BUSINESS

Public sector banks step up focus on fee income growth through insurance products

Government-owned banks are now increasingly focusing on selling more insurance and other third-party products to boost their profits on the back of higher non-interest income.

BUSINESS

Lenders, shareholders may come to the rescue of debt-laden IL&FS

The saving grace may come with a caveat that the infrastructure lender may have to create a tangible plan to monetise its assets. RBI is set to meet shareholders on Sept 28

BUSINESS

SBI will continue to lend to NBFCs, no liquidity concerns: Chairman Rajnish Kumar

This statement comes after reports emerged that banks are restricting their lending to NBFCs, especially mortgage financiers, and on construction-related priority sector loans

BUSINESS

Debt market crisis leads to contagion effect on equity markets

After the defaults by IL&FS in the past month, liquidity crisis fears are gripping the debt market

BUSINESS

Cash crunch fears, risky exposures to debt market hurt financial stocks

Ripple effects of the DHFL-panic were also felt on other companies including non-banking financial company (NBFC) and mortgage lender Indiabulls Housing Finance.

BUSINESS

Yes Bank's hunt for Rana Kapoor's successor could run into legal, boardroom battles

Analyst Hemindra Hazari believes that the ageing composition of Yes Bank’s board of directors and the absence of whole-time directors apart from Kapoor exposes the bank to leadership risk

BUSINESS

RBI cuts short Rana Kapoor's term as Yes Bank CEO and MD to January 2019

Kapoor has been the bank's CEO since 2004 and his last term ended on August 31.

BUSINESS

RBI reduces maturity of overseas borrowings of up to $50 mn by manufacturers to 1 year

Prior to this announcement, the tenure was a minimum average maturity period of 3 years

BUSINESS

Bank of Baroda, Vijaya Bank, Dena Bank merger: NPAs, integration, union protests to pose challenges

Post-merger, the non-performing assets (NPAs) will be a problem for all the three banks with cumulative gross NPAs around Rs 80,000 crore. This will also require an increased focus on the clean-up process.

BUSINESS

Banks step up asset sale to ARCs as insolvency process gets delayed

The sale process also comes after the Supreme Court, last week, asked banks to not proceed with the insolvency process for assets in the power, shipping, textile and sugar sectors

BUSINESS

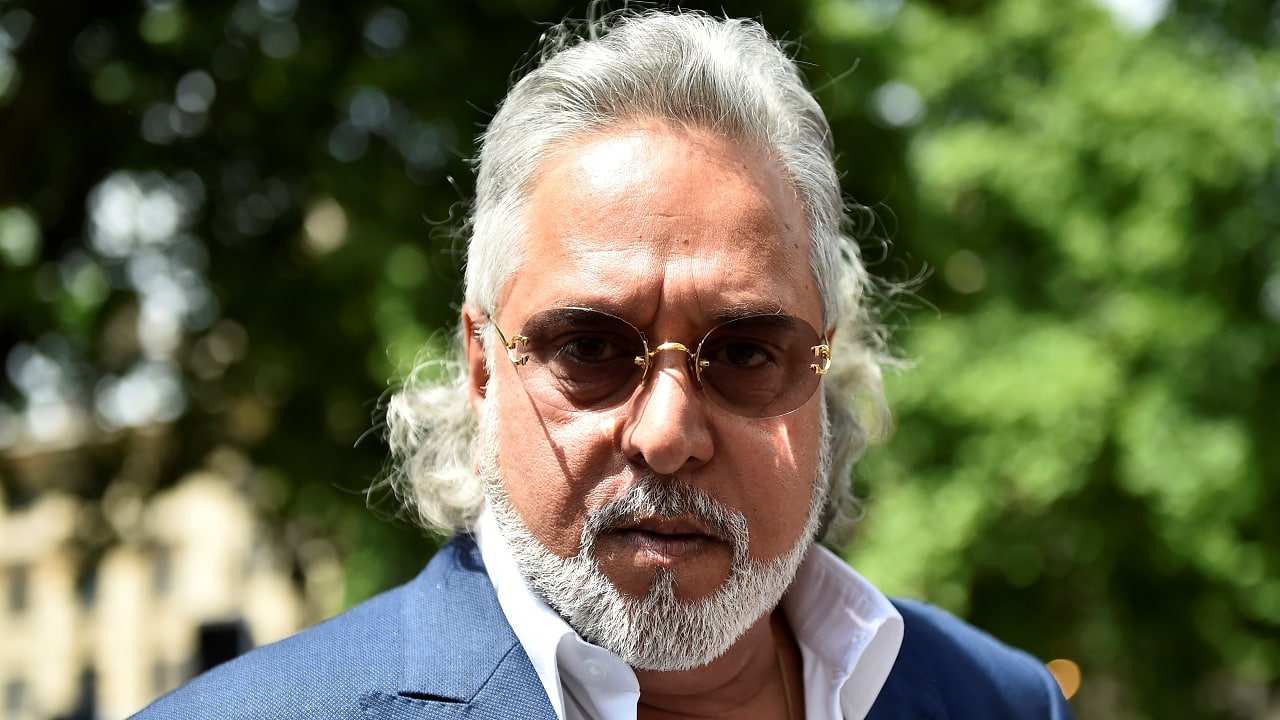

Will the Narendra Modi-led govt bring Mallya back to India before 2019 Lok Sabha elections?

The 62-year-old liquor baron’s claims of meeting Finance Minister Arun Jaitley before he left India two years ago has stirred a hornet’s nest

BUSINESS

Exclusive | HDFC refuses to give loans to cash-starved IL&FS

“Their (IL&FS’s) biggest problem is they got the arbitration that they are not getting the order from NHAI and hence they have a liquidity issue,” sources said.

BUSINESS

Debt and defaults: What happened to IL&FS?

The first signs of trouble emerged in June when IL&FS defaulted on inter-corporate deposits and commercial papers (borrowings) worth about Rs 450 crore

BUSINESS

ICICI Bank board faces tough questions from shareholders, Chanda Kochhar skips AGM

Some shareholders in attendance from different cities were also disheartened given the lower-than-expected dividend declared by the bank at Rs 1.5 per share, an analyst said

BUSINESS

Critical to resolve stressed power assets before November: Bankers

Experts feel that any delay in bringing a solution to the stressed assets will only deteriorate its value further

BUSINESS

Essar Steel lenders eye maximum loan recovery, pin hopes on favourable SC order

Bankers are hoping the final process of Essar Steel is completed before October 11, after which the asset is likely to go for liquidation going by the 270-day deadline

BUSINESS

Domestic investor participation key to attract foreign buyers for stressed assets: PNB Chairman

Nearly 2 months after Mehta-led committee proposed project Sashakt, the operating guidelines of the inter-creditor agreement to get all banks on board under the project have been finalised

BUSINESS

From posting parcels to delivery of banking services, will India Post succeed?

India’s 164-year-old government-owned postal service, which has fallen into its traditional public sector mould, attempts to resurrect into a common man’s tech-savvy doorstep banker

BUSINESS

Majority of 34 stressed power projects head to NCLT after failed resolution push

Bankers have been able to approve only about four or five stressed power assets out of 34 earmarked for resolution.

BUSINESS

Payments firms seek extension of RBI's October deadline for data localisation

RBI is taking stock of the progress on a fortnightly basis. But it is yet to issue any extension or clarification on the same

BUSINESS

Is it too late for Shivinder Singh to absolve himself from the group’s troubles?

Shivinder Singh, the younger sibling, broke his silence on Tuesday accusing his brother Malvinder and family friend Sunil Godhwani for systemically undermining the interests of the group companies and their shareholders

BUSINESS

Public sector banks look to pare stake in insurance ventures to unlock capital, focus on core business

Capital and good quality loans are the need of the hour for banks, and insurance being a non-core business provides good monetisation opportunity.

BUSINESS

Sunil Hitech to go into bankruptcy motion - for excess use of Amex credit cards

Sunil Hitech has been unable to settle its corporate credit card dues of about Rs 45 crore.

BUSINESS

Next year to be key as 'wise owl' Urjit Patel completes two years as RBI governor

Patel took over the saddle from his high-profile and “rockstar” predecessor Raghuram Rajan on September 4, 2016