BUSINESS

Experts urge caution as KCC loans outstanding rise 20% in FY22 to Rs 9.37 lakh crore

The Kisan Credit Card scheme was introduced in 1998 for farmers to use when buying agriculture inputs and to draw cash for their production needs.

BUSINESS

No evidence of data leak, says ICICI Bank ED

According to Cybernews, a digital news portal, there was a leak of around 3.6 million files of ICICI bank’s customer data

BUSINESS

Top bankers never retire! Fintechs rope in veteran bankers to build brand, trust

Some experts also suggested that when fintech companies hire a veteran banker, a certain goodwill also comes along.

BUSINESS

RBI allows HDFC Bank to hike stake in HDFC Life, HDFC ERGO to more than 50%

The merger between HDFC Bank and HDFC is expected to complete by July 2023.

MCMINIS

What is a digital banking state?

In a digital banking state, the chances of cyber crimes are also higher as the usage of digital services increases

BUSINESS

Crisis-ridden cooperative banks continue to face RBI’s ire, 8 lose license in FY23

Reasons for license cancellation varied from inadequate capital to failure to comply with legal regulations under the Banking Regulation Act and lack of earning prospects in the future. In fiscal 2023, the Reserve Bank of India (RBI) cancelled licenses of eight cooperative banks and imposed monetary penalties for 114 times

BUSINESS

Big banks zero in on gold loans, line up cheaper rates for bigger market pie

HDFC Bank saw a 19 percent jump in its gold loan portfolio in fiscal 2023 whereas traditional gold loan lenders Manappuram Finance and Muthoot Finance saw an 11 percent fall and 1 percent growth, respectively, in their gold loan portfolios till December 2022 quarter

BUSINESS

HDFC to complete its merger with HDFC Bank by July

India’s largest housing finance company HDFC Ltd will merge with country's largest private sector lender HDFC Bank to create a financial behemoth

BUSINESS

Ruthless recovery agents, aggressive loan outreach put spotlight on Bajaj Finance

The questionable methods adopted by the shadow bank to flog loans and recover dues have sparked a public outcry, particularly on social media.

BUSINESS

Growth-hungry NBFCs want a bigger share of MSME loan market

Non-Banking Financial Companies eclipse commercial banks in loan growth to small companies. The competition is set to heat up.

BUSINESS

MC Explains: What do RBI's new draft rules on loan penal charges say?

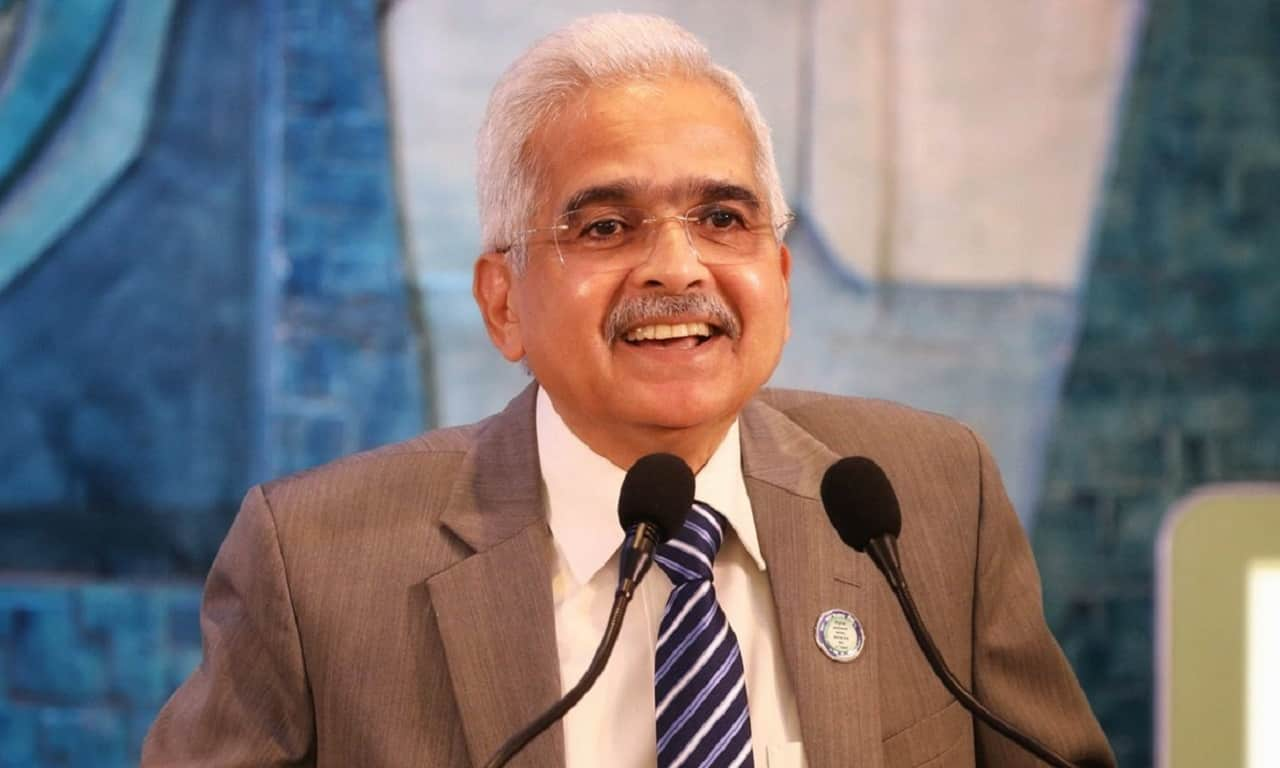

RBI Governor Shaktikanta Das in February said that the central bank will issue draft guidelines for monitoring the penal charges levied by financial entities on consumers on loans

BUSINESS

IndusInd Bank, Bandhan among major lenders in MUDRA Yojana

Experts attribute this to the lenders’ rising microfinance portfolio, among other reasons

BUSINESS

Lenders to reschedule second round of auction for RCap, new date undecided

The second auction is set to bids from Torrent Investments, Hinduja Group’s IndusInd International Holdings Limited (IIHL) and Oaktree Cap"

BUSINESS

Indian banks to post strong growth numbers, well-placed to manage risks, say experts

Several private and public sector banks in their January-March 2023 quarter preview reported strong advances and deposit growth

BUSINESS

MC Explains| What is pre-sanctioned credit line through UPI, how will it work and other questions answered

A credit line, different from a loan, is a lending facility where a borrower can borrow money on a flexible and revolving basis from a lender

BUSINESS

Web portal for unclaim deposits to be ready in 3-4 months, says RBI DG M Rajeshwar Rao

RBI Governor Shaktikanta Das announced a centralised web portal for the public to search unclaimed deposits.

BUSINESS

UPI pre-sanctioned credit line different from BNPL, says RBI deputy governor Rao

The Reserve Bank of India (RBI) Governor Shaktikanta Das said that the new measure has a pre-sanctioned loan from banks, which customers can operate through UPI

BUSINESS

RBI Policy: Avail funds from banks through UPI as RBI allows pre-sanctioned credit lines

This initiative will further encourage innovation, said Das

BUSINESS

Monetary policy: Here's a look at comments by MPC members over the past one year

Out of the six members of the Monetary Policy Committee, two have voted against a repo rate hike in a couple of instances.

BUSINESS

MC Explains | Unclaimed deposits with banks down to Rs 35,000 crore. What does it mean?

An unclaimed deposit is one which does not see any activity like infusion of funds, withdrawal, etc. from the depositor for 10 years or more, and is deemed as an inactive deposit.

BUSINESS

SBI’s YONO story: Drop in new account opening, loan disbursals and rising customer complaints

State Bank of India launched its digital interface YONO in 2017 with the aim of attracting millennials and digitising banking for its more than 400 million customers

BUSINESS

CBDC retail pilot: Some customers complain of technical glitches in apps, transactions

Customers of HDFC Bank, ICICI Bank, Yes Bank, Bank of Baroda and IDFC First Bank who participated in the retail digital rupee pilot have complained of technical problems and issues while making payments

BUSINESS

South Indian Bank hires Hunt Partners to look for new MD & CEO, says Murali Ramakrishnan

The current MD&CEO, Murali Ramakrishnan’s tenure will end on September 30, 2023

BUSINESS

Small banks pad up with cricket partnerships to build brands and add customers

Equitas Small Finance Bank, AU Small Finance Bank, Ujjivan Small Finance Bank and Fino Payments Bank have recently partnered with Indian Premier League teams and sponsored other cricket events.