The S&P BSE Sensex fell nearly 5 percent in October, but managed to stage a smart bounce back in November with gains of about 2 percent. Anecdotal evidence suggests that bears remained in control on D-Street in 7 out of last 10 years during the month of November.

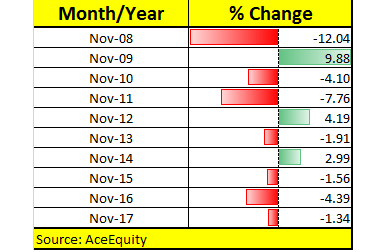

Sensex saw a dip of 1-12 percent in the last 7 out of 10 years. The worst fall was seen in 2008 when the index plunged 12 percent followed by 2011 when it saw a decline of 7.7 percent, and in 2016, the Sensex saw a decline of 4.3 percent.

It ended in the green in just 3 Novembers out of the last 10 years. It gained the most in 2009 when the index saw a rally of nearly 10 percent while in 2012, Sensex gained 4.1 percent, and in 2014 it rose by nearly 3 percent.

But, the next big question is what will happen in November 2018?

Well, after two straight losses seen in the last two months, Sensex/Nifty finally saw some stability in November and hopefully, the index should be able to hold gains throughout this month, suggest experts.

“Contrary to the historical behaviour, current month of November can be a month of consolidation with a positive bias as the Nifty50 already corrected by around 13 percent in the last two months,” Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in told Moneycontrol.

“We expect some relief for bulls which appears to be unfolding in the current leg of the upswing from the lows of 10.004. However, this counter-trend rally has strong resistance around 10840 levels and can be solidified further if Nifty50 consistently trades above this level for couple of sessions,” he said.

Mohammad further added that in such a scenario 11,089 on the Nifty can be expected, and on the downside, 10,100 shall continue to remain a sacrosanct support below which recent lows of 10,000 will come under threat.

In terms of flows, November saw increased flows from foreign investors while outflows from domestic investors. Anecdotal evidence suggests that FIIs remained net sellers in 4 out of last 10 years. They were net sellers in the year 2016, 2015, 2011, and 2008.

Domestic investors or mutual funds were net sellers in 5 out of last 10 years which include 2008, 2009, 2010, 2012, and 2013. Both FIIs and MFs were net buyers in the year 2017 when the index fell by about 1.3 percent.

However, FIIs remained net sellers in the September quarter as well as in October which weighed on investor sentiment. FIIs pulled out about Rs 10,000 crore in September quarter and nearly Rs 30,000 crore in October alone.

The last two months of September and October were more like speed breakers in the overall uptrend of the market. The Sensex saw a fall from the level of 39000 to the level of 33300 and in the recent scenario it took the intermediate trend line support at the level of 33200 and is marching towards northern trajectory.

“We are at the opinion that the Sensex will continue to march towards the northern trajectory in the month of November till the level of 36200 which is in the proximity of 50% of Fibonacci retracement level of the previous fall,” Ritesh Ashar, CSO, KIFS TradeCapital told Moneycontrol.

“If we talk about the major factors that will dominate markets in the month of November then there are three major factors which are crude oil price, rupee-dollar movement, and the upcoming state elections. Volatility may prevail due to these factors are the global cues are in a positive zone currently and will remain the same till the end of this month,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.