gained 0.92 percent for the week.

BUSINESS

Time to bag small & midcaps after recent decline? 15 stocks fall 40-70% since August

Selling in some small & mid-cap stocks started in the beginning of 2018 also —thanks to high valuations, but the pressure increased further post August

BUSINESS

November scare for 2018: Bears controlled D-Street in 7 out of last 10 years

The worst fall was seen in 2008 when the index plunged 12% followed by 2011 when it saw a decline of 7.7%

BUSINESS

Technical View: Nifty forms bearish candle; 10,532 remains crucial for bulls

The index reversed gains after hitting levels between 10600-10650 for the fifth consecutive day in a row and now a close above 10,650-10700 is required for bulls to regain control over D-Street.

BUSINESS

Nifty could touch 12K in a year: Top 10 technical picks that you can bet on

The market is likely to stay in a range of about 1000 points, i.e. 10,000 will act as crucial support till next Diwali and on the upside, we could well surpass 11,760 and hit a fresh record high, experts say.

BUSINESS

Will Chhattisgarh election impact Mr Market? Maybe not, suggest experts

Market is unlikely to either breakout or breakdown from the range of 10,000 on the lower side and 11,000 on the higher side, suggest experts.

BUSINESS

Technical View: Nifty forms Piercing pattern; 10,645 will act as resistance

The strong rally seen in the index took shape of a Piercing pattern which signals a temporary halt to the downtrend. The pattern is formed by two consecutive candlesticks.

BUSINESS

Worried about FII selling? Foreign investors raised stake in over 100 cos in last 4 quarters

FIIs raised stake in 96 companies which fell up to 84 percent in 2018.

BUSINESS

'Shani' likely to rule in 2019; metals, IT among sectors that will be in focus

Investors’ focus should be on sectors which are ruled by planet ‘Shani’ or ‘Saturn’ which will be the ruling planet for Vikram Samvat 2076, suggest astro gurus.

BUSINESS

Top 10 short-term trading ideas that could give 4-17% return in 1 month

On the lower side, 10,540 - 10,500 are seen as immediate support for the index. We advise traders to continue with a stock-centric approach by adopting a proper exit strategy, says Sameet Chavan of Angel Broking.

BUSINESS

HCL Technologies, Escorts among top 5 ideas that could generate wealth in next 2-3 years

Valuation of the broad market continues to be on the higher side and needs to settle as earnings growth is likely to downgrade further, says Vinod Nair of Geojit Financial Services.

BUSINESS

Technical View: Nifty forms a ‘Hanging Man’ pattern; 10,500 crucial for bulls

A Hanging Man is a bearish reversal candlestick pattern which is usually formed at the end of an uptrend or at the top (more than 600-point rally from its recent low of 10,004 recorded on October 26).

BUSINESS

Two years since demonetisation, these 44 stocks have more than doubled investor wealth

Individual stocks that more than doubled investor wealth in the last two years in the S&P BSE 500 index include names like HEG, Indiabulls Ventures, Graphite India, V-Mart Retail among others.