COMMODITIES

Soaring pump prices weigh on growth in India retail fuel sales

A jump in prices has seen growth stall in India’s sales of gasoline and diesel

BUSINESS

Deutsche Bank AGM shouldn’t absolve leaders, advisor says

Proxy adviser Glass Lewis listed probes against Deutsche Bank’s asset manager DWS Group and an unidentified management board member in connection with a tax evasion scheme known as Cum-Ex, according to a report published on Sunday

BUSINESS

China contagion threatens to derail the world’s emerging markets

China’s slowdown will compound the challenging outlook for emerging economies facing soaring energy prices and tighter monetary policy from the major central banks, said an economist.

BUSINESS

Green fix to replace Russian gas is stymied by Europe’s red tape

Russia’s biggest buyer of gas is Germany, where the government vowed to accelerate green-energy development through measures such as increasing the areas available for solar parks, expanding electric grids and adding wind farms at sea

ECONOMY

Singapore says world could face recession in next two years

Singapore’s central bank said last week it expects global growth to moderate to 3.9 percent in 2022 from 5.4 percent last year as inflation reaches its fastest in 14 years

BUSINESS

Buffett is back with one of his biggest buying sprees in years

The conglomerate made roughly $41 billion of net purchases in the first quarter, including a boost to its Chevron Corp stake that vaulted the investment into Berkshire’s top four common stock holdings

ECONOMY

Powell takes lead in round of rate hikes around the world: Eco Week

In a week that’s likely to be marked by a global round of rate hikes, Fed officials are expected to raise their benchmark on Wednesday, and may also announce they’ll start letting the central bank’s bloated balance sheet start to shrink

WORLD

Shanghai new Covid cases kept to quarantine areas for second day

Beijing, which recently detected infections that were spread in the community, found 59 new cases on Saturday, up from 54 the previous day, according to city authorities

BUSINESS

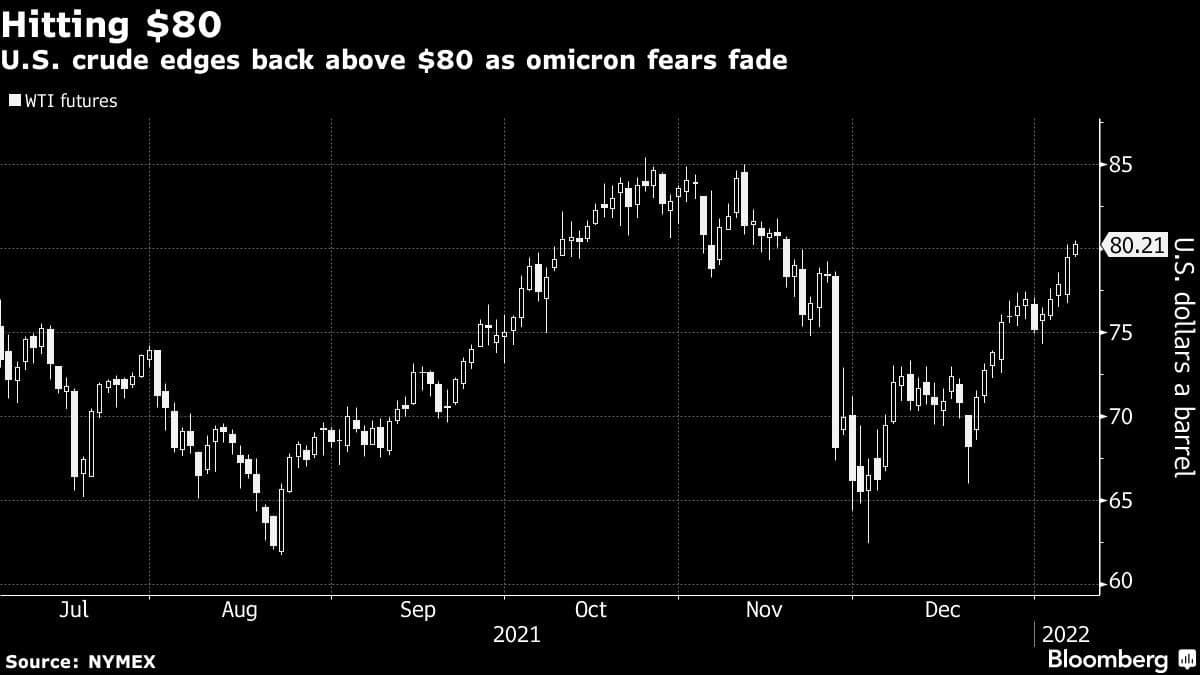

Oil rides longest monthly winning streak since early 2018

Crude is rallying with demand concerns perceived to be short-term while supply concerns are persistent, said Rebecca Babin, senior energy trader at CIBC Private Wealth Management

BUSINESS

Jeff Bezos loses $13 billion in hours as Amazon shares slump on poor quarterly show

Shares of the e-commerce company were down 14 percent on Friday after it reported a quarterly loss and the slowest sales growth since 2001

ECONOMY

Oil rides longest monthly winning streak since early 2018

With the war entering a third month, Germany has signaled that it wouldn’t oppose a European Union embargo on Russian oil, but expressed skepticism that it’s the most effective means of damaging President Vladimir Putin

WORLD

Alarmed by Russia’s Invasion, Europe Rethinks Its China Ties

In the EU, the sense of dismay at China is arguably most acute among countries in central and eastern Europe that have the most hawkish views on Russia. Paradoxically, they are also among the EU nations with which China had the best relations via its 16+1 forum that allowed smaller states an audience with Beijing’s leadership.

BUSINESS

Shell agrees to buy India’s Sprng Energy for $1.55 billion

The deal will triple Shell’s operational renewables capacity and help it achieve net-zero carbon emissions by 2050

WORLD

Turkish President Erdogan plans meeting with Saudi crown prince to revive ties

Turkey's President Recep Tayyip Erdogan will meet Saudi Crown Prince Mohammed bin Salman in Saudi Arabia on Thursday, according to senior Turkish officials with direct knowledge of the Turkish president’s programme.

BUSINESS

Next EV hurdle: Lithium bid up 140% after Elon Musk's 'Insane Levels' call

Pilbara Minerals Ltd.’s auction of spodumene concentrate -- a partly-processed form of lithium -- attracted a top bid of $5,650 a ton on Wednesday for a cargo of 5,000 tons. That compares with $2,350 at the previous sale in late October on the Australian miner’s Battery Metal Exchange.

BUSINESS

A powerful dynasty bankrupted Sri Lanka in just 30 months

The finance minister at the time, Mangala Samaraweera, called a briefing to assail the “dangerous” pledge to reduce the value-added tax to 8% from 15% and scrap other levies.

BUSINESS

How Nandan Nilekani is helping build an e-commerce platform to counter Amazon, Walmart-owned Flipkart

Now 66, Nandan Nilekani has one more ambitious goal. The high-profile mogul is helping Prime Minister Narendra Modi build an open technology network that seeks to level the playing field for small merchants in the country’s fragmented but fast-growing $1 trillion retail market.

BUSINESS

Twitter legal executive hit with online abuse following Elon Musk tweet

Musk, who has 86.4 million followers on Twitter and has clinched a deal to buy the company for $44 billion, often uses the site as a way to criticize Twitter’s decisions, particularly when they involve banning accounts from people who violate the platform’s rules, some of whom Musk sees as being unfairly sidelined.

BUSINESS

Indonesia adds to global food shock with widened Palm export ban

The ban will be expanded to crude palm oil, RBD palm oil and used cooking oil, Coordinating Minister for Economic Affairs Airlangga Hartarto said at a briefing Wednesday.

BUSINESS

LIC IPO: India’s biggest listing attracts Norway’s wealth fund and GIC among others

Abu Dhabi Investment Authority is also among those in discussions to participate in Life Insurance Corporation of India’s first-time share sale

BUSINESS

Archegos founder Bill Hwang hit with criminal charges

Hwang and Halligan were charged with racketeering conspiracy, securities fraud, and wire fraud offenses.

BUSINESS

Elon Musk’s pursuit of Twitter accentuates Tesla’s key-man risk

Tesla’s stock plunged 12% on Tuesday, seemingly due to lingering concern that Musk will have to sell a substantial portion of the 172.6 million shares he owns to cover almost half of the financing for Twitter.

BUSINESS

India woos Intel and TSMC to set up local semiconductor plants

Prime Minister Narendra Modi’s government late last year unveiled a $10 billion incentives plan, offering to cover as much as half of a project’s cost, to lure display and semiconductor fabricators to set up base in India.

BUSINESS

Anger erupts at Xi Jinping’s ‘Big White’ army of lockdown enforcers

The 33-year-old business director at a fund, who relocated to Shanghai recently from Hong Kong, hoped that signing up would allow him to get more transparent information on the Covid cases in his complex.