BUSINESS

JNK India IPO: A strong bet on the domestic manufacturing push

Strong order book provides good revenue visibility and valuation looks reasonable

BUSINESS

Va Tech Wabag: The stock makes new high, but more to come as prospects improve

While the company’s initial focus was on international markets, it is now seeing big opportunities in the domestic market, thanks to govt and private capex.

BUSINESS

Defence Engineering quartet: Execution does not match up with expectations

Defence PSUs are notorious for delayed or slow execution, but revenue visibility will support stock prices

BUSINESS

PGCIL: Why it's a good bet in today's market

The company offers revenue visibility and a reasonable amount of earnings certainty

BUSINESS

Bharat Electronics: Better revenue visibility, strong earnings potential to drive stock return

Focus on localisation and import substitution along with strategic initiatives should support the company’s growth

BUSINESS

MTAR Technologies: Stock ripe for re-rating

Robust order pipeline and improved execution augur well for the company

BUSINESS

IRCON International: A strong play on railways

Recent correction offers a good buying opportunity as capex on railways and highways continues to boost order book

BUSINESS

ION Exchange: Better risk-reward play after recent correction

Recovery in both domestic and international markets and increased industrial activity augur well for the company

BUSINESS

NTPC: A defensive play on green energy

Recent correction offers a good entry point as earnings visibility remains strong

BUSINESS

Engineers India: Why we are turning cautious

While the company has good opportunities and a strong balance sheet could support its initiatives in the exports and the energy transition space, it would be worth keeping a watch on their execution over the next two quarters

BUSINESS

Bharat Dynamics Q3: A good bet even after the stellar show?

With strong focus on innovation and technology, BDL is the showpiece of India's defence capabilities

BUSINESS

NTPC: What should support the stock in future?

The core business of thermal power is thriving while the power utility is plugging into clean energy

BUSINESS

Power Grid Corporation of India: What is supporting the stock price

Betting on India's planned spike in power T&D investments, Power Grid is ramping up capital expenditure

BUSINESS

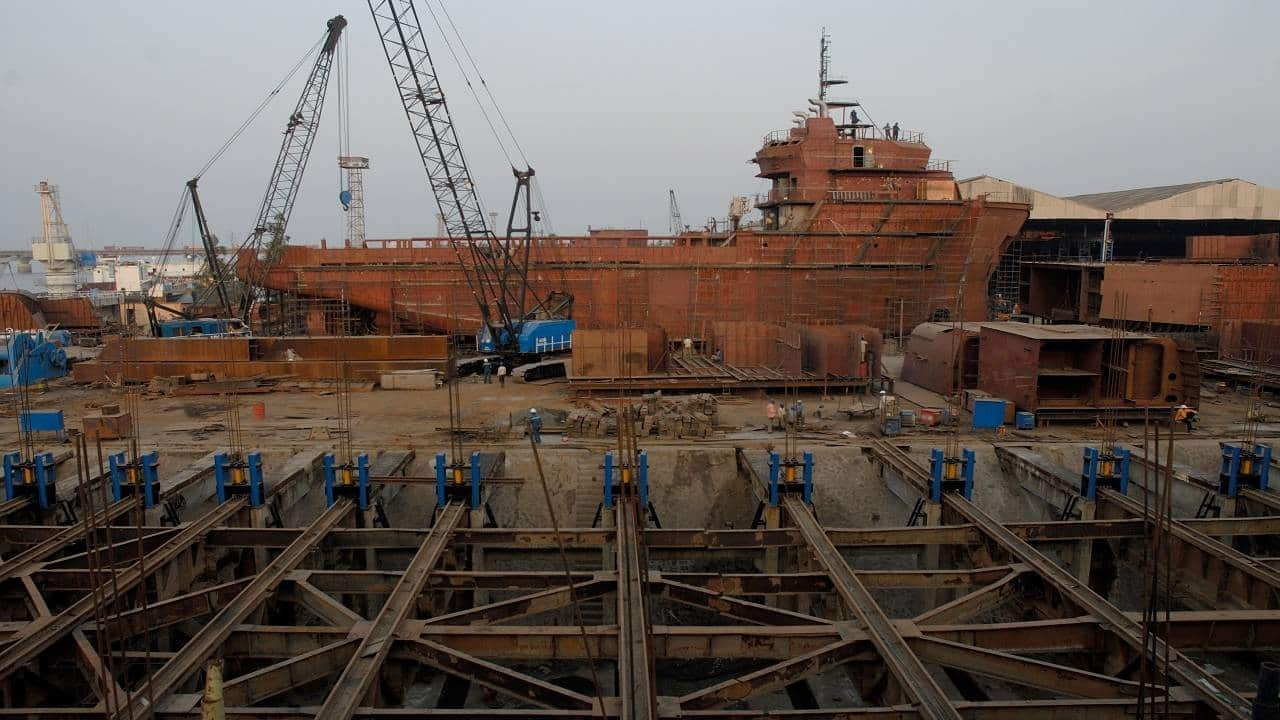

Cochin Shipyard: Improving execution, strong order book to support stock

While the valuation is on the higher side of the historical range, the stock should do reasonably well, considering the earnings visibility and orders in hand

BUSINESS

MTAR Technologies: Poised to do better

The quality of business, capital allocation, and strong order pipeline are some of the factors that should drive growth

BUSINESS

IRCON International Q3: Strong execution capabilities visible

Robust rail and highway capex will boost the order book; however, competitive intensity and delay in execution will have to be watched

BUSINESS

Va Tech Wabag: Higher scale to support strong earnings growth

The company is confident of maintaining good execution on the back of a strong order pipeline

BUSINESS

Tata Power: More room for growth

Investments in renewables and the green energy value chain have unlocked the potential for the future

BUSINESS

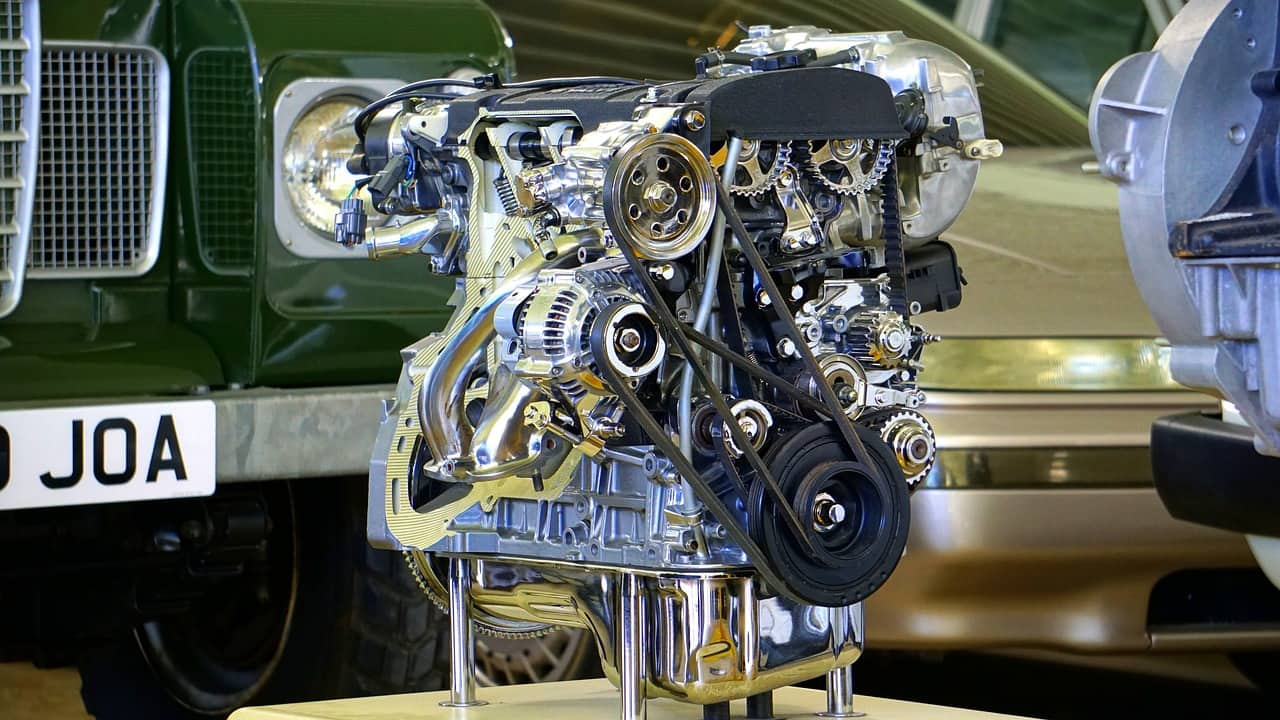

Cummins India: Higher valuation could limit stock upside

The company is capitalising on opportunities in the domestic market as the export market remains sluggish

BUSINESS

Data Patterns: Continuity in earnings growth to support stock

With the ongoing investments and efforts to demonstrate its enhanced capabilities, the company is looking for a larger pie of the domestic defence and other critical electronics markets over the next 1-3 years

BUSINESS

ideaForge Technology: The beginning of a new chapter

Well positioned to capitalise on multiple revenue streams and address evolving customer needs.

BUSINESS

Bharat Electronics: Improving visibility, earnings to support stock

Improving product mix, strong R&D focus, increase in non-defence segment revenue, and exports should drive BEL performance

BUSINESS

Momentum for railway, defence in India Budget

The provision of Rs 1 lakh crore for R&D is a ground-breaking move

BUSINESS

Larsen & Toubro: Growth momentum could moderate

Stock upside is capped because of the likely sluggishness in domestic business